Jeremy Poland

Amplify Energy Corp. (NYSE:AMPY) is focusing on Beta development in 2024, putting around 76% of its 2024 capex budget towards various Beta projects. This investment reduces its 2024 free cash flow, although due to improved oil prices, Amplify is now projected to generate approximately $43 million in free cash flow in 2024. This is above Amplify's prior guidance range for $20 million to $40 million in free cash flow in 2024, helped by oil strip around $6 higher than what Amplify assumed in its guidance.

Amplify's free cash flow calculations exclude several obligations, so factoring in those obligations, it is expected to pay down its credit facility debt by around $17 million in 2024. Amplify's free cash flow should improve by around $40 million in 2025 compared to 2024 though.

I now estimate Amplify's value at $10 per share at long-term (after 2024) $75 WTI oil and $3.75 NYMEX gas. This is a reduction of $1 since my October 2023 look at Amplify, due to increased operating costs.

Huntington Beach Oil Sheen

Amplify's stock was temporarily slammed by reports about an oil sheen near Huntington Beach in March 2024. However, it later became apparent that the oil sheen was likely the result of natural seepage from the ocean floor and also involved relatively minimal volumes of oil.

Amplify indicated it was confident that the oil sheen wasn't related to its operations, and its stock basically ended up recovering to roughly where it was before the oil sheen showed up.

Focusing On Beta Development

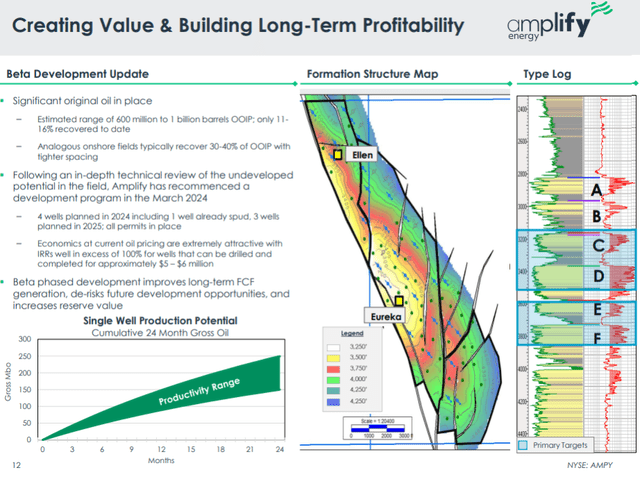

Amplify's 2024 capex budget is around $55 million, and 76% of that is being allocated towards Beta.

The company intends to drill four wells in 2024 and three wells in 2025. Amplify anticipates that the Beta wells can pay back within a year, with oil strip prices in the $70s.

Two of the 2024 wells are expected to come online in Q2 2024 and the other two are expected to come online in Q4 2024. Thus, this will have some impact on 2024 production levels, but more impact in 2025. Amplify mentioned that the first 12-month gross production from a new Beta well should average around 350 barrels of oil per day (or around 125,000 barrels for the year).

Beta Development (amplifyenergy.com (Q4 2023 Investor Presentation))

The 2024 Beta wells (based on the production potential mentioned above) could contribute around 400 net barrels of oil production per day to Amplify's 2024 results, but around 1,000 net barrels of oil production per day to its 2025 results.

2024 Outlook

Amplify expects approximately 20,000 BOEPD in 2024 production, with a production mix of 42% oil, 16% NGLs and 42% natural gas. Amplify's average total daily production in 2024 is expected to be down slightly versus Q4 2023 levels, partly due to a scheduled 15-day Beta shut-in for the completion of the electrification of the platforms.

The current strip for 2024 includes roughly $81 WTI oil and $2.35 NYMEX gas. At those commodity prices, Amplify may be able to generate $318 million in revenues inclusive of hedges. Amplify has around 85% of its 2024 natural gas production hedged at an average floor/swap price of $3.58 and 68% of its 2024 oil production hedged at an average ceiling/swap price of $77.35.

| Barrels/Mcf | $ Per Barrel/Mcf (Realized) | $ Million | |

| Oil | 3,084,250 | $77.88 | $240 |

| NGLs | 1,149,750 | $23.00 | $26 |

| Natural Gas | 18,158,750 | $2.08 | $38 |

| Other Revenue | $3 | ||

| Hedge Value | $11 | ||

| Total Revenue | $318 |

Amplify is currently projected to generate $43 million in 2024 free cash flow at current strip prices before cash taxes. This is above the $20 million to $40 million guidance range that Amplify mentioned earlier, which was based on $75 WTI oil for 2024.

Amplify's free cash flow guidance did not include the impact of cash income taxes or scheduled payments to the Beta sinking fund or federal fines that are due. After $8 million in cash income taxes and $16 million in Beta sinking fund payments (for future decommissioning costs) and $2 million in federal fines, Amplify may have $17 million to put towards debt reduction.

| $ Million | |

| Lease Operating Expense | $142 |

| Production and Ad Valorem Taxes | $21 |

| Gathering, Processing and Transportation | $19 |

| Cash G&A | $26 |

| Cash Interest | $12 |

| Capital Expenditures | $55 |

| Cash Income Taxes | $8 |

| Total Expenses | $283 |

Amplify ended 2023 with around $94 million in credit facility debt (net of cash). It is now projected to end 2024 with $77 million in credit facility debt (net of cash) and $31 million accumulated in its Beta sinking fund.

Due to a combination of increased Beta oil production, reduced Beta operating costs (with the platform electrification) and lower capex, I expect Amplify's 2025 free cash flow to be around $40 million more than its 2024 free cash flow.

Notes On Valuation

At my long-term (after 2024) prices of $75 WTI oil (CL1:COM) and $3.75 NYMEX gas (NG1:COM), I estimate that Amplify's proved developed reserves could have a PV-10 of around $700 million to $750 million.

At a 0.65x multiple (reflecting the market value of mature properties) to proved developed PV-10 and factoring in Amplify's net debt and hedges (as well as giving credit to its Beta sinking fund balance), this would result in a value of approximately $10 per share for Amplify.

Amplify's assets tend to be mature properties with fairly high operating costs. As such, the value of its reserves are quite sensitive to changes in commodity prices. This can be seen with Amplify's estimated reserve value based on late February 2024 strip prices (as seen below). At strip prices that average around $71.25 WTI oil and $3.21 NYMEX gas over the next three years, Amplify's proved developed PV-10 drops to $545 million.

February 2024 Strip Prices (amplifyenergy.com (Q4 2023 Investor Presentation))

A 0.65x multiple to that results in an estimated value of around $7.50 per share for Amplify. This is around Amplify's current share price, although current strip has improved compared to late February.

Conclusion

Amplify Energy is expected to pay down its credit facility debt by around $17 million in 2024 as it invests in Beta. This investment is expected to have more of an impact on Amplify's 2025 results, and I am currently forecasting a $40 million increase in Amplify's free cash flow in 2025 at current strip prices.

Amplify is currently fairly valued for a scenario where oil prices drop to the mid-to-high $60s in a couple of years. At my flat $75 WTI oil and $3.75 NYMEX gas commodity price outlook, I estimate Amplify's value at around $10 per share.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

Note: The free trial offer is valid only for people who have not subscribed to Distressed Value Investing previously.