Justin Paget

When investors are hunting for bigger dividend yields, they often undervalue the long-term sustainability of that yield. All too often, people think that if a cut is coming, they will:

- Find out in advance.

- Admit to themselves that it's coming.

- Dump the shares and reallocate before the market figures it out.

I don’t see many investors succeeding at that strategy, but many try.

I’ll start by highlighting some ideas I don’t like.

I’m not a fan of common shares of AGNC Investment Corp. (AGNC) (at $9.46), ARMOUR Residential (ARR) (at $16.91), or Orchid Island Capital (ORC) (at $7.13) today.

AGNC trades at a substantial premium to tangible book value. Many investors have piled in on the following factors:

- AGNC has a big yield.

- Earnings look strong.

- The Federal Reserve might cut interest rates, perhaps even a few times.

Well, having a big yield is pretty obvious. That isn’t doing research. It’s just looking at the yield. Sorting a list by dividend yield is not research. Sorry, not sorry.

The earnings look strong (not amazing, but still pretty strong) because AGNC still has hedges from when rates were very low. Those are gradually expiring. Consequently, AGNC’s cost of funds is going up. Even if the Federal Reserve cuts rates, the cost of funds is still going up because most of AGNC’s cost of funds is effectively locked in via swaps.

Could it happen that the Federal Reserve cuts rates so dramatically that it overpowers that effect? Well, technically, it might be possible. But that’s an extreme scenario and would likely involve a recession and the long end of the yield curve falling also. Why? Because it would require some dramatic reductions in short-term rates. That would cause AGNC’s interest income to fall, so that's not the scenario investors are hoping for.

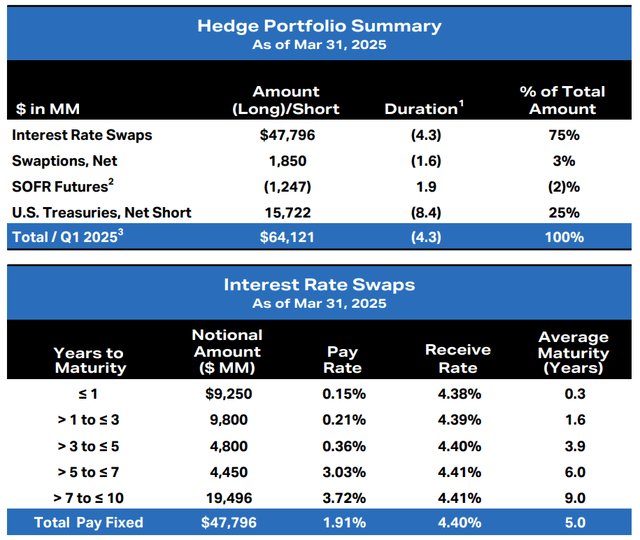

But why would AGNC’s cost of funds go up even if rates are cut moderately? Well, have a look at their hedge book:

AGNC

AGNC has a bunch of interest swaps. That’s their primary tool for managing interest expenses. The swaps that are near expiring (less than one year left) only require AGNC to pay 0.15% while they receive 4.38%. Those are really nice swaps. But that batch of swaps had an average maturity of only 0.3 years. That’s $9.25 billion of swaps. It’s a big deal.

AGNC is using the interest income on those swaps to reduce the reported net interest expense for funding their portfolio. However, as they run out, the cost goes up.

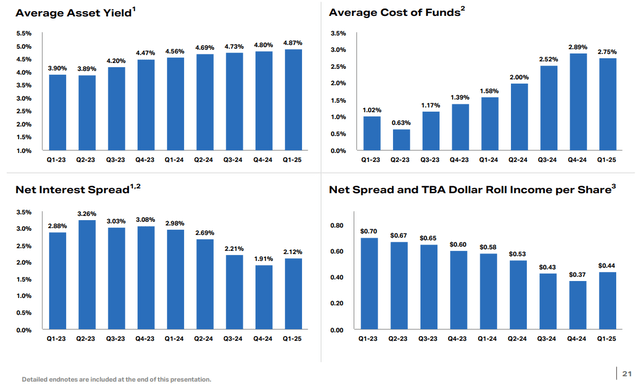

Want to see what it looks like over time?

AGNC

Notice that AGNC’s yield on assets was increasing, but the cost of funds was increasing faster. Consequently, the net interest spread was falling. Because book value (not pictured above) and net interest spread were falling, the “Net Spread and TBA Dollar Roll Income per Share” was also falling. You might notice that the coverage ratio for the dividend now is dramatically lower than it was two years earlier.

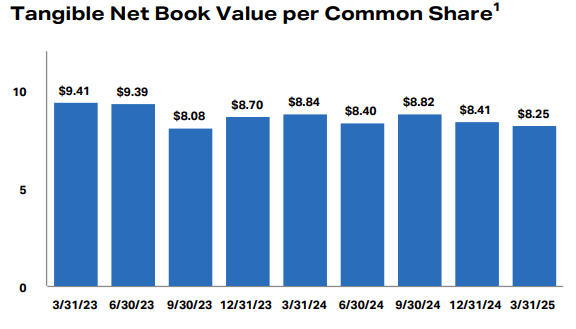

Want the history for tangible book value per share? Seems reasonable. Here it is:

AGNC

That’s down about 12% to 13% between Q1 of 2023 and Q1 of 2025. When that’s combined with the decreasing net interest spread, we see the reduction in income.

Now, what about ARR and ORC?

Imagine if AGNC were smaller, less popular, and worse at making decisions. Congratulations, you’ve got a good enough picture of ARR and ORC. Do they have the same hedge portfolio? No. But they're still comparable enough that the same general factors apply.

Does that mean these companies are dying? No. Not at all. They can issue equity.

Better Ideas

I’m really fond of using the baby bonds and preferred shares for this sector.

We’re swimming in opportunities to get a very respectable yield. We’re looking at 9% to 10% in most cases. It is not as high as the common shares, but the shares are far less volatile. See how AGNC lost just over 12% of book value in the last two years?

The preferred shares didn’t have that erosion. It was a lower yield, but far more stable.

There are quite a few options investors could consider for preferred shares or baby bonds. While I tend to be quite cautious as I deploy capital, there are quite a few preferred shares and baby bonds that are trading below our targets. I have executed limit-buy orders four times in the last 30 days as we’ve been getting some nice opportunities to build our positions. Of course, my portfolio is also the portfolio for The REIT Forum. It’s easier to evaluate an analyst if they share all the transaction details for their own portfolio.

Expensive Ideas

No, investors in AGNC shouldn’t expect the price to simply pop back. It’s already at a massive premium to tangible book value. Of course, some investors will argue that share price declines don’t matter, but share price declines typically come before dividend reductions. I’m not saying that’s about to happen right now, but getting such a large premium over book value is very unusual.

For ARR and ORC, the situation is more like trading very close to book value. That’s expensive for them. Given their frequent mistakes and losses in book value, they should be perpetually priced at discounts to book value.

Ideas Are Always Welcome

We got some great suggestions for charts in the comments of our prior article. I’m still going over possibilities for how we might add some of those charts. So long as I can get past the uploading, I can provide quite a few charts. In many cases, readers are asking for images (or tables) using data we either already have or can acquire quickly. So feel free to check out what we already have and make suggestions in the comments here.

Charts

You can see all the charts here.

It’s just one extra click, and it saves me a ton of time on uploading the article.

All The Stocks

The charts compare the following companies and their preferred shares or baby bonds:

- BDCs: (CSWC), (BXSL), (TSLX), (OCSL), (GAIN), (TPVG), (FSK), (MAIN), (ARCC), (GBDC), (OBDC), (SLRC)

- Commercial mREITs: (GPMT), (FBRT), (BXMT)

- Residential Hybrid mREITs: (MITT), (CIM), (RC), (MFA), (EFC), (NYMT)

- Residential Agency mREITs: (NLY), (AGNC), (CHMI), (DX), (TWO), (ARR), (ORC)

- Residential Originator and Servicer mREITs: (RITM), (PMT)

Thank You

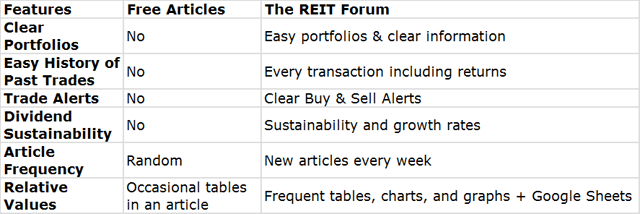

Want the best research? It’s time to raise your game. Get access to several features you won’t find on the public side.

You can get access to everything we have to offer right now. Try our service and decide for yourself.

If you saw this message, you were one of a very small number of people. Congratulations!