Review

The market was under extreme pressure this week after CannTrust revealed that it used not-yet-licensed rooms for cannabis production. Its products are temporarily unavailable for sale, and the company is submitting responses to Health Canada by next week. It's not clear how the regulator will deal with the situation, which could include destruction of the inventory, a fine and possible loss or suspension of its license. Health Canada issued seven new licenses, boosting the total to 196. It also revoked the previously suspended license of Agrima (Ascent Industries). Ohio is reviewing licensing for Harvest and Acreage, continuing a trend of states pushing back against the efforts of MSOs to get multiple licenses under their control.

During the week, I posted the second of three articles for the August edition of the 420 Investor Newsletter:

Why HEXO Corp Deserves a Look

Here are some of this week's highlights for Focus List names:

- ACRGF CMO Harris Damashek left the company.

- CTST revealed a major problem that threatens its long-term viability as well as its near-term financials. The company jumped the gun, cultivating in rooms, currently licensed, before approval by Health Canada. The company faces punishment that could range from fines, inventory destruction and possible license suspension or revocation.

- CVSI resolved its five-year old lawsuit as the plaintiffs dropped their case related to the original acquisition of its assets. It announced more than 500 acres of U.S. hemp production for 2019.

- FFLWF opened another Alberta store, its 23rd overall

- GRWG added former Home Depot CEO Bob Nardelli as an advisor

- GTBIF opened its fourth Florida dispensary

- HEXO will be moving from the NYSE American to the NYSE on July 16th.

- HRVSF announced an acquisition in Arizona and a dispensary opening in North Dakota.The Supreme Court of BC approved its combination with Verano Holdings.

- IIPR announced a $19.8 million Michigan project with Ascend, its third in the state. The company sold 1.3 million shares at 126.

- ITHUF announced that its CBD For Life products will be distributed by Dillard's. It's CFO bought 20K shares on the open market.

- KSHB announced that it has applied to the NASDAQ for listing. The company's Q3 showed revenue slightly above expectations with EPS in line.

- MMNFF renegotiated the terms on its $250 million debt deal with Gotham and sold them an additional $30 million of stock at US$2.37. It began selling smokable flower in Florida.

- OGI announced that it has developed a proprietary nano-emulsification technology that will allow for the production of both liquid and powdered cannabinoid products.

- SNNVF former President Pedersen revealed the sale of 792K shares since departing in May

- SPRWF closed its Blissco acquisition

- TCNNF launched SLANG Worldwide RESERVE vaporizer cartridges in Florida. The company extended voluntary lock-ups from July to January for a portion and next July for the majority of the 62.25 million shares representing 59% of the company's stock on a converted basis.

- TLRY imported medical cannabis into Ireland for the first time

- TRSSF received an amendment to its license that permits it to sell oils in Canada

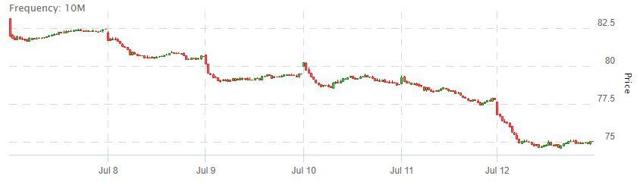

The Global Cannabis Stock Index fell for the second straight week, dropping 9.0% to 75.03:

The index, up 17.2% so far in 2019, lost 54.9% in 2018 after gaining 91.8% in 2017 and 88.8% in 2016. It currently includes 64 stocks and ended 2018 at 64.02:

Model Portfolios

420 Opportunity ended the week valued at $110,420, down 9.4%. The model portfolio has gained 16.7% year-to-date and has increased 121% since April 2014. 420 Quality ended the week at $145,227, down 8.8%, and has increased 22.0% year-to-date. This model portfolio was launched in March 2017 targeting long-term investors seeking to invest in leading cannabis stocks with low portfolio turnover and has gained 190.5% since inception compared to the 7.2% decrease in the index. Flying High ended the week valued at $226,206, down 7.3%. The year-to-date gain has been 40.2%, while the return since inception in late 2013 has been 2162%.

Outlook

The cannabis sector is seeing rapidly improving quality due to new entrants and some of the older names executing. Valuations generally remain cautionary, and fundamentals are questionable for most of the over 800 companies in the sector. While the sector has been volatile and has declined since early 2018, the longer-term trend since early 2016 has been bullish. There are some catalysts ahead, including the changes ahead due to hemp legalization, progress in the Canadian legalization that commenced October 17th and in German MMJ as well as the continued roll-out of the implementations in California and Massachusetts for adult-use as well as medical cannabis in several other states. The demise of the Cole Memo had left a big overhang in the U.S. market, but I believe this is now behind us and advocate a more aggressive approach for investors with respect to legitimate U.S. companies. A major change has been the stepped up pace at which higher quality U.S. operators are going public via the CSE in Canada. Consolidation within both Canada and the U.S. will continue, but the Canopy deal with Acreage paves the way for potentially more cross-border consolidation. Finally, expect to see more of the Canadian LPs list on major U.S. exchanges.

The big themes ahead are likely to be continued cross-industry investment into the sector and more consolidation in Canada and in the U.S., insight into the President's plans regarding the federal view on state-legal cannabis (especially in light of the apparent deal with Senator Cory Gardner and the introduction in the Senate of Strengthening the Tenth Amendment Entrusting States (STATES) Act ), better clarity from the federal government for banks and cannabis research, FDA pushback towards the CBD from industrial hemp industry, the GW Pharma launch of Epidiolex, the inclusion of a broader range of extracts in Health Canada's ACMPR program and its continued growth in patient enrollment, the rollout of MMJ in Denmark, Germany, Mexico and in Australia as well as continued advances in South America, progress with respect to the new legal cannabis implementations in CA, IL, MA and MI, and the new MMJ implementations in Arkansas, Florida, Maryland, Michigan, Ohio, Oklahoma, Pennsylvania and Texas, possible legalization via the legislatures in CT, MD, MN, NH, NJ, NM, NY and RI and implementation of potential commercial programs in ME and VT. The 2020 elections will start to get a lot of attention later this year as well.

Here are some of the most interesting stories we published on New Cannabis Ventures this week:

Cannabis REIT IIPR Sells 1.3 Million Shares at $126

CannTrust Flagged by Health Canada for Cannabis Production from Previously Unlicensed Grow Rooms

Demetrix Raises $50 Million to Pursue Cannabinoid Biosynthesis

Former Home Depot CEO Bob Nardelli to Advise Hydroponics Retailer GrowGeneration

Gotham Green to Invest Additional $30 Million Into Medmen After Revising Terms to Prior $250 Million Financing

Green Growth Brands to Buy Cannabis Extracts Company Moxie for $310 Million

iAnthus Subsidiary CBD For Life Continues to Expand National Footprint with Dillard’s Department Store Partnership

KushCo Holdings Generates $41.5 Million in Revenue in Fiscal Q3

Trulieve Cannabis Corp. Announces Extension of Voluntary Lock-Up Agreements with Company Founders

Resources:

- Stay on top of all of the NCV news on publicly-traded stocks

- Track cannabis stocks with the Global Cannabis Stock Index

- Follow Canadian Producers with the Canadian Cannabis LP Index

- Monitor the American Cannabis Operator Index

- Access free Canadian cannabis investor resources

- Learn about our featured companies

- Check out our "Revenue Tracker"

- Discover upcoming new issues and IPOs

- Stay on top of upcoming earnings calls

- Subscribe to the free Weekly Newsletter

- Follow all the NCV news real-time, by liking the Facebook page

- Get the NCV App (Apple)

- Get the NCV App (Google Play)

- Find a job with a leading cannabis company

- Read my articles on the Forbes Contributor site

- Read my articles on Leafly

- Subscribe to the 420 Investor Monthly Newsletter ($199 year)

- Become a 420 Investor VIP Member ($599 year)