We'll use terms that are practical and simple: "money" is the funds used to settle the purchase of goods and services, "price inflation" is a basket of trade weighted average of prices rising, where the basket is infrequently changed (or else there would be a downward bias from substituting less expensive, lower quality items), and "monetary inflation" is the expansion of 'money' used to make purchases, irrespective of whether that new money finds it's way into prices quickly or not.

Since we are considering money to be 'spendable funds', a deposit balance in a bank qualifies as money, because it can be transferred to another account (by check or other means) even though this balance is technically bank debt (the bank owes the depositor reserves). This makes sense because if deposits were to collapse, spendable funds would shrink, and we would undergo severe price deflation. The bank deposit balance also is expected to be redeemed at least at par under all circumstances. Clearly bank deposits are used economically as 'money'.

For our purposes then, money is spendable funds which are cash plus deposits.

First question is then, is money (cash plus deposits) rising or falling?

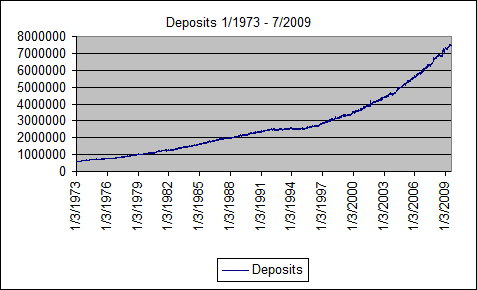

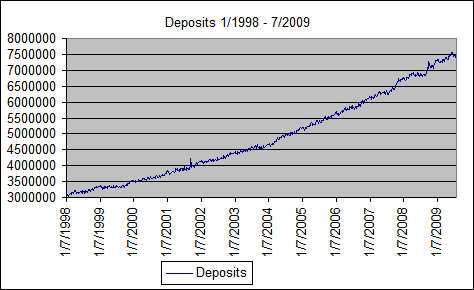

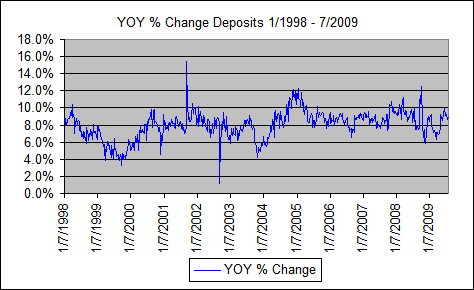

Answer: it is rising slowly. You can see total deposits by looking at commercial bank liabilities, line 31, and cash by looking at the Federal Reserve Bank's liabilities (currency in circulation), and by observing the charts of deposits below:

While total bank credit after a mark-to-market writedown may be contracting, the liability side is not going to contract as the Fed will "print" as much money as is needed to cover bank liabilities should there be a need for it. The fiscal authorities will further backstop the deposit liabilities (partly by FDIC, partly by capital support, and partly by Fed assistance) on the bank's balance sheet. We can reliably conclude that deposit growth is