bjdlzx

American Tower (NYSE:AMT) is on the verge of becoming a value play after years of poor stock performance. The AFFO multiple has been re-rated to reflect slower growth in recent periods but could be overdone. We believe the slower growth is event-driven with a finite end date after which more rapid growth should return. At the higher rate of growth starting in 2026, AMT appears opportunistically cheap.

Let us begin with a discussion of the long-term growth of the tower business, along with what caused growth to be weak in 2020-2025.

Historical growth in the tower business

Towers have consistently been one of the highest organic growth infrastructure sectors. There are 3 characteristics which have ensured impressive growth for the sector:

- Colocation

- Efficiency of existing infrastructure

- Natural local monopoly

A macro tower is not high-tech at all. Its only job is to be sturdy and tall. The high-tech equipment is operated by tenants and merely placed on the REIT’s tower.

Building of the tower is somewhat expensive. It requires well-located land, permitting and a whole bunch of metal. The expense is sufficiently large such that it would be a low return for a single entity to have equipment on a tower. It becomes efficient, however, when the same infrastructure can be used for the equipment of 2, 3 or even 4 cell carriers.

The revenue multiplies as more tenants co-locate on a tower, while the cost remains unchanged. The real estate cap rate goes from maybe 4-5% with a single tenant up to the high teens with 3 or 4 tenants.

The U.S.-based towers owned by American Tower and their peers have mostly been in place for a long time. They have already paid for themselves with the rental revenues already generated. From this point forward, they are cash flow machines.

Since the tower itself is just a big metal structure, it requires very little capex relative to its revenue, making it among the highest margin forms of infrastructure. Once a tower gets multiple tenants, its profitability is extraordinary, and it is rather rare for a tenant to leave a tower which has largely kept churn low (with one notable exception which we will get to later). There are 3 reasons tenants are sticky:

- It is not economically viable for a tenant to build their own tower. The rent paid by a single tenant is less than the economic equivalent of a building.

- It may not be allowed for a tenant to build a competing tower, even if they wanted to. Regulatory bodies oversee factors such as wavelengths and interference, which typically keep towers a certain distance apart. There tends to only be 1 tower in each coverage radius.

- Leaving without having a replacement tower would mean loss of coverage area and likely loss of customers for the carrier.

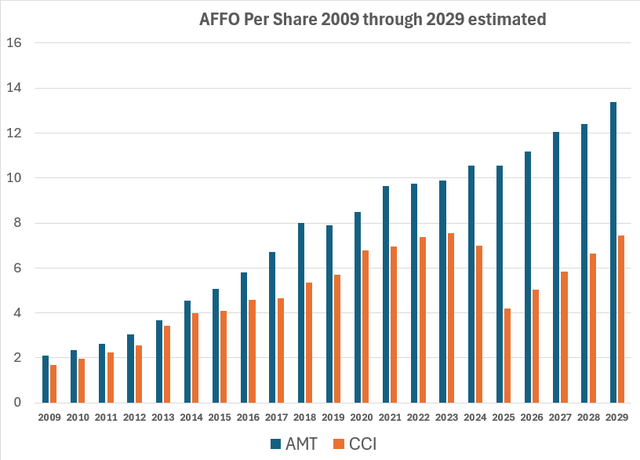

These aspects of the tower business have made it remarkably lucrative over the long term. They have pushed rents up considerably just about every year and have a runway to continue pushing rent. Higher rent without higher expenses has allowed AMT to increase its AFFO per share 5-fold since 2009.

S&P Global Market Intelligence

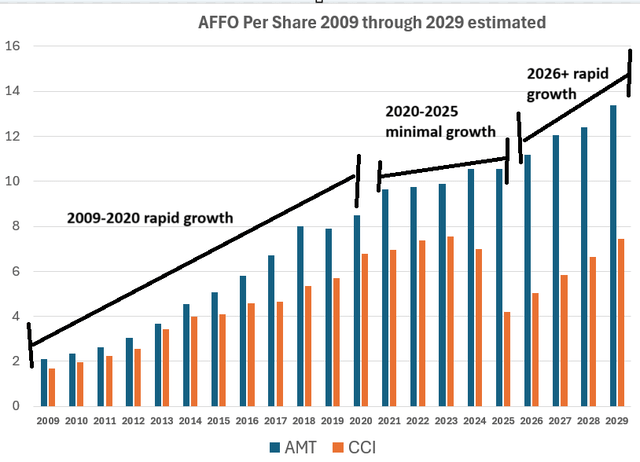

There are 3 distinct periods in the graph above, which I have annotated below.

S&P Global Market Intelligence

2009 through 2020 represents the rapid growth associated with the colocation and rental rate growth discussed above.

The 2020-2025 period looks quite different, with relatively minimal AFFO/share growth for AMT and even negative AFFO/share growth for Crown Castle (CCI).

So what happened?

T-Mobile buying Sprint shocked the tower industry

In 2020, T-Mobile (TMUS) bought Sprint. There were 4 major wireless carriers (TMUS, AT&T, Verizon and Sprint) and suddenly, it became 3.

Regulators at the time of the merger were concerned that having only 3 carriers would reduce competition, so they aimed to establish a new 4th major player. To accommodate regulators, Boost Mobile was acquired by DISH in 2020 as part of the Sprint/T-Mobile merger.

DISH was supposed to be that 4th player, but largely failed to achieve real scale. It has since merged with Echo Start, but has still largely failed to scale.

This had ramifications for the tower REITs because their low churn industry suddenly became high churn.

With TMUS now owning Sprint, overlapping equipment became redundant. Any tower that was leased to both TMUS and Sprint was going to face churn as soon as the Sprint leases expired.

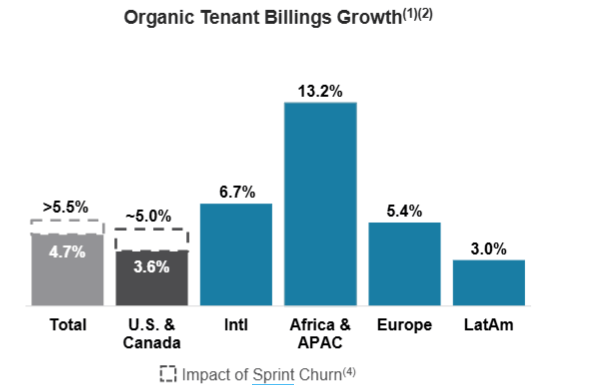

These were long leases, with some expiring each year. Sprint churn is still taking a bite out of growth. Below is AMT’s organic tenant billings growth in 1Q25.

AMT

Growth was 4.7%, but it would have been 5.5% without the Sprint churn.

Some periods have more Sprint churn impact and others have less, but the net effect has been dramatically slowed growth for the tower REITs in the 2020 through 2025 period.

The core business is still growing nicely. Rental rates are still rolling up at a good pace. It is just that the positive growth is being offset by lost revenue as Sprint leases expire.

AMT’s 10-Q explains that Sprint churn will continue to be a headwind through the end of 2025.

“We expect that our churn rate in our U.S. & Canada property segment will remain elevated through 2025 due to contractual lease cancellations and non-renewals by T-Mobile, including legacy Sprint Corporation leases, pursuant to the terms of our master lease agreement with T-Mobile US, Inc. entered into in September 2020”

As all of this is contractual, it should be included in guidance and analyst numbers for 2025.

Sprint churn is permanent but finite.

2026 seems to be when the growth is supposed to start back up at 7%-10% annually according to consensus estimates.

AMT market price weakness

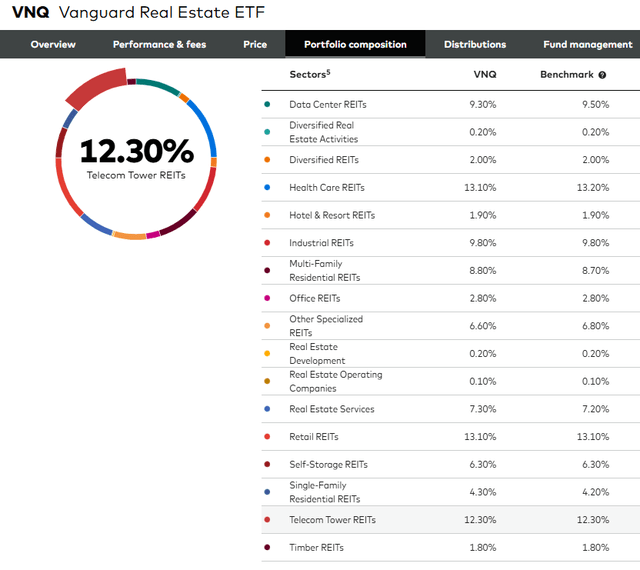

Since the tower REITs are quite large in market cap, they make up 12.3% of the REIT index and thus a 12.3% weight in ETFs like the Vanguard Real Estate ETF (VNQ)

We have been substantially underweight towers the last 5 years, generally having between 0% and 5% exposure. We were concerned with Sprint churn as well as the high AFFO multiple at which the sector traded.

This underweight turned out to be fortunate, as the sector had a rather dismal 5-year return.

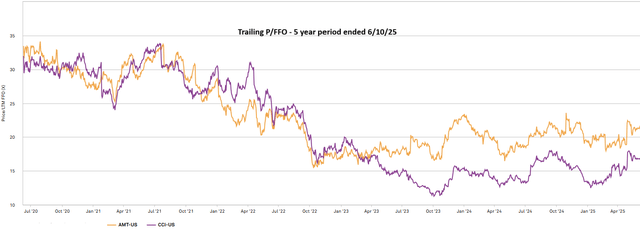

5 years ago, tower REITs were considered the cream of the crop. They traded at multiples in the 30s on the belief that the rapid growth would last for a long time. Those multiples were probably too high.

AMT continued to grow earnings, but at a much slower pace, and the market seems to once again believe the recent pace is permanent. The multiples of the tower REITs have dropped to around 20X.

S&P Global Market Intelligence

There seems to be a bit too much extrapolation of recent history in the way the market is pricing REITs.

In this case, the weak growth of 2020-2025 is attributable to a defined event (Sprint buyout by TMUS). That event is ending, and growth is likely to return to a higher level.

If the analyst estimates calling for 7%-10% annual growth in 2026 and beyond are correct, AMT is trading opportunistically.

We are starting to limp into a position.

Why just a limp in rather than a full position?

Well, the next few quarters will continue to be challenging on comps.

In September 2024, American Tower sold its business in India for 182 billion INR, or approximately $2.2B USD. As such, the upcoming quarters (2Q25 and 3Q25) will have challenging comps as the prior year to which they are compared will still include revenues from their India business.

Further, the rest of 2025 will still have Sprint churn headwinds.

It is in 2026 that the growth should resume to a fuller pace. Perhaps the market will be forward-looking and price that in early, which is why we are buying some shares now. However, it may be viewed as a “show-me story” where the market will not give AMT credit until they actually see the growth in 2026. As such, it could be dead money for another 6 months, so we are keeping a rather small position.

Overall, I like the prospects of AMT. The underlying business remains strong. The balance sheet and cash flows are exceptionally good. It is also the lowest multiple way to invest in data centers, as AMT trades far cheaper than Digital Realty (DLR) or Equinix (EQIX).

I think AMT’s CoreSite ownership pairs nicely with the tower business. Since towers are so low capex, they can plow cash flows from towers into the very capital-intensive buildout of data centers. In this fashion, they should be able to capture similar data center growth to DLR, just at a much cheaper multiple.

Risks to AMT

The perennial risk to tower REITs is their full exposure to a single product. While tower infrastructure has historically been very resilient, the damage to AMT would be catastrophic if macro towers were to be disrupted.

- 5G has at times been considered a threat to 4G towers, although in more recent periods it seems to work more in tandem with the macro tower network.

- Satellites can threaten macro towers in more rural areas, but likely don’t compete on latency in high density areas.

I can’t identify the threat that might eventually take out macro towers, but that doesn’t mean it can’t happen. I just might not be smart enough to see the future tech that displaces it.

Upside scenario

The big upside scenario would be a 4th real player emerging. Maybe EchoStar will finally get out of its own way and actually build out a real network.

Such an event would be a huge win for towers. Rather than having 3 tenants co-located on each tower, they could have 4. The revenues would be almost strictly additive, with minimal extra expenses.

The bottom line

Tower growth is not broken; it has just been offset with churn. As the churn subsides, the growth should return, which makes the now lower multiple on AMT potentially opportunistic.

So far, Portfolio Income Solutions subscribers consist largely of investment professionals, whether current or retired. That’s great, I love having an educated readership as they ask questions that challenge me to dig deeper. At the same time, I believe financial information should be available to all and that financial education is foundational to success in life. As such, I have launched a new branch within Portfolio Income Solutions that I am informally calling REIT University. It contains a crash course in fundamental investment and then goes deeper into REIT specific analysis.

Grab a free trial and start learning today!