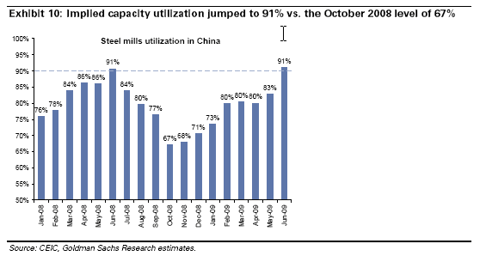

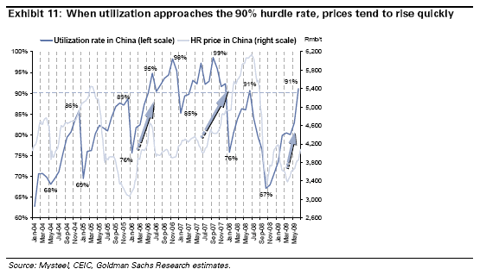

June data appears to have put Chinese steel utilization at over 90% as per Goldman's recent "Ten drivers for sweet spot" piece. Steel prices have indeed been on the rise over the last 15 weeks partly driven by infrastructure capex being up 49% YoY in 1H09 as per the piece. Overall they expect China steel demand to end up flat for 2009, vs. some previous expectations for a slight decline YoY.

Great, Chinese stimulus is boosting near term steel demand. Each steel stock in particular needs its own examination, but broadly speaking, stock price levels that are equivalent to 2007 levels or higher are highly dependent on Chinese government action. They are not value buys, they are let's chase- the-Chinese-government buys. Steel producer EV/EBITDAs look to be about $1,000/ton in Asia, $1,600 in Europe & Latin America, and $1,200 in the US.

More importantly, as per our channel checks, so far strength is mainly coming from acceleration in existing infrastructure construction projects. When the government announced the stimulus package in November 2008, new projects could not be immediately launched due to a lack of blue prints, land purchase lead time, funding lead time, and the establishment of appropriate management teams. Yet the government was eager to kick-start the economy, therefore it fast-tracked the completion of existing projects. For example, our visit to railway construction companies shows that project completion schedule could be shortened to two years from three years or to one year from two years.

Our channel checks indicate that new projects are entering their key construction intensity stage in 2H09. • One way we cross-checked this is in the pickup of mid- to long-term loan increases (usually to fund infrastructure/ FAI projects) as a percentage of total loan growth. June has jumped to 45% from 33% at the beginning of the year. 2Q09 share jumped to 48% from 37% in