Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m. on Seeking Alpha, iTunes, Spotify.

FRED

Crunching numbers

Who benefits from stock market gains? Shareholders and investors, of course. Those that have done well are celebrating the market comeback over the past quarter as stock picking continues in earnest for the second half of the year. Everyone is welcome to do their own investment research and join the party, though there has been some renewed discussion over how much wealth is concentrated at the top.

Quote: "I don't think we should have billionaires," said Zohran Mamdani, who just clinched the Democratic nomination for mayor of New York City. "Frankly, it is so much money in a moment of such inequality. There has to be a better distribution of wealth." The Big Apple not only houses the New York Stock Exchange (ICE) and Nasdaq (NDAQ) but is also the financial capital of the world, where the top 1% of the city's earners pay nearly half of all of its taxes, according to the NYC Independent Budget Office.

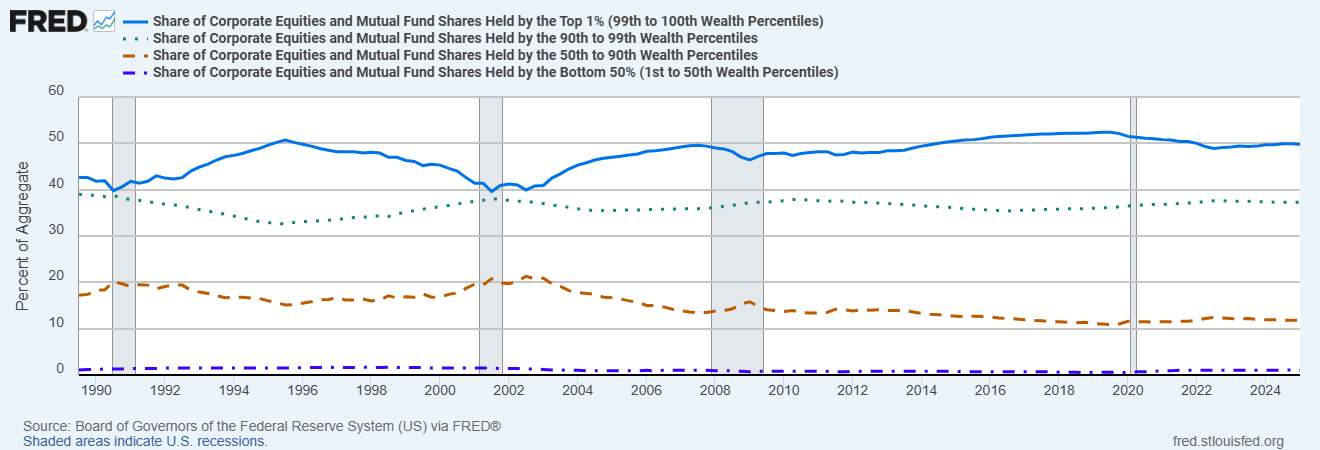

Turning to the stock market, the wealthiest Americans also control a majority of shares. In fact, the top 1% own half of all corporate equities and mutual funds in the U.S., per data from the St. Louis Federal Reserve. When factoring in the top 10% of Americans by wealth, ownership of the group rises to close to 90% of all stock market holdings (see the graphic above). However, this number has not changed meaningfully over time, with the percentage oscillating between 80% and 90% in data that goes back to the end of the 1980s.

Outlook: Much of the wealth, employment and services generated in society today have been facilitated by billionaires. Shop on Jeff Bezos-founded Amazon (AMZN)? Promote your business on Mark Zuckerberg-owned Instagram (META)? Wear a pair of Phil Knight-founded Nike (NKE)? The list goes on. While there are legitimate concerns over the effects of concentrated economic power, a better measurement might be how accessible it is to climb the income ladder, or to start a competitive business. The same holds true with regard to public equity markets, and whether it has become easier or harder to trade and invest in recent decades.

Here's the latest Seeking Alpha analysis

This Changes Everything: One Of The Most Important Shifts For Dividend Investors

Nvidia: Why I Am Aggressively Accumulating At All-Time High

STRD: A 10% Preferred Stock IPO From MicroStrategy

Collect Massive Preferred Stock Income For Your Retirement: PFFA

Two Less Popular ETFs That Are Better Than SCHD And Perfect For Retirees

What else is happening...

Senate passes 'BBB' without tax on wind and solar projects.

Design platform Figma files for IPO, to trade under FIG ticker.

Intel's (INTC) new CEO weighs big shift in marketing strategy.

Paramount to pay $16M to settle Trump's 60 Minutes lawsuit.

Banks are upping their dividends after latest stress tests.

Modelo owner Constellation Brands (STZ) logs softer demand.

Fed's Powell: Waiting to cut rates is the prudent thing to do.

Nasdaq's (NDAQ) first-half U.S. IPO listings soar past NYSE.

Amazon-backed Anthropic reaches $4B in annualized revenue.

Trump won't extend pause on tariffs as July 9 deadline nears.

Today's Markets

In Asia, Japan -0.6%. Hong Kong +0.6%. China -0.1%. India -0.3%.

In Europe, at midday, London +0.3%. Paris +1.1%. Frankfurt +0.2%.

Futures at 6:30, Dow +0.2%. S&P +0.1%. Nasdaq +0.1%. Crude +1% to $66.10. Gold +0.1% to $3,351.70. Bitcoin +1.2% to $107,801.

Ten-year Treasury Yield +4 bps to 4.28%.

On The Calendar

Companies reporting today include Zenvia (ZENV).

See the full earnings calendar on Seeking Alpha, as well as today's economic calendar.