24K-Production

You may be familiar with the term "time in the market over timing the market." The idea is that we are not going to time everything perfectly in the stock market. This is why we don't just liquidate holdings when times get

Are You Getting The Returns You Want?

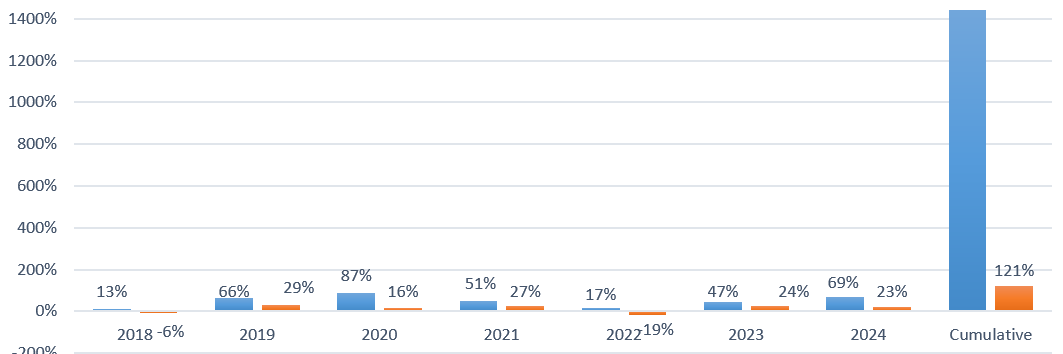

- Invest alongside the Financial Prophet's All-Weather Portfolio (2024 69% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Don't Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market today!