Over the past several days I have seen many articles in which a comparison is made between Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL). The question raised is if Apple will follow Microsoft's fate. For those who have not noticed, Microsoft's fate has been that it has done nothing for investors for over a decade. In fact, assuming you bought Microsoft stock in late 1999, you are still losing a lot of money.

Sorry to disappoint everyone, but Apple has nothing to do with the Microsoft of a decade ago. The simple fact that Apple has corrected from the $700 mark to where it is today is totally by chance. Microsoft's correction, however, was a sure thing. You see, over a decade ago Microsoft was a bubble of mythical proportions. It was only natural that it would correct and, frankly, Microsoft shareholders are very lucky that the stock did not correct by more than 90% back then. The only reason it didn't was that tech stocks were trading at stratospheric multiples.

The above chart shows the market cap of both stocks. Looking at this chart, one might think the argument that Apple will follow in Microsoft's footsteps is valid -- that is, until we look a little deeper.

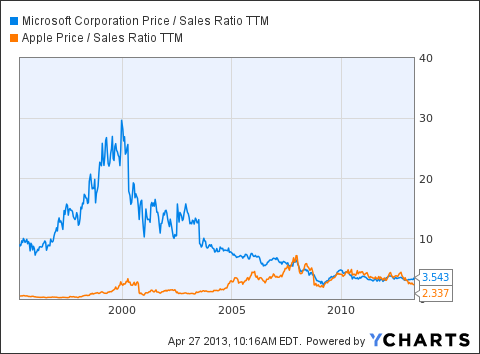

The above chart shows the price/sales ratio of both stocks. This metric is one that many people feel has no meaning. As you can see, Microsoft had a price/sales ratio of up to 30 at one point. Apple, on the other hand, was never a bubble in terms of this metric in its history.

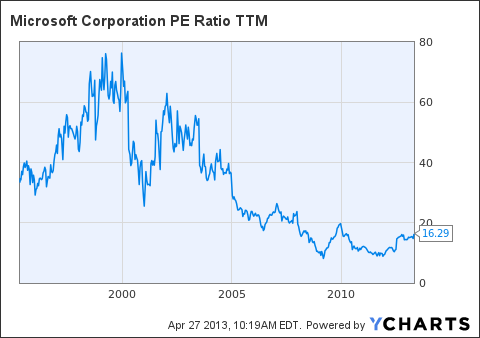

If you want to see what Microsoft's P/E looked like, the above chart is very revealing. Would you buy a company today with a P/E of 80, knowing what you know about Microsoft today back then? (More on that subject later.)