Richard Drury

By Aye Soe

At a Glance

- As geopolitical tensions, shifts in trade policies and inflationary pressures remain elevated, investors may turn to less-correlated markets

- Alternative asset classes like commodities and cryptocurrencies could play a bigger role in investors' portfolios

In 2025, portfolio diversification is becoming a key strategy for managing risk. As investors look to derisk the weight of U.S. equities, four key areas of interest have emerged.

1. Diversification Within U.S. Equities

U.S. equities set record highs last year, and the weight of U.S. equities as a percentage of global equity comprised nearly 67% by the end of 2024, up from 62.57% in 2023, according to the MSCI All Country World Index (ACWI). Within U.S. equities, the combined weight of Apple, Nvidia, Microsoft, Amazon and Alphabet in the S&P 500 reached nearly 29% on December 31, 2024.

The dominance of U.S. equities combined with the heavy concentration in the top five names is a reminder for investors to proactively manage concentration risk and diversify within the equity asset class itself.

During market selloffs led by mega-cap names, the S&P 500 Equal Weight Index tends to decline less than the cap-weighted S&P 500. As an example of its ability to reduce risk, on January 27, 2025 the S&P 500 declined -1.46% on a price return basis, led by Nvidia, when investors learned of the Chinese AI company, DeepSeek. The S&P 500 Equal Weight Index posted +0.02% on the same day.

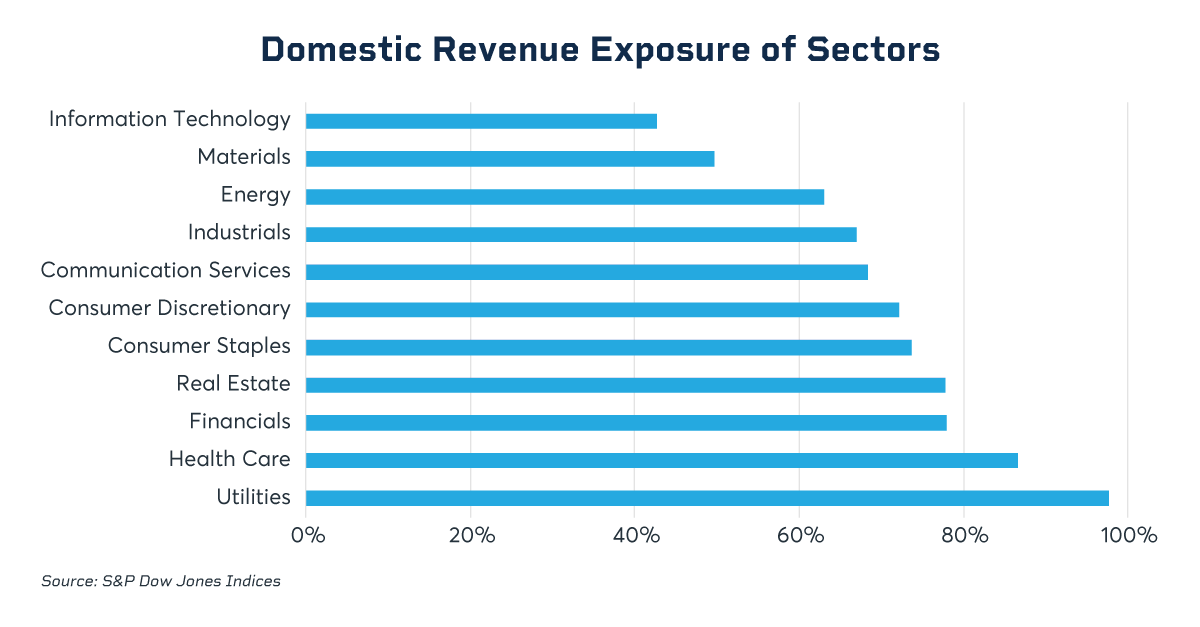

Performance can also vary by sector. One way to assess the potential implications of trade policy changes, for example, would be to determine the percentage of foreign and domestic revenue received by companies in each Global Industry Classification Standard (GICS) sector. An S&P Global study shows that sectors such as financials, utilities, health care and real estate have the highest percentage of domestic revenue while sectors such as industrials, energy, materials and information technology have a higher percentage of foreign revenue.

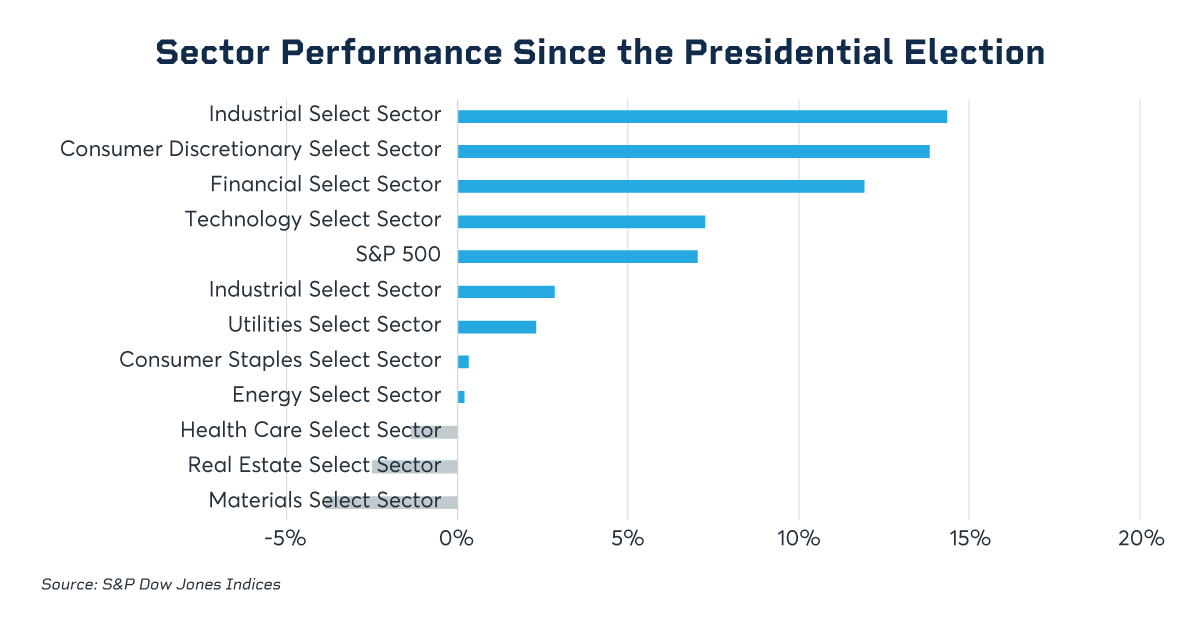

Sector performance since the presidential election has been mixed, with a wide dispersion of returns observed among the sectors. Industrials, consumer discretionary and financials posted double-digit gains while materials, health care and real estate are in the negative. The wide dispersion of returns may continue for the remainder of 2025 as the market digests evolving trade policies and their potential impact.

As trade-related events continue to unfold, Sector futures and options can be important tools within the U.S. equity space to make tactical adjustments as well as medium term repositioning.

2. Diversification with Less-Correlated Markets

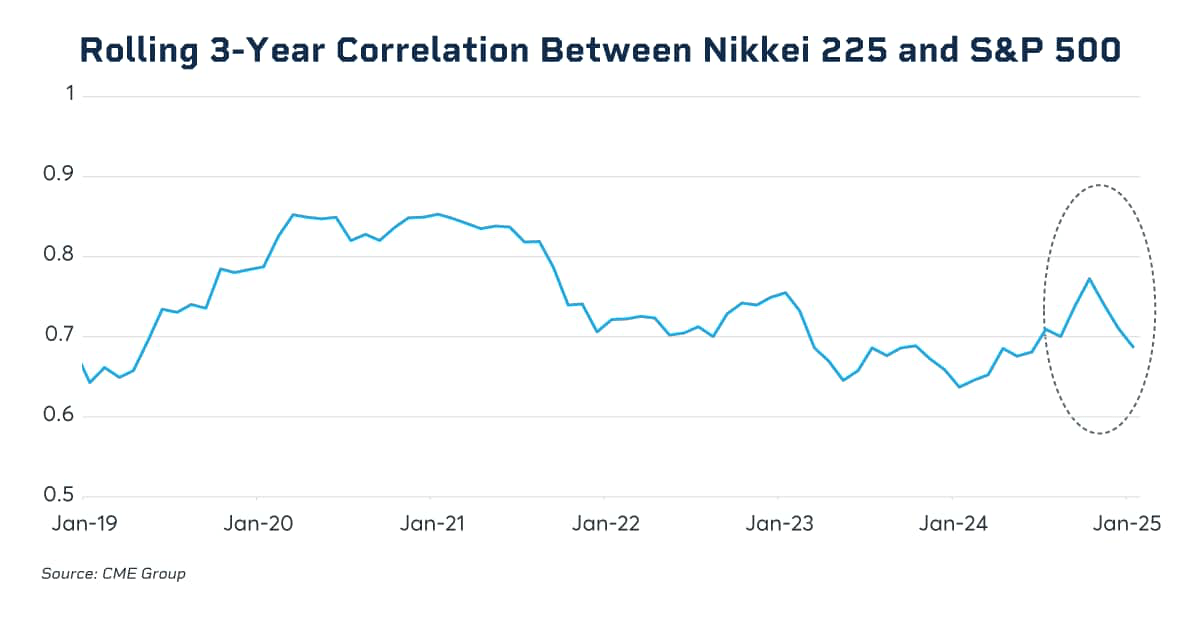

Investors are increasingly looking to international equity markets to diversify their U.S. equity holdings. Japanese equities, in particular, are gaining more attention. The Nikkei 225 Index, measured in local currency yen, posted significant gains in 2023 (28.24%) and 2024 (19.22%) due to an economic rebound and the return of inflation. Additionally, the correlation between U.S. and Japanese equities has been decreasing in recent months.

3. Broad Exposure via Commodity Indices

2024 was one of the turning points for commodities, as both the S&P GSCI and Bloomberg Commodity Index (BCOM) posted positive returns. Commodity markets could continue to be active throughout 2025 as the implications of geopolitical tensions, shifts in trade policies and inflationary pressures remain elevated.

Commodity Indices - 2024 Returns | Spot Return | Total Return | Excess Return |

S&P GSCI | 2.61% | 9.25% | 3.79% |

Bloomberg Commodity Index (BCOM) | 6.27% | 5.38% | 0.12% |

| Source: Bloomberg, S&P Dow Jones Indices. Data as of 12/31/2024. Returns in USD. |

When it comes to commodities though, index choice matters. For example the S&P GSCI is production weighted and does not apply sector weight constraints. As a result, the index tilts heavily toward energy. The BCOM index, however, is a combination of production and liquidity weighting while maintaining equal weight across sectors. As a result, the two indices can have different risk/return profiles depending on which commodity sectors are driving the performance.

Adoption of the CME Group commodity complex, which includes S&P GSCI and BCOM futures, has increased significantly since 2020, with open interest (OI) growing from nearly $900M to almost $6B in notional basis as of January 31, 2025.

4. Growth and Innovation in Crypto

Last year saw many new developments in the cryptocurrency ecosystem, including the launch of spot bitcoin ETFs and bitcoin hitting $100,000 for the first time. With the new administration may come new frameworks and regulations around cryptocurrencies in 2025 and beyond, which could inspire further innovation and growth in this space.

Against this background of potential regulatory change, institutional adoption of cryptocurrency is expected to rise as crypto infrastructure improves and the product landscape evolves, with different types of investment vehicles coming to market, according to a PwC report.

Uncertainty Continues

Market uncertainty has heightened in 2025 amid shifts in trade policy, inflation remaining stubbornly elevated and investors becoming cautious of the outsized returns generated by mega-cap stocks. Amid these changes, diversification as a risk management tool is becoming central to investing for many market participants.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.