fcafotodigital

Observation of a dark chocolate lover

As a proud owner of Hershey's (NYSE:HSY) stock, having last covered it in December 2023, I deal with the question daily in the back of my head, when will the cocoa market crash? As a self-proclaimed dark chocolate lover, the bitter stuff with 70+% cocoa content, I've recently observed some strange goings-on during my recent dark chocolate bar purchases. Our local Raley's and Safeway grocery stores are blowing out several brands of "indy" private label dark chocolate.

I admit that I am not extremely familiar with these brands and often just buy the best deals. They all present themselves in the same way, "independently owned", "fair trade" and "organic". In a world of high cocoa prices, the first thing that comes to my head is low-profit margins, maybe negative right now. Most of these bars cost $5-$6 a bar. However, the aforementioned grocery stores now have many of these brands labeled as discontinued and I even bought multiple bars recently for under $2 each!

Something is happening.

My scuttlebutt story

Phil Fisher and Peter Lynch were not only famous for spotting growth companies but also for going out and asking questions to company management and observing retail trends-[in the case of Peter Lynch with retail]. While I'm a fundamental investor primarily, I am always paying attention when I'm out shopping. What's inflating, what's deflating, what's disappearing, and what is newly appearing?

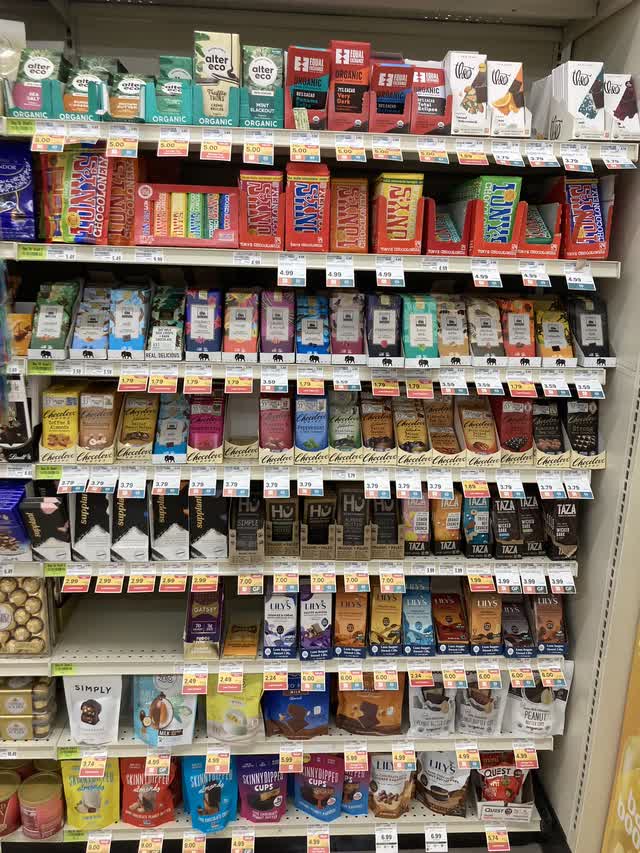

Below are a few photos from a local Raley's. I have been to 5 or 6 Raley's and Safeways all over town the last couple of weeks and have noticed a trend in the Dark Chocolate section.

Firstly, let's look at the over saturation of selections:

my own photo

Again these niche organic Dark Chocolate brands are not large compared to Hershey, but collectively they suck up a lot of cocoa. These guys are backed into a corner. They are "healthy" dark chocolate brands that can't make their bars without 70-80% cocoa mass.

Next, we have some deals, 50% off and buy one get one free have left me in Dark Chocolate Lover's heaven the past few weeks.

Indy brand deal #1

my own photo

Indy brand deal #2

My own photo

I was determined this time upon checkout to ask the two clerks at the front,

"What gives? I am seeing massive discounts all over town in the Dark Chocolate aisle. Are they all going out of business?"

They were very aware of the situation and first gave me a background on the cocoa market. They then said that many of these suppliers cannot get enough cocoa to supply them with new candy bars so they are discontinuing many of them.

Clear enough, when you need 7-8 X more cocoa per bar than the big boys who are already ahead of you in line for beans, good luck!

Are all these dark chocolate brands to blame?

This is my hypothesis. Historically, most people enjoyed milk chocolate. A lot of milk chocolate actually has very little cocoa solids, I found this analysis of cocoa content fascinating from www.gourmetboutique.net:

To distinguish between American and European chocolates, there are four major differences you will find. One is the cocoa content. The United States requires a lesser percentage cacao in their chocolates, ten percent to be exact, while in Europe anything considered “chocolate” is twenty percent or higher. For example, if you were to compare a Hershey bar made in America versus a Cadbury Dairy Milk bar made in Europe, you would find a significant taste difference. That’s because those Cadbury milk bars contain 23 percent cacao in comparison to the American-made Hershey bars, which contain only eleven percent cacao, resulting in a much darker, richer taste in the Cadbury bar.

Eleven percent is barely chocolate. On the other hand, the bars I had been buying were 70-80%. If that's the case, the amount of cocoa these independent dark chocolate brands are producing may have a 7-8X higher cost of goods sold vs a Hershey's milk chocolate bar! Of course, a bar is a bar and the weight has to be comprised of something edible and none of those things are free, but if Hershey's is using cheaper fill content [milk, sugar, other fats and emulsifiers], then the costs for these independent makers must be at least 5 X more.

The problem is they're all private labels

With most of these dark chocolate makers being private and independently owned, we have no insight into their costs to produce a bar. My guess is, the grocery stores are discontinuing the sales not only for the reasons they mentioned to me, but also :

- A: They're [the chocolate bar company] going out of business soon... or

- B: They can't buy them from the distributor cheap enough to make a profit and the distributor can't cut prices for the stores because they can't afford it.

- Or C: The grocery stores have way too many dark chocolate brands, and they need to reduce stagnant inventory. This will lead to certain companies losing distributors.

Keep in mind that these are also the companies with the "fair trade" moniker which usually means a bump in purchase price to the growers to account for inflation. While this is admirable, it just adds to the cost strain that they must already be under.

Therein may lie the key to cocoa prices

Two things can't be true at once, the demand for chocolate is at record highs and the private label dark chocolates are sitting and need to be liquidated under cost. The demand for milk chocolate may be very high, but dark chocolate seems very low from a scuttlebutt sleuthing perspective. The dark chocolate market is way over saturated and each bar they produce may consume 7-8X the cocoa of a Hershey's milk chocolate bar. This may be one of the key reasons why the cocoa market has been driven up like a rocket. As they go under one by one, this may lead to a crash in cocoa prices.

That is my thesis. Next time you're at the store, look for dark chocolate bars on sale for yourself.

In essence, I believe the indy dark chocolate labels that have sprung up everywhere are creating artificial cocoa demand by producing far too many bars with dense cocoa solid concentrations.

Who knows?

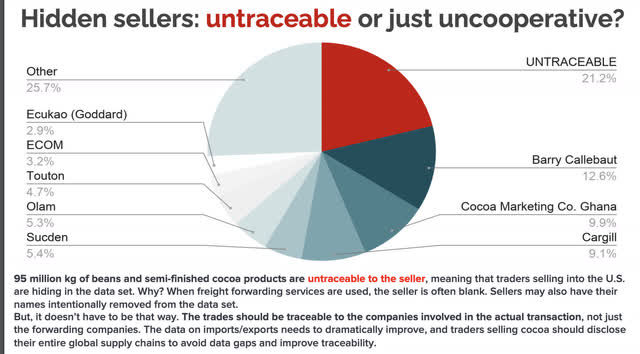

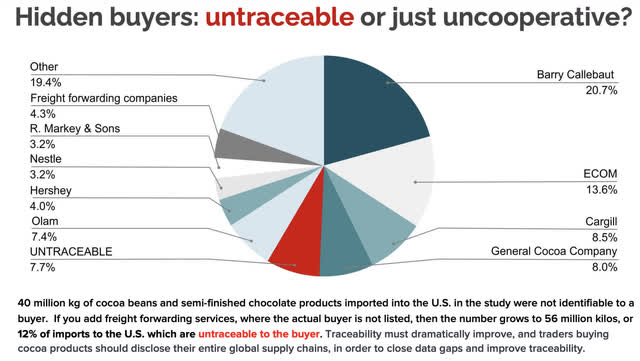

So much of the cocoa bean industry is shrouded in secrecy. Supply chains are largely undocumented or documented poorly. Many of the cocoa sellers and buyers are not publicly listed companies, so data is lacking. A great report by mightyearth.org shares some insight:

The data sets from these independent reports are from 2020.

mightyearth.org

mightyearth.org

Weather in West Africa

The primary accusations around the spike in cocoa prices come from a bad spat of weather patterns hitting West Africa, the primary producer of cocoa beans.

The problems reported are not consistent. Some blame hotter and drier weather brought about by an El Nino. Other reports claim wet weather is to blame for causing rot in cocoa tree roots. Other reports claim the aging population that farms cocoa is to blame, along with inspectors making sure that child labor is no longer being used. There is a myriad of problems that are compounding the issue.

Although none of the above helps, I also believe that the phantom dark chocolate demand is a big part of the issue with at least 27.1% of buyers being untraceable, most likely private label buyers. That was 2020 and the number has most likely risen since.

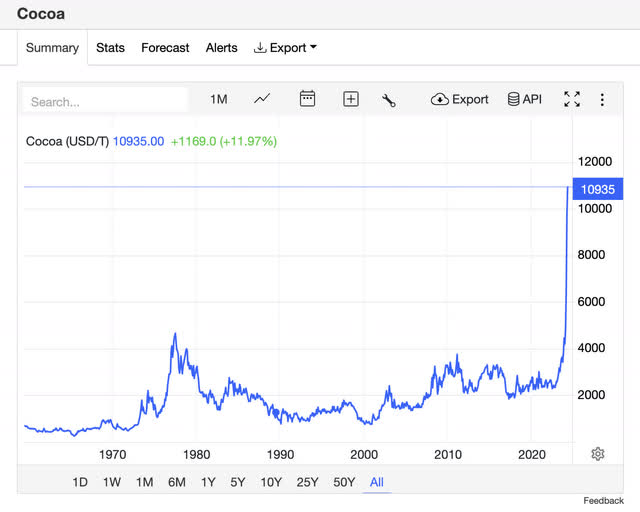

Coca price charts

tradingeconomics.com

We can see from the above there are no agricultural-based commodities that rival the price appreciation of Cocoa over a year which is up 241%. There's been rumblings of a coffee bubble coming up the rear after a strong month, but the numbers look little like cocoa over a 12-month span.

tradingeconomics.com

The parabolic chart that now surpasses any other era has to be a confluence of issues, weather is certainly one of them, but I have not seen any good data that parses demand from chocolate producers from demand from chocolate consumers.

Charlie Munger on Hershey

Charlie Munger once had a high opinion of Hershey, here is an excerpt from Poor Charlie's Almanack on flavor when speaking about Coca-Cola and Hershey flavor differentiators:

One of my favorite business stories comes from Hershey. They get their flavor because they make their cocoa butter in old stone grinders that they started with in the 1800s in Pennsylvania. And a little bit of the husk of the cocoa bean winds up in the chocolate. Therefore they get that odd flavor people like in Hershey's chocolate.

Hershey knew enough when they wanted to expand into Canada to know they shouldn't change their winning flavor. Therefore, they copied their stone grinders. Well, it took them five years to duplicate their own flavor. As you can see, flavors can be quite tricky.- Charlie Munger, Poor Charlie's Almanac pg. 225

Companies like Coca-Cola and Hershey succeed because they have a winning flavor. It is well thought out and studied by their flavor scientists. To be quite honest, when it comes down to dark chocolate brands, they all taste very similar to me. The only thing alters the taste is an additional flavor added like salt, fruit or caramel. I find these Dark chocolate brands have focused little on creating a unique replicable flavor and more on the cocoa content, which has backed them into a corner.

Hershey advantage

sources of revenue

From 2023 Q3 10Q

| REVENUE SEGMENTS | PERCENTAGE |

| TOTAL | 100% |

| N AMERICA CONFECTIONARY | 81% |

| N AMERICA SALTY SNACKS | 11.39% |

| INTERNATIONAL | 7.49% |

Many have been worried about healthier confectionery competition rolling up to take on Hershey. Now in hindsight, realizing how little cocoa Hershey needs per bar, I believe that competition may be getting washed out soon as margins are most likely going negative for many of the private labels. They can't get their hands on enough cocoa, but still have overhead. A recipe for disaster.

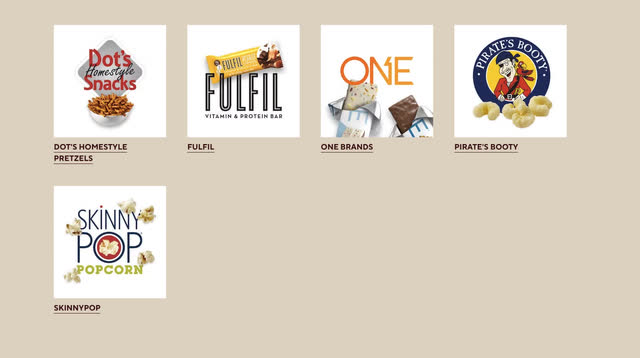

Salty snacks keep growing. Skinny Pop and Pirate's Booty, 2 corn-based salty snacks, are not going through a commodity crisis and are a Costco staple.

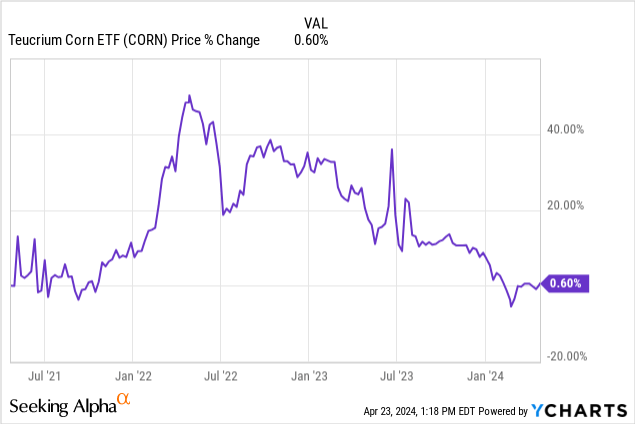

Using the Teucrium Corn Fund (CORN) as a proxy, we can see that there is near zero inflation in corn over the last 3 years. A great growth segment for Hershey to attack.

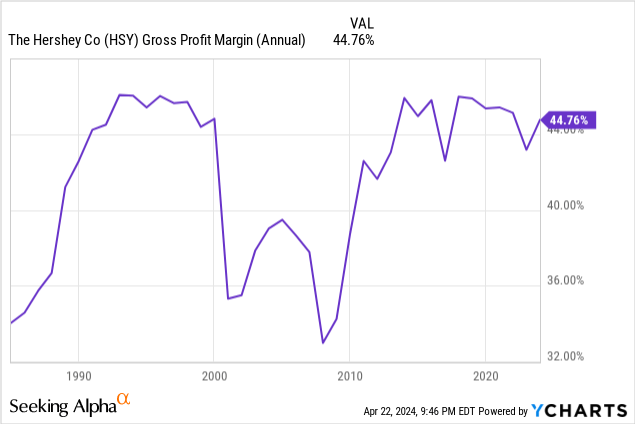

Hershey margins

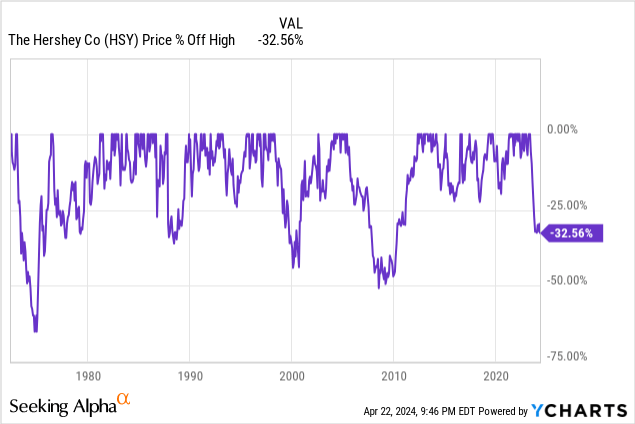

Percent off high

Still in clear bear territory at -32% off it's high, Hershey's is a still growing company able to maintain gross margins as a confectionary company in a cocoa crisis. Say that three times fast. Looks like a good place to go bear hunting.

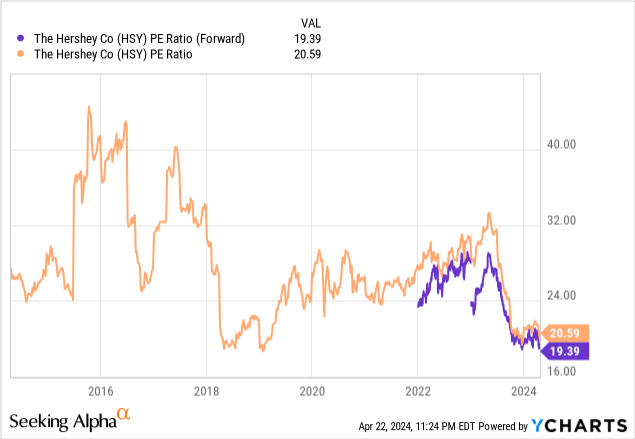

Valuation

On a trailing and forward basis, Hershey is trading at a near-record low 10 year price-to-earnings multiple. The graph consistently holds above the 24 X line for most of the decade outside of the COVID era. Even using 24 X earnings as our fair value from the historical market multiple times full-year 2024 guidance would give us a fair price of 24 X 9.61 2024 EPS = $230.64

going out further to 2025 estimates:

24 X 2025 EPS guidance of $9.97 = $239.28

Dividend Discount model

With Hershey's being one of the better companies out there from a return of capital to the consumer perspective, let's take a look at valuation from a dividend discount model:

Data courtesy of Seeking Alpha

| DIVIDEND[numerator] FWD | $5.48 |

| 10 YR GROWTH RATE | 9.83% |

| RRR 12% | |

| Denominator RRR minus Growth rate | 2.17% |

| PER SHARE VALUE | $252.53 |

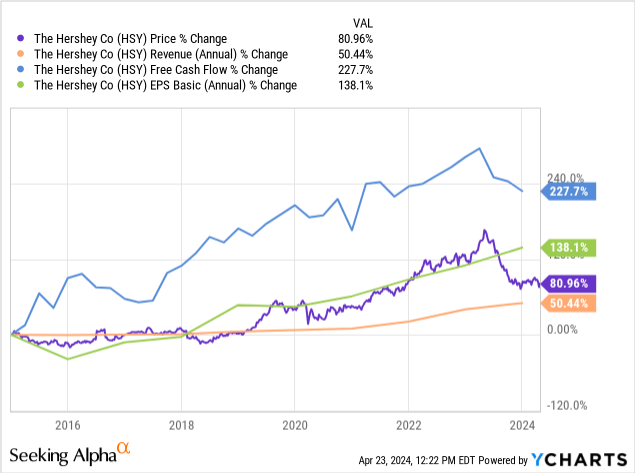

SP growth versus earnings metrics

The share price for Hershey's is now clearly below EPS growth and free cash flow growth rates over the past decade. A good value indicator when we are at decade-low EPS multiples to boot.

Balance sheet

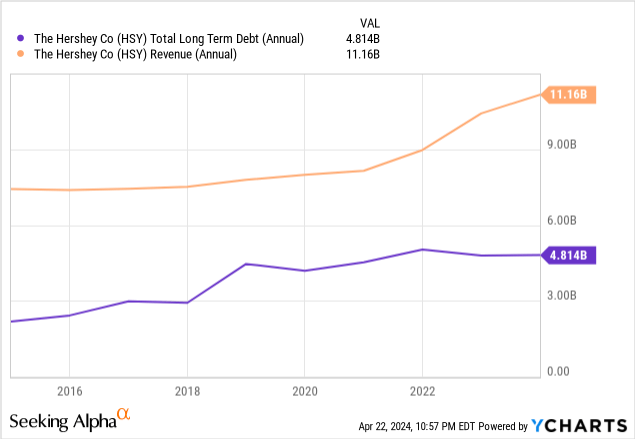

Hershey has increased long-term debt in the past few years, largely to diversify away from chocolate products, with big buys of Skinny Pop and Pirate's Booty.

hersheyland.com/brands

Revenue has grown along with debt, but interest rates still make excess debt a drag on net income.

Ooey gooey sticky inflation

The inflation problem for consumer staples is usually sharply negative in the short run and largely profitable in the long. When the cost of goods sold subsides, which, I believe, will be due to private label companies throwing in the towel, the increased prices by a company like Hershey will probably remain largely unchanged. This will increase gross margins at the very least.

Upcoming earnings

Seeking Alpha

Hershey will report pre-market May 3rd, 2024. Analysts are expecting growth in GAAP EPS and revenue even with 13 negative revisions in the past 90 days. This will include the Easter holiday, which is one of the larger candy buying seasons.

Risks

If this is purely a weather and demographic issue, this will not be resolved for some time. Even if cocoa solids are a small portion of a Hershey chocolate bar on average, a quadrupling or more in cost of one of your essential ingredients will still hurt your bottom line over a long period.

Summary

I sense something has to give. These cocoa prices are not sustainable and deep discounts in dark chocolate brands being apparent in my neck of the woods indicates to me an over-saturation in dark chocolate products that may be creating a phantom demand for cocoa beans which is not actually from the end consumer. With many times more cocoa solids in dark chocolate, a few small to medium-sized dark chocolate sellers could be equal to a company 7-8 X their size from a demand perspective when compared to a low cocoa solid product producer like Hershey.

I think being a dark chocolate label has now doomed several companies from a cost perspective. I think we're close to a cocoa peak. Strong buy.