HerbaLife (NYSE:HLF) has been at the center of a battle of the hedge fund titans after Bill Ackman of Pershing Sq. publicly disclosed his belief that HerbaLife was one of the "best run Ponzi schemes in the world" and said "our price target is zero." (visit his Herbalife site here) No sooner did that news break than did Dan Loeb of Third Point (another notable activist) announced that he was LONG shares of HLF. Finally, Carl Ichan apparently felt he was missing out on the fun so he jumped into the fray (in an exceptionally entertaining exchange on CNBC) calling Ackman's claims ridiculous (while insisting on referring to him as "this guy").

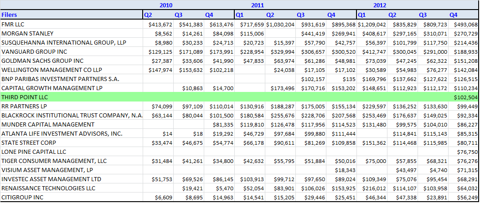

We took a deeper look at not only who's in HFL now, but who's BEEN in HLF over the years to get an idea of what the full constellation of hedge fund ownership looks like. The top 20 holders of HLF by market value as of Q4 2012 are shown below with Dan Loeb occupying the 9th spot. Interestingly, Loeb and Steve Mandel of Lone Pine are the only two top 20 holders that have totally new positions as of this past quarter:

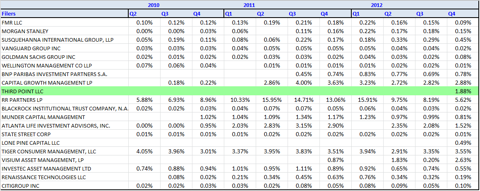

If we normalize those market values by the total reported long positions for each of those filers we can get a sense of the relative level of conviction each filer has in this name. As we see, most of the top 20 holders, including Loeb, don't really have a meaningful stake in HLF:

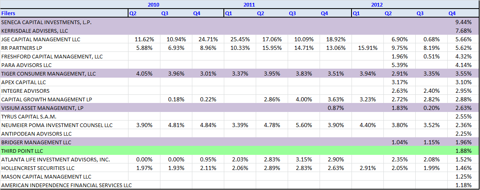

If we now sort by this conviction score we can see which filers are actually making the biggest bets in HFL, given their level of capital. Interestingly, we see some well-known hedge fund names that haven't been in the news lately:

Tiger Consumer