On Saturday, we asked if Trump’s trade wars are “fake news“.

That was just a kind of off-the-cuff post aimed at highlighting some commentary from Goldman which suggests that while the market is pricing in the impact from the narrow steel and aluminum tariffs, no one seems particularly concerned about an imminent escalation.

[...]

Well, yet another bank is out suggesting that this is all just a political gambit and in the course of the analysis, there are some interesting points about China.

“The Trump administration’s announcement of tariffs on steel and aluminum imports seems to be oriented more toward domestic political goals than any substantial re-engineering of trade flows,” Deutsche Bank writes, in their latest fixed income weekly note, before adding that the “carve outs” for Canada and Mexico underscore the notion that Trump is just trying to create some leverage (although there, the leverage is aimed at getting the upper hand in NAFTA talks, so it’s still about trade one way or another).

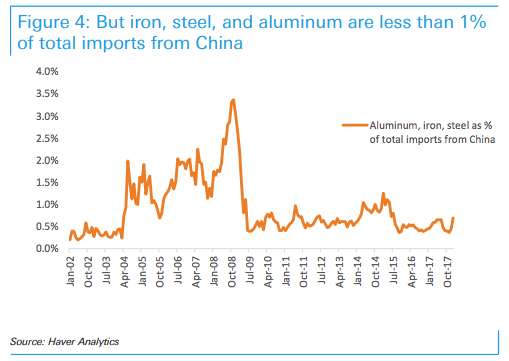

As far as China is concerned, Deutsche notes that while the Chinese “could well be the major economy subject to the tariffs, steel and aluminum imports are an even smaller component of total goods imports from China than for the rest of the world [as] over the last year, steel and aluminum imports have on average amounted to just over 0.5% of monthly total goods imports.”

More here:

More here: