f11photo/iStock via Getty Images

Introduction

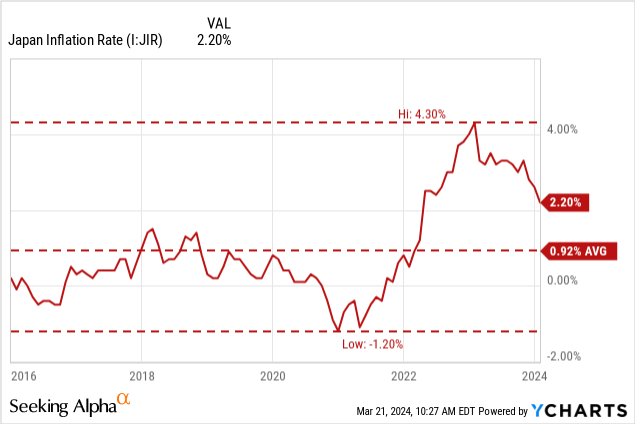

The Bank of Japan, or "Nichigin" (日銀), finally ended its experiment with negative interest rates this week. Since 2016, in an attempt to create synthetic inflation, Nichigin has kept their key interest rate below 0%, effectively charging to keep deposits. This was meant to create a pressure on consumers to spend more and save less.

This worked for a few years, and the Yen saw positive inflation rates until the global Stagflation crisis in 2021 — 2022 caused the Yen to dip back into negative inflation territory.

Japan has a history of deflationary pressures on their currency, which has created a culture of price stagnation and hesitancy among domestic businesses to raise prices due to the threat of consumer backlash.

Bucking Pay Stagnation

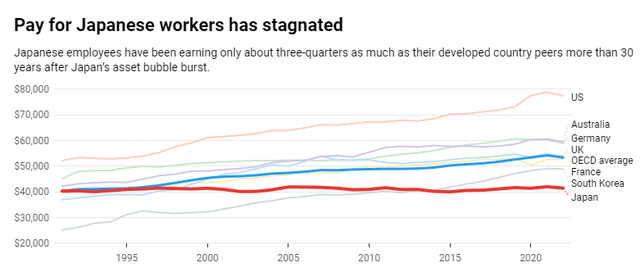

For a very long time, Japanese workers have not seen real wage increases. What increases they do see stay on par with inflation. The following chart depicts real wages, that is, wages accounting for inflation/deflation.

Figure 1 (OECD)

In its statement on why they are ending the negative rate experiment, Nichigin said that they expected this trend to end. Labor unions in Japan have been fighting for pay increases following the inflation spike in 2023, and they are winning.

This should lead to increased consumer spending, one of the contributors to sustained inflation over the long-term. Nichigin wants to be at 2% consistently, and consumer spending needs to increase for this to happen.

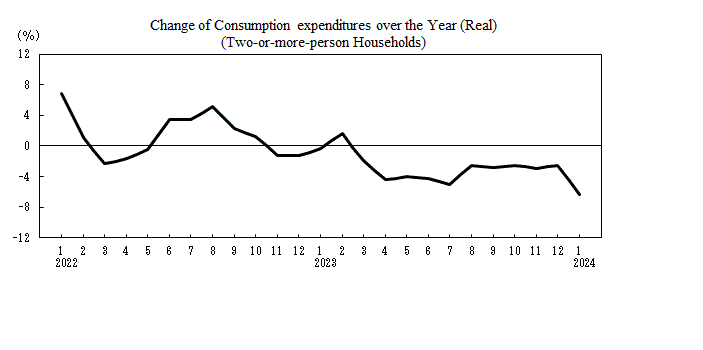

There has been a decrease in consumer spending because of the previously-mentioned inflation. The BOJ believes that these pay increases are going to fix this trend.

Figure 2 (Statistics Bureau of Japan)

Consequences

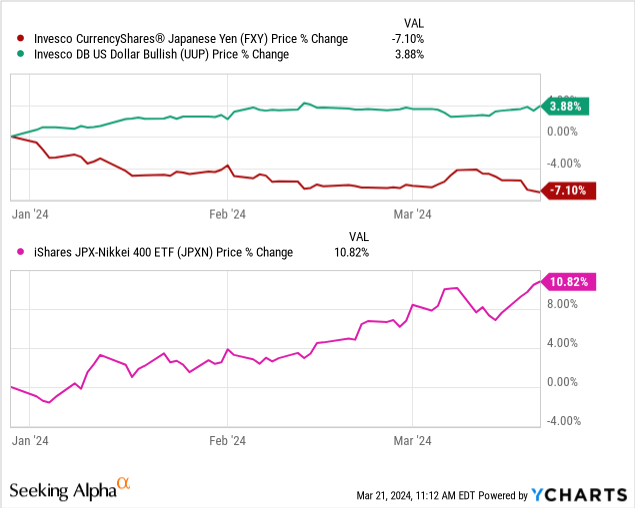

Japan was able to avoid a technical recession earlier this month. This, along with the announcement from the BOJ, has pushed the Japanese market to new heights and pushed down the Yen against the US Dollar.

This shift in policy has made me bullish on the Japanese economy and markets, as domestic companies gain more pricing power the longer the inflation narrative continues. If the BOJ is right that the Yen is going to regain some of its strength, that means that consumers will get more purchasing power for imported goods as well.

The Trades

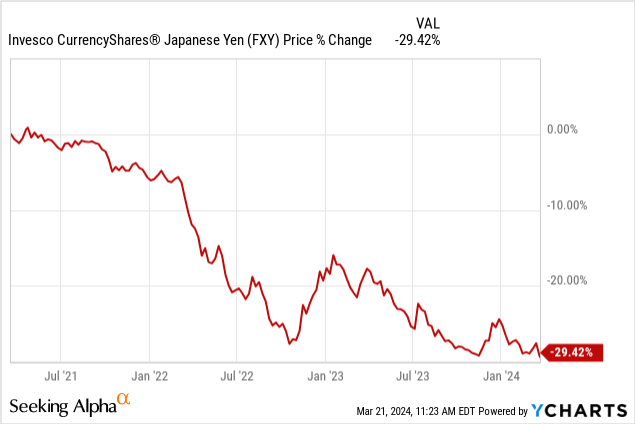

First and foremost, investors could consider investing in Nichigin's narrative: the Yen will gain strength and inflate moving forward. This would make taking a position in Yen via a fund like the Invesco CurrencyShares Japanese Yen Trust ETF (NYSEARCA:FXY) a trade idea for the next two-to-three years as we wait for the BOJ's inflation narrative to play out.

I consider this announcement from Nichigin a "calling the bottom" on the Yen, and I believe that investors could see a recovery of that 30% loss in the last three years on the JPY:USD trade in the next three years.

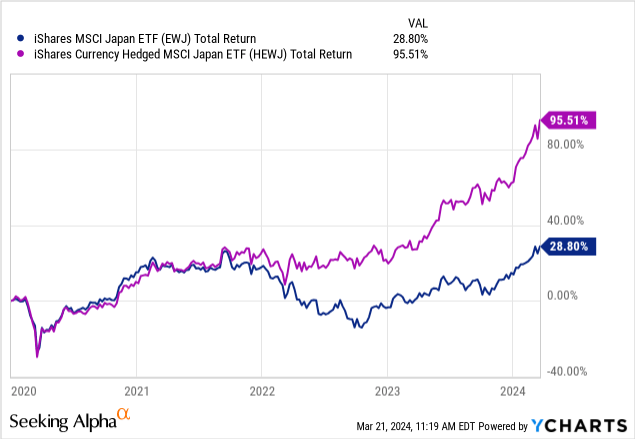

In a world where the Yen gains more strength, I believe the dollar will follow. That means that currency-hedged exposure could be beneficial for US investors as they could profit off of the spread between the two.

This could be achieved with the iShares Currency Hedged MSCI Japan ETF (HEWJ) or the WisdomTree Japan Hedged Equity Fund ETF (DXJ), which negate currency risk while still offering exposure to Japanese markets.

There is some drag associated with this hedging strategy, but I believe the gap in returns speaks for itself.

Risks

We should consider that the BOJ could be wrong in their assertions. If we don't see a meaningful rise in consumption, we could see a return of the deflationary pressures that have caused real wage stagnation over the last thirty years.

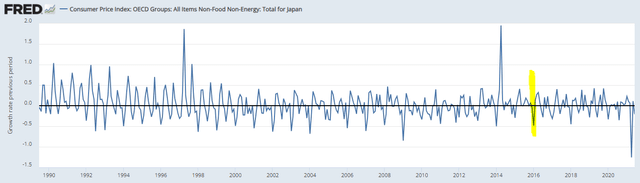

Figure 3 (FRED)

The above chart is "core-core inflation," which is less food and energy. The highlighted section is where the negative rate experiment began.

Note that there was no meaningful change in this rate since the policy began. It did not do its job, as there was still consistent bouts of negative inflation rates.

If the bank's new plan is as effective as this last one, we may not see returns on the Yen. This is the reason why I am still advocating for currency-hedged exposure despite this bullish turn on the Yen.

Conclusion

The Bank of Japan has finally called an end to its seven-year experiment with negative interest rates, leading to buying opportunities for the Yen and in the Japanese stock market. I believe this is a "calling of the bottom" by Nichigin.

I am broadening my exposure to Japan, but am cautious about adding too much currency risk to my portfolio, so I am still recommending hedged exposure at this time.

Thanks for reading.