Woman Gets Her Beauty Sleep After Successfully Helping "Prince" Transfer Funds

megaflopp/iStock via Getty Images

Oxford Lane Capital Corporation (NASDAQ:OXLC) is a fascinating fund to follow. As far as CLO funds go, it has indeed performed far better than the rest. Yet, that is not the only perspective that investors should focus on. What they should focus on is

Are you looking for Real Yields which reduce portfolio volatility?

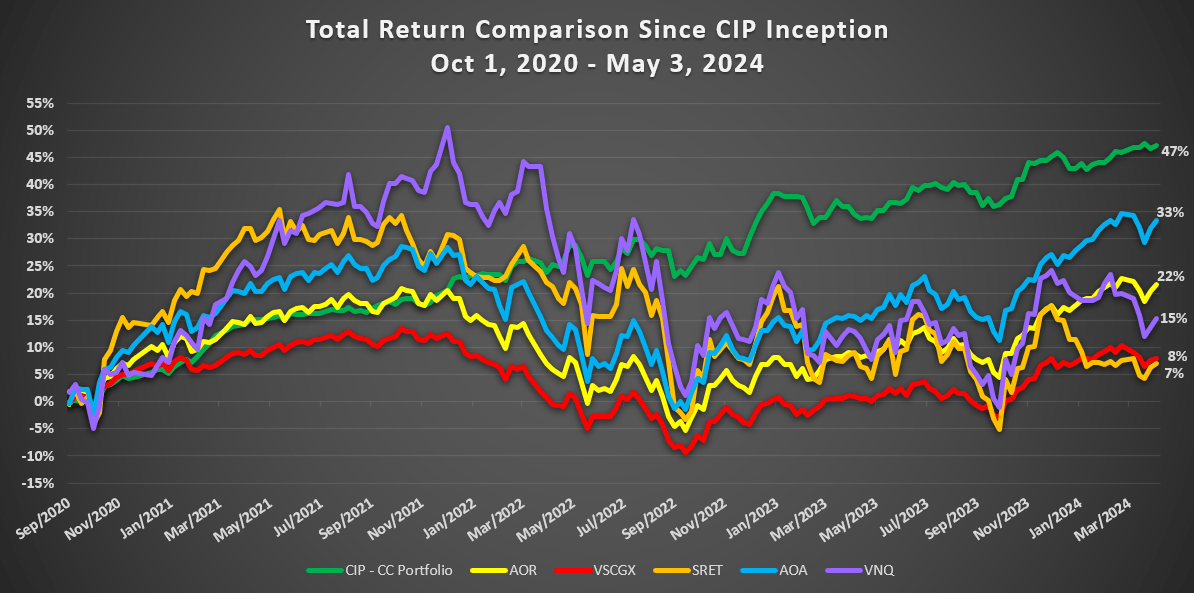

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.