brightstars

"Gold is the money of kings." - Anonymous

Preface

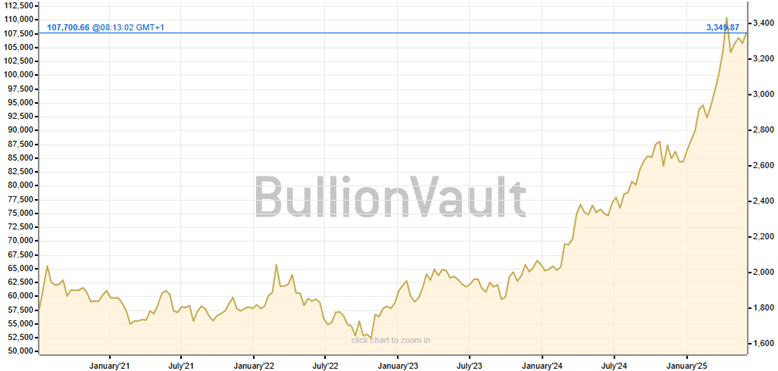

We have been bullish on gold for years and have enjoyed spectacular returns since early 2022 (Exhibit 1). From time to time, it has indeed been tempting to take the chips off the table but, although we have occasionally cut back a little bit, as we didn’t want the position to get too big, we have not been out of gold for years.

Exhibit 1: Gold price, last 5 years

Source: Bullion Vault

This month’s Absolute Return Letter is about why the party isn’t over yet. Nothing goes up (or down) in a straight line. To expect gold to rally to $4,000/lb without any meaningful setbacks would be outright naïve; however, $4,000 is coming and, below, I will explain why that is.

Before I begin, I must make a confession. Although Goldman Sachs (GS) was not the source that inspired us to go long gold in the first place, it has certainly inspired me to write this month’s newsletter. About a week ago, the commodity research team at GS published a research paper, where they made the strategic case for going long both gold and oil. As we don’t invest in fossil fuels, this paper will, to the degree possible, ignore the case for oil; however, a mention or two cannot be avoided.

The philosophical background for the GS paper has to do with the fact that bonds have failed to protect against equity downside more recently. Historically, a 60/40 portfolio has offered plenty of protection but not in recent months. The underlying reason for this month’s Absolute Return Letter is therefore the following challenge: is it possible to identify a better solution than a 60/40 portfolio, should one seek protection from the ongoing volatility in global equity markets?

The case for going long gold

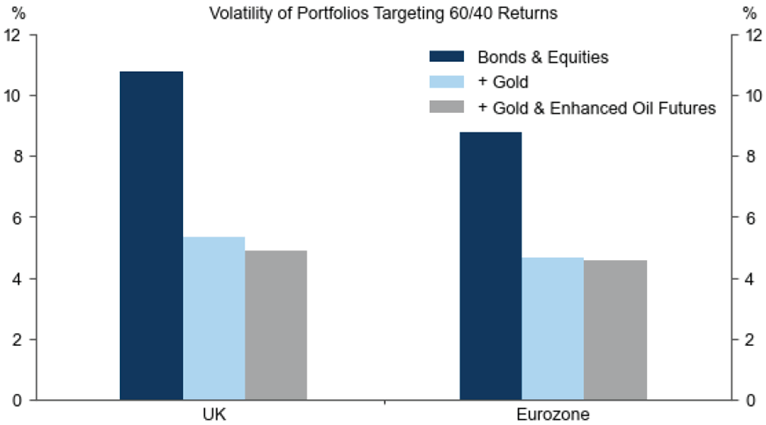

According to GS, history suggests that gold and oil offer the best protection when investors seek to minimise tail risk, reason being that they protect against two very different shocks that may affect equity returns. Gold protects against inflation caused by a loss of central bank and fiscal credibility, whereas oil protects against inflation caused by negative supply shocks. However, as you can see in Exhibit 2, gold offers more protection (diversification) than oil or, at least, it has done so during the years covered in Exhibit 2.

Exhibit 2: The impact on portfolio volatility in the UK and the Eurozone from adding gold and oil

Note: Eurozone data: 1987-2025; UK data: 2005-2025. Source: Goldman Sachs Global Investment Research

Our take

We hold gold for the following two reasons:

- there continues to be plenty of appetite from central banks, particularly EM central banks; and

- gold has a long history of protecting against tail risk when economic policy uncertainty ('EPU') is high.

Even if we could invest in fossil fuels, I am of the opinion that gold looks particularly attractive at present, and there are two reasons for that. The risk of shocks to US institutional credibility is very high at the moment from for example fiscal expansion or because of undue pressure on the Fed. Secondly, central bank demand for gold continues to be strong.

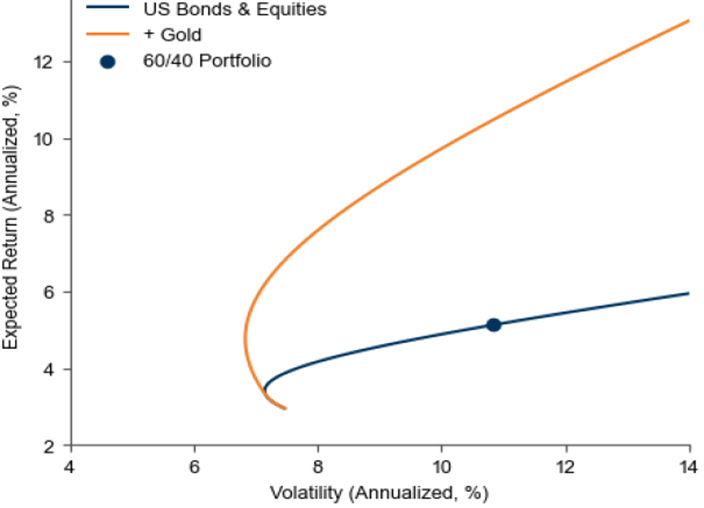

As you can see in Exhibit 3 below, going long gold has sharply improved risk-adjusted portfolio returns during periods where US institutional credibility has been challenged. This is because such credibility shocks typically lead to a flight to gold.

As far as central banks are concerned, the common approach in the OECD is to hold over 50% of reserves in gold. Although there are some noticeable exceptions to that ‘rule’ (Spain holds only about 20%, the UK only about 10% and Japan no more than 5% in gold), most OECD central banks hold a substantial share of total reserves in gold.

Exhibit 3: The efficient frontier when adding gold, assuming institutional credibility is low

Source: Goldman Sachs Global Investment Research

If you switch to leading EM central banks, a very different picture emerges. China, India and Brazil all hold well below 15% of their reserves in gold and, worldwide, gold reserves make up only about 15% of total reserves. It is no coincidence that countries with low gold reserves dominated the list of major central bank buyers last year. Poland came in #1, China #2, Kazakhstan #3, the Czech Republic #4 and India #5. None of those five countries hold much in gold. If the current trend of de-dollarisation continues, one would expect plenty of EM central bank buying to come. There is still a long way to 50%.

As far as EPU is concerned, I wrote about it recently and made the point that excessive amounts of it is detrimental, both to economic growth and to equity prices. Obviously, not all types of EPU are inflationary, but Trump’s tariff show certainly is, and that is an important part of the reason we currently invest in gold.

The bottom line

If EPU concerns intensify and EM central banks’ appetite for gold continues, and I believe it will, the gold price could go much higher. In my book, $4,000/lb is on the wall in this cycle, most likely before the end of next year. My logic is quite simple. Because the gold market is so small relative to other major asset classes – global gold ETF holdings represent only about 1% of outstanding US Treasuries and only 0.5% of the market cap of the S&P 500 – even a small percentage being diversified away from bonds or equities into gold could have a massive impact on the gold price.

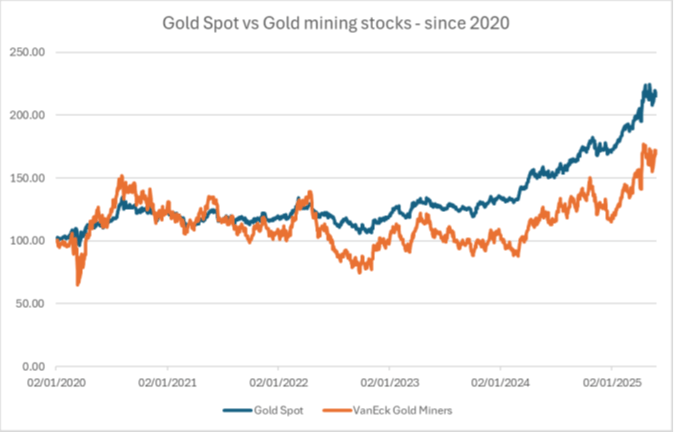

Exhibit 4: Gold mining stocks vs. physical gold

Source: FactSet

In that context, it is also worthwhile pointing out that, today, most institutional investors hold less than 1% of their assets in gold. Adding to that, it is quite interesting how gold mining stocks have underperformed gold bullion more recently. Gold miners started to underperform physical gold in early 2022 and have underperformed ever since (Exhibit 4). The most likely explanation for that is the dominance of central banks in the current wave of buying. Central banks buy physical gold, not gold miners.

However, at some point, that gap will close. It always does. The two markets can’t stay disconnected forever and, given the high operating leverage in many gold mining companies, one could argue that with a gold price at about $3,350/lb, gold miners could quite possibly significantly outperform bullion over the next couple of years. If you need a couple of names, I suggest you take a closer look at VanEck Gold Miners ETF (GDX). I haven’t done much work on gold miners in recent years so shall refrain from sounding smart.

Niels Clemen Jensen

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.