GCShutter

Background

In my 2023 article on Exxon Mobil, I discussed my issues with coal companies, specifically how metallurgical coal (met coal) companies are likely behind the curve and at risk of being disrupted by the transition away from coal and other fossil fuels:

Coal companies seem content to say and do nothing [to transition to green energy], despite the even greater risks to coal as one of the dirtier and faster-declining fossil fuels … Case in point, coal companies Warrior Met Coal (HCC) and Thungela Resources Limited (OTCPK:TNGRF) appear to have no plans to reach net zero anytime soon, even with the looming threat of electrified steelmaking technology indirectly disrupting the metallurgical coal industry that is central to both firms’ businesses.

While I may have been a bit hasty in predicting coal’s demise, its days are still numbered, with coal predicted to restart its decline after 2026. Met coal companies are still likely to fall victim to the energy transition in the coming years, as blast furnaces for producing steel are replaced by electric arc furnaces, or EAFs. The question is, how might a long-term investor prepare for this, and what company or companies might one be interested in buying or avoiding being on the right side of the transition?

I think the winning strategy would be to buy a steelmaker that has already made the transition and is financially secure, so among the companies I will look at in the space, Nucor (NYSE:NUE) appears to be the best bet for the long term.

The Coal-to-Electric Transition and the Companies Involved

The survival of met coal companies has been in question for years, as highlighted by Keith Williams a decade ago, when he was first alerted to danger signs for this class of companies. The situation has since deteriorated for met coal and the companies reliant on it.

Even though steel itself is primed to increase dramatically in production, as highlighted by David Trainer in his October 2023 Nucor article, the world is moving away from met coal use in steel production. Despite the boost to met coal companies’ business during the disruption of energy markets due to the 2022 Russian invasion of Ukraine, the long-term trends are not in met coal’s favor, as governments the world over are trying to phase out the use of fossil fuels in all areas of their society due to climate concerns. Met coal/coking coal may be cleaner than other fuel sources for steelmaking, but it is still a fossil fuel, so eventually (perhaps as soon as November of this year) it will still be targeted by governments eventually, especially with the organic rise of electric arc furnaces or EAFs.

In 2022, three quarters of global steel was made by blast furnace, yet 70 percent of American steel came from electric arc furnaces. There are several reasons the US is likely ahead of the global steel industry in terms of EAF usage, and not an outlier in the global steel market.

Per Reuters:

High costs and environmental opposition have prevented the construction of blast furnaces at steel mills in the United States since 1980…

…blast furnaces operate around the clock and need more workers. They are more expensive to run when they have to be stopped and restarted to account for changes in demand, as often happens with the automotive sector.

…Nucor's and Steel Dynamics' carbon footprints [from EAF usage] are more than two-thirds smaller than [Cleveland-]Cliffs' and U.S. Steel's [from blast furnace usage], their sustainability disclosures show.

The concerns held around the world regarding reducing carbon emissions, as well as understandable business concerns regarding high costs, regulatory mandates, and opposition movements to polluting industries, are quite likely to make blast furnaces a worse choice for steelmakers around the world over time, and a less appealing choice in the long run.

Counterintuitively, Cleveland-Cliffs (CLF) CEO Lourenco Goncalves has been on a campaign to reduce the costs of operating blast furnaces by gobbling up all the blast furnace-using operations the company can absorb. He likely plans to utilize economies of scale to make Cliffs’ blast furnace steel cost about as much as EAF steel. Goncalves has also stated that recycled steel from EAFs is not up to the tasks of virgin steel made in blast furnaces.

Setting aside the fact that recycled steel can be as durable and reliable as virgin steel, which I will address in a later section, Goncalves’ strategy of buying blast furnace users is floundering. His bid to acquire blast furnace-based US Steel (X) failed back in 2023, as Nippon Steel (OTCPK:NPSCY) (OTCPK:NISTF) emerged as the most likely buyer by the end of the year. But now even the Nippon deal to buy US Steel has come under fire, due in part to environmental concerns over the use of blast furnaces and political concerns over national security risks.

Many of these concerns could be avoided if steelmakers (especially American ones) transitioned toward electric arc furnaces and away from blast furnaces and met coal. All this supports my view that EAF users will be the long-term winners in the steel industry. I will now go over some of the companies I think are most relevant to the steel industry’s energy transition, and how I think they are positioned for it.

Nucor

Nucor is a steelmaker that uses recycled steel and electricity to produce all of its steel products. It is quite rare, and possibly unique, in the steelmaking industry as an all-EAF, all-scrap-sourced steelmaker. Part of this is due to Nucor’s history: after several decades of bad business decisions, underperforming business divisions, and poor financial prospects, the company that would become Nucor sold off all of its unhealthy business lines – including its nuclear business that at one point provided the source for its previous name, Nuclear Corporation – and got into steelmaking. Under threat from well-established competitors with, so to speak, an iron grip on steel supply, Nucor decided to literally pick up the scraps, investing in EAF technology to turn scrap steel into useful products. Management, particularly CEO Kenneth Iverson, went on to make Nucor a versatile, efficient, and profitable-enough company to outcompete the dominant competitors of the era, and emerge the top US steelmaker by volume.

Regarding its long-term prospects, since Nucor already uses EAFs for its production, the company will not be disrupted as steelmaking shifts to using EAFs over time, and could easily be the company that disrupts other steelmakers still using blast furnaces.

Compared to steel made using virgin iron (which usually requires blast furnaces), Nucor’s recycled steel is cheaper and more sustainable. In addition to using cheaper scrap steel instead of virgin iron, Nucor’s use of electricity instead of coal or gas-fueled furnaces significantly reduces its costs further. This also makes it possible for the company’s operations to be nearly carbon free, so long as it uses renewable and low-carbon power, which is exactly what Nucor is planning to do.

Nucor set up two virtual power plant agreements to use renewable energy for its operations in 2020 and 2021; this is on top of an agreement in 2019 to power one of its steel mills with wind energy from a local utility in Missouri. There will likely be more low-carbon power agreements in Nucor’s future, including a pivot by Nucor back to nuclear. In May 2023, Nucor announced an agreement with NuScale Power (SMR) to consider co-locating small modular nuclear reactors near Nucor EAF facilities, guaranteeing on-demand carbon-free electricity as needed for Nucor’s operations; this was followed up a few months later by an announcement that Nucor invested $35 million into Helion to explore the establishment of fusion power plants to deliver energy to Nucor. While I consider nuclear fusion to be more of a “show me” story, I respect Nucor for playing the long game and betting on it as big clean energy source early in its development, while also committing to contemporary nuclear and renewable energy in the meantime to secure green energy for its operations in the short and medium term.

Nucor was also cited by the Payne Institute as a case study in the steel industry for creating a circular economy. The value of building up a sustainable industry that prizes recycled material is somewhat underestimated today, so early pioneers like Nucor have a strong advantage over companies like Cleveland-Cliffs that stay committed to unsustainable ways of doing things.

Cleveland-Cliffs’ chief aims to become the big fish in a shrinking pond by buying up less-desirable, more costly, environmentally damaging and unsustainable blast furnace operations, relying on economies of scale and increasing market share via acquisitions to keep up profitability; and yet, the organic advantages Nucor has over blast furnace steelmakers, including its lower operating costs and its more sustainable business operations through its use of scrap and EAF, will make it naturally more profitable and more attractive for steel customers nationwide and worldwide in the long run. Ironically, this may grant Nucor the market share gains and profitability that Cleveland-Cliffs seeks, as Nucor’s advantages become apparent compared to competitors in the steel industry who use more virgin iron, use blast furnaces, and take in less profit as a result.

US Steel

Independent of any merger prospects, US Steel is actually making a pivot toward growing its EAF production capacity significantly, and according to Morgan Stanley, this transition to EAF-based steel would contribute to an increase in profitability. Still, while this implies long-term benefits for US Steel’s finances, there are near and medium term costs for the company to bear before realizing the gains from switching to EAFs, and considering how much of US Steel’s operations are powered by blast furnaces (about 13 million tons out of 16 million tons total produced in 2022), it may be a long time before EAFs contribute a significant majority to US Steel’s production.

In the (now-unlikely) scenario US Steel does indeed get bought out by another steelmaker, that buyer would either continue US Steel’s transition and reap the subsequent benefits while US Steel’s original shareholders only make out with the purchase price from the deal, or US Steel’s buyer halts the EAF transition, capping the long-term profitability that US Steel’s operations would contribute to the new company’s finances and curbing the upside of the purchase for the buyer’s shareholders.

While US Steel plans to have 6 million more tons of EAF steel produced annually by the end of this year, Nucor will likely still be larger in terms of total steel volume, and has plans to expand its production further by investing in capex at current and new facilities, per Ray Merola’s article:

… [Nucor] completed construction for a new $325 million third generation flexible galvanizing line at its Nucor Steel Arkansas facility. This project complements a new $245 million specialty cold roll mill in Arkansas. These investments are intended to grow the company's auto market share.

In addition, [Nucor] completed a $650 million investment to modernize and expand its Gallatin, Kentucky flat-rolled sheet mill, and a cutting edge $1.7 billion plate mill facility also in Kentucky, on the Ohio River. This location offers Nucor products outstanding access to customers via waterborne and over-the-road deliveries.

Notably, in recent years Nucor makes more steel by volume than US Steel by about 10 million tons, so even with US Steel’s new plant producing 6 million tons of EAF steel over time, Nucor may continue widening the gap between the two American steelmakers. And again, all of Nucor’s steel is made by EAF, compared to only some of US Steel’s product, so Nucor is already maxing out the profitability benefits of EAF use, and doesn’t need to invest in transitioning away from blast furnaces, unlike US Steel.

The likely benefits of owning US Steel are therefore reduced compared to owning Nucor. US Steel isn’t necessarily a bad choice, but its prospects are less certain, and probably much lower, compared to Nucor’s.

GrafTech International

GrafTech International (EAF) is a microcap that specializes in creating graphite electrodes. The company is a natural choice for a pick-and-shovel play in the growing electric arc furnace space, as it supplies materials needed for EAFs to work; it can also put its graphite electrodes toward batteries, semiconductors, and spaceflight applications, so GrafTech’s product is both valuable and versatile. However, as explained in an article by The Value Investor, it is facing near-term financial issues that could hamper its ability to survive. The long-term prospects seem bright for this company, but only if it can endure its short-term headwinds. This is a name to watch, but not necessarily one to buy at this time.

Metallurgical Coal Companies

Thungela Resources, Warrior Met Coal, SunCoke Energy (SXC), Arch Resources (ARCH), and Alpha Metallurgical Resources (AMR) are all at risk. Arch and Alpha Met in particular are at great risk because these US-based met coal companies are operating in a national steel market that has disproportionately transitioned over the years toward electric arc furnaces, and away from blast furnaces using met coal. But all five companies’ business are at least somewhat dependent on met coal to survive, making them poor long-term bets.

Other companies adjacent to the energy industry may know this already, hence some firms’ attempts to spin off their coal businesses in recent years and collect what capital they can from them. For example, Thungela is actually a recent spinoff of Anglo American’s (OTCQX:NGLOY) (OTCQX:AAUKF) South African coal business.

As the transition away from coal and toward EAF tech continues, these companies stand to be disrupted the most, and I would therefore avoid them all until they show significant signs of transitioning away from coal and other fossil fuels as central features of their business.

Recycled Steel Quality

A common critique of using recycled steel is that it is lower in quality than virgin steel, so virgin steel will always be needed for certain applications, as will the blast furnaces required to make it. But recycled steel can often be used for most of the jobs of virgin steel, and can be processed to match virgin steel’s quality via multiple processes

One example I was given is that recycled steel cannot be used for structural support, implying that virgin steel will remain in widespread use in infrastructure and construction. While this may have been true in the past, it is no longer a given. Structural steel is 93% recycled, directly contradicting old claims about recycled steel’s lower quality in structural applications. This is not to be confused with second-hand or reclaimed steel, which may require a degree of processing to gain the characteristics needed to become high-quality recycled steel.

For example, efforts are underway to make recycled steel higher-quality at the outset by removing impurities. Such efforts include a joint program being run by the REMADE Institute and Arizona State University. Sridhar Seetharaman, currently Chief Science Officer & Professor at ASU, had this to say (emphasis added):

Steel is hard to decarbonize, and improving recyclability will impact this positively by reducing the most carbon-intensive step: iron ore reduction.

If it is true that iron ore reduction is key to producing low-carbon, high-quality recycled steel, then Nucor is a well-positioned player in the space. It addresses this issue via another joint partnership, this time with Electra, a self-proclaimed “green iron company” focused on significantly reducing the energy and carbon emissions necessary to purify iron ore. Electra’s partnership with Nucor aims to scale up the use of the former’s low-emission, low energy-intensive iron purification method for use in Nucor’s recycled steel operations.

For removing impurities in recycled steel without the use of novel green iron feedstock, purification and refinement measures already exist to keep the quality of recycled steel high. As stated in this breakdown on recycled steel, a critical step in producing it is to purify it using electrolysis and/or magnetism; another article notes that “common techniques [for steel refining and purification] include electrolysis, distillation, zone refining, and chromatography.” Both articles state that sorting of higher- and lower-quality steel scrap happens beforehand, as a quality control measure.

And a GlobalSpec article on producing quality steel had this to say (emphasis added):

In order to produce high-quality steel [from EAF scrap], it is imperative that scrap metal is well sorted. It is also imperative that any coating is removed before entering the furnace as these coatings typically contain tramp metals, which cannot be removed by pyro-metallurgical processes in a high-temperature furnace.

…

Scrap purification processes used to remove tramp elements [include] electrolytic reactions, low-temperature alkaline reactions, selective vaporization and other chemical reactions…

[S]crap purification and sorting are the two largest factors affecting liquid [EAF scrap] steel quality. As EAF methods increase market share, this trend will continue…

With these processing steps in place, green iron feedstock or not, the quality of recycled steel (such as Nucor’s steel) should likely remain on par with virgin steel quality, at a fraction of the cost.

Aluminum Parallels and General Metals Recycling

On a related note, this piece goes into great detail on the many methods to purify and refine aluminum/aluminum alloys, with one stated goal of the article being to help “find suitable processes and methods leading to high-quality purified [aluminum] melt.” This is because aluminum demand is set to rise by up to 40% during the 2020s decade, largely on the back of the “transportation, construction, packaging and the electrical sectors.” The need for cheap, low emissions, low energy-intensity steel that led to increased steel recycling will likely mirror the need for cheap, low emissions, low energy-intensity aluminum that will birth aluminum recycling.

As recycling takes hold with steel and aluminum, so it should take hold with other metals too, as I explained in my article on Glencore and metals recycling. The sustainable and cheap recycling of high-quality steel is thus a consequence of broader shifts in all metals and materials industries, and should be understood as such among investors in these spaces.

China and the Steel Industry Downturn – Near Term Pressure on Steelmakers

A recent Bloomberg report indicates that due to China’s economic sluggishness as well as its housing and property crisis, demand for steel has plummeted in the nation, and steel inventory has risen significantly. Additionally, unlike in past instances where China was the source of overproduction, the Chinese government will not be issuing a stimulus to domestic steelmakers to help get them through the crisis this time. China’s steelmakers are responding by offloading their excess steel supply onto the global market. Accordingly, the China-sourced steel glut is pushing global prices down, reducing the profits from producing and selling steel for all other steelmakers in the world. Steel prices are likely to see a large and steady fall, as China produces more than half (page 5) of the world’s steel, so the profitability of global steelmakers will probably see a large fall as well.

In an environment of such lowered steel prices, the steelmakers that will most likely endure it must have at least one of these four things: low operating costs compared to the competition, large cash piles, a lot of room to cut costs, and/or a willingness to issue lots of stock or debt to keep operations funded. Ideally, any given steel industry player would only have the first two out of the four qualities – the unlucky players would then have to act on the latter two qualities.

Since Nucor’s steel is made from scrap (cheaper than virgin iron) and EAFs with electricity (cheaper than blast furnaces with coal), Nucor is fundamentally better-positioned than other steelmakers for both the short-term challenge from Chinese overproduction and long-term customer preferences for cheaper, greener, and more sustainable EAF steel.

Which Steelmakers Will Best Endure the Steel Price Crisis?

To determine how steelmakers will fare in the near and medium term, I will look at SA charting data for several of the world’s top non-Chinese steelmakers by volume to determine their financial health.

First, revenues. Nucor has consistently remained in the bottom half of revenue generators, but considering it makes more money per unit of steel than most large steelmakers, especially in recent years, it actually punches above its weight.

Per data collected by the World Steel Association up to 2022, Nucor produced 25.7 million tons of steel in 2022, compared to Cleveland-Cliffs and US Steel at 16.3 million tons each, and ArcelorMittal (MT) (OTCPK:AMSYF) at 68.8 million. Dividing by each company’s total revenue in 2022, Nucor made about $1600 per million tons, versus Cleveland-Cliffs’ ~$1400 per million, US Steel’s ~$1300 per million, and ArcelorMittal’s ~$1150. Even Nippon Steel, which aims to buy US Steel, only made ~$1350 per million, just above US Steel.

Notably, at over $1700, only POSCO Holdings (PKX) beats Nucor in revenue per million tons, but POSCO is still very committed to using blast furnaces. Even if its plan to modernize its furnaces with smart monitoring systems brings down operating costs of blast furnaces enough to be competitive with EAFs, the consequences of blast furnace carbon emissions will still eventually require POSCO to shift away from furnace use – and the investment will be quite expensive, redirecting much of POSCO’s revenue.

While Nucor isn’t a leader in total revenue, both Nucor and POSCO lead in revenue gained per unit of steel sold, with only Nucor’s revenue free from a need to shift away from blast furnaces.

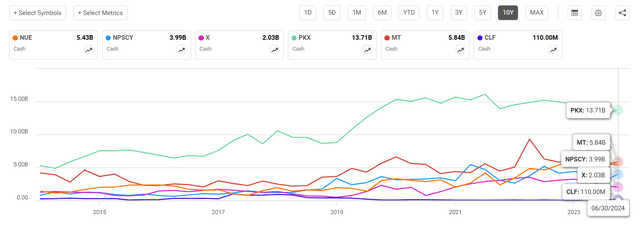

Next, cash. Most of these companies have been steadily growing their cash balances over the past decade, but two require special mention: POSCO, South Korea’s top steelmaker, and Cleveland-Cliffs.

POSCO has been aggressively growing its cash pile, amassing $13 billion worth of funds for a rainy day, as of Q2’24. This is more than the combined reserves of Nucor and ArcelorMittal, which take third and second place at around $5-6 billion. This will give it significant cushion in the short term as prices fall from the Chinese glut. However, POSCO’s debt is much higher, at $21 billion. POSCO’s ratio of cash to debt is about 3:5, which is the second-best ratio among the top steelmakers, but it’s less impressive than Nucor’s ratio of about 3:4. If the steel price crisis persists longer than expected, POSCO’s debts might add more stress to the company’s financials than Nucor’s.

Turning to Cleveland-Cliffs, unlike its peers that have netted billions in cash, the company has not managed to reach $1 billion in cash at any point in the past 10 years, and currently has only about $100 million remaining. Further, Cliffs’ cash to debt ratio is abysmal, standing at 1:32 with over $3.5 billion in debt at the time of writing – not that this has dampened its enthusiasm to bid on US Steel again.

Even assuming Cliffs doesn’t pursue a financially taxing merger with margins under imminent threat from industry oversupply, Cliffs’ only hope to avoid cash burn and minimize cost cuts is to somehow keep profitability high. But the next chart shows that this is unlikely to happen.

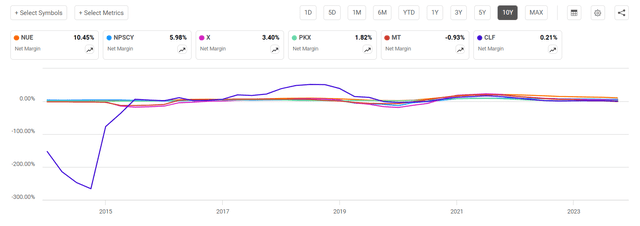

Next, net margins. Cliffs has suffered difficult times of late, with its margin plummeting far below, and rising far above, the competition in the first half of the decade. Recently, though, its net margin has fallen in line with its peers, and now lags most of them. Cliffs’ margin is barely above 0% today, and with steel prices set to fall further in the short-to-medium term, Cliffs’ net margin is likely to go negative soon, requiring tough decisions by Cliffs’ board to manage the situation.

Cliffs’ big margin swings make the rest of its steel peers’ margins harder to examine, so I looked at net margin data ex-Cliffs.

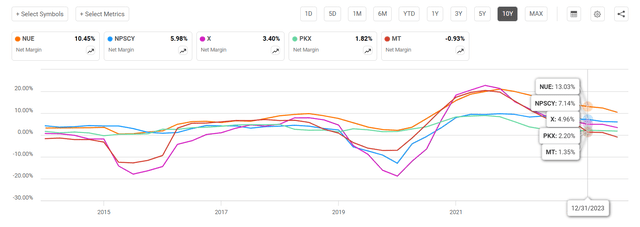

Oddly, it isn't Cliffs, but ArcelorMittal, that has the worst net margin of the group at this time, at -0.93%. Without positive profitability, ArcelorMittal’s business can only continue by burning cash, cutting costs within the company, raising capital, or a mix of all three. This is an unfortunate position for the top non-Chinese steelmaker to be in, but all that can be done is to navigate the coming storm as best it can.

On the other hand, Nucor has been one of the margin leaders the entire decade, no doubt due to the favorable costs of using recycled steel and electricity for its operations instead of virgin steel, coal, and blast furnaces. In fact, Nucor has spent about half of the decade as THE net margin leader at one point or another, and remains the leader today, head and shoulders above second place Nippon with a more than 50% advantage, 10.5% to Nippon’s 6%. In a short-term crisis, nothing beats having firmly profitable operations and billions of cash to spare; for long-term growth, the same holds true.

All in all, while ArcelorMittal and POSCO have their finer points – scale and cash, respectively – Nucor has the advantage of profitability, resilience, relatively low debt, and fundamental cost/pricing advantages compared to others. This makes Nucor a safe bet for both the short-term challenges and long-term opportunities presented by the steel industry, while displaying financial traits that, I think, make it more favorable to own than US Steel, Nippon, and especially Cleveland-Cliffs.

Valuation and Dividend

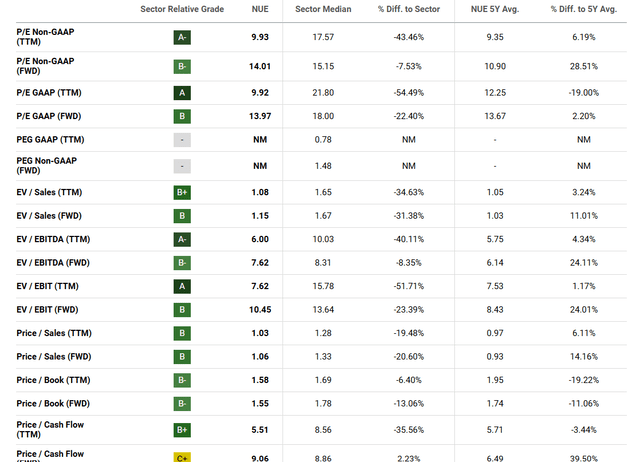

While Nucor seems to be the safest option among big names in the steel industry for the short and long term, that safety doesn’t seem to come at much of a premium, and actually includes quite the attractive dividend.

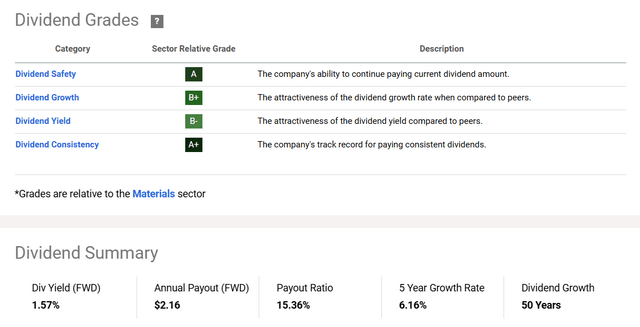

NUE stock trades at a reasonable discount to the materials sector on nearly all metrics. By comparison, X trades at a raised EV/EBIT ratio of ~18, PKX trades at a high EV/EBIT of ~20, and CLF trades at a massive P/E ratio of ~100. Only NPSCY/NISTF and MT/AMSYF particularly match or outperform NUE on valuation, but even those two don’t beat NUE on dividend metrics.

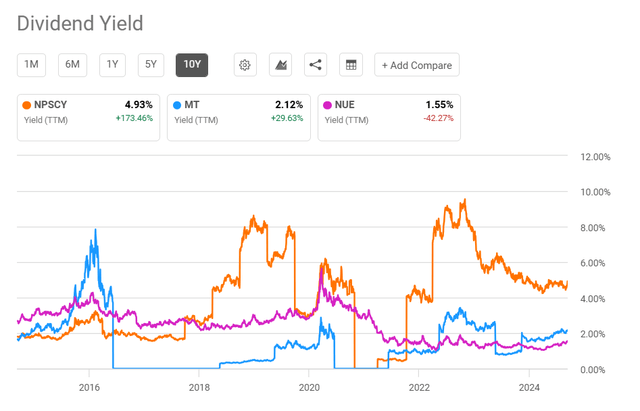

Few companies on the market can say they have grown their dividends annually for over a decade; fewer still can say they have grown dividends for five decades in a row. Nucor stock is one of those lucky few, rising in the ranks to become a dividend aristocrat (25 years of growth) and ultimately to become an established dividend king (50 years of growth). Nippon and ArcelorMittal have occasionally paid higher dividends throughout the years, but in just the past decade alone, they have underperformed NUE’s yield, cut their dividend completely, then paid unexpectedly high yields.

Such wild swings will not bring any comfort to income investors, especially since the coming margin pressures and EAF transition costs may require the redirection of company funds away from dividend payouts. All of this should further drive home the point that NUE stock is likely the safest option for investors looking to ride out the short and long-term shifts in the steel industry.

Risks to Thesis

Company risks include the possibility that Cliffs and US Steel make serious headway on transitioning to EAFs, and thereby transitioning to greater profitability; the possibility that Cliffs gathers large stores of cash in the short term, possibly from sales of its least profitable operations or from capital raises; and the possibility that Nucor’s EAF approach is surpassed by a more profitable and more sustainable method of steelmaking.

Geopolitical risks include successful protectionist measures to mitigate the offloading of Chinese steel inventory upon the global market, keeping steel prices raised globally and allowing worse-positioned steelmakers to continue their operations somewhat profitably, and the risk that China’s domestic issues that reduce domestic steel demand will correct themselves, lowering the prospects of a steel glut from the country and buffing up global steel prices. I consider this second possibility to have a very low chance of occurring, due to the structural, political, and demographic headwinds that reduce the prospects for China’s economic growth and property sector viability.

Lastly, sustainability risks include the (very slim) possibility that carbon capture can cheaply and effectively increase the sustainability and profitability of blast furnaces above and beyond the equivalent effects of pivoting to EAF technology, and the possibility that green technology makes blast furnaces more environmentally friendly could extend their use, and delay the transition to EAF steel facilities, such as the green technology discussed here.

Conclusion

The history, operations, long-term plans and investments, and present financials of Nucor strongly suggest that this company will be the best pick during both the steel industry’s short-term challenges and the industry’s long-term energy transition. It has solid and leading profitability, as well as sustainable operations that include renewable and carbon-free energy and nearly 100% materials recycling, with plans to double down on all of these things. This compares very favorably to its steel industry peers, which are either doubling down on high-cost blast furnaces and met coal, or are only slowly transitioning away from blast furnaces to EAFs.

Therefore, for short and long-term steel industry investors, I rate shares of NUE a buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.