manything/iStock via Getty Images

I discussed increasing gold exposure in November, as gold had a constructive pullback to the $2,600-2,550 support zone. Since then, gold has been on fire, surging by about 40% to a recent ATH of around $3,500. Many market participants didn't expect gold to surge all the way up

Are You Getting The Returns You Want?

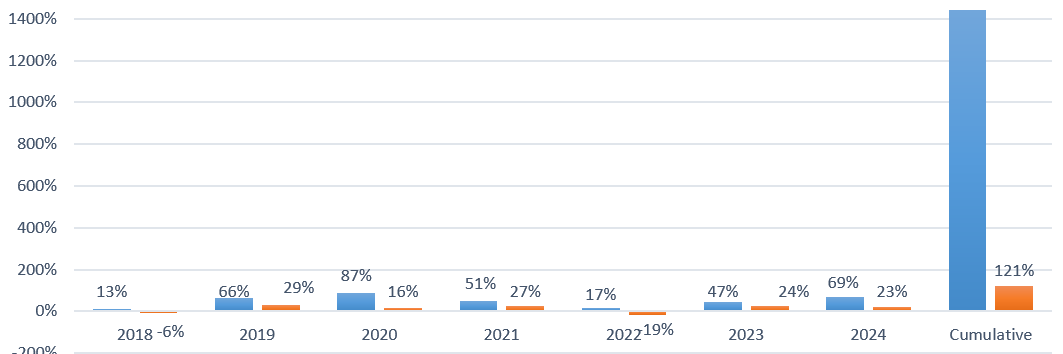

- Invest alongside the Financial Prophet's All-Weather Portfolio (2024 69% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Don't Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market today!