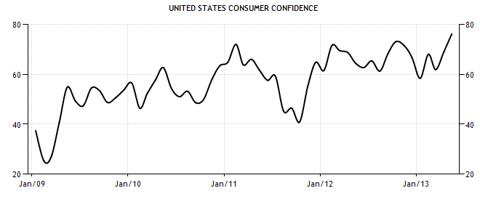

A marked upswing is evident in consumer confidence levels across the US as unemployment and inflation are the primary targets of current monetary policy. Analysts have raised several concerns regarding the consequences of a shift in policy but for now such a change appears to be a long shot as the targets for macroeconomic variables have not been met. Following these events, the economy is recovering. Yesterday's reports on housing prices and consumer confidence support the gaining momentum of economic recovery.

Source: Trading Economics

In this context, the industries which are highly sensitive to general economic activity and consumer confidence in the economy are looking at improved prospects in the future. The watch industry is also looking at a similar improvement as the boost in consumers' disposable income is being reflected in their spending. The economic recovery is not only limited to the US. The global economy is also surging as the equity indices are showing strong bullish sentiments. The emerging markets are posting decent growth rates and this overall economic trend is supporting the industry across the globe. Movado Group Inc. (NYSE:MOV) is among the smaller components of the watch industry with a market capitalization of $875.2 million and annual revenues of $505 million.

Industry Overview and Business Strategy

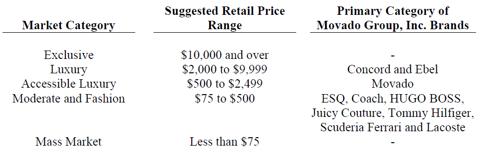

The watch industry is very competitive as the product is priced across a wide range and the industry comprises a number of players most of which are large companies. Due to the large size of the industry, a number of price segments persist. Movado's business strategy is to provide a quality product which is stylish and affordable at the same time. This is why most of the company's products range between $500 and $2,500.

Source: Annual Report 2013-01

The above table shows the industry segmentation as conducted by the company