Accenture (NYSE:ACN) is one of the leading organizations providing management consulting, information technology and outsourcing services around the world; last fiscal year it made $29.77 billion dollars in net revenue, and got a decent 13.06% of solid cash after capital expenditures, or $3.89 billions of owner earnings as W. Buffett calls it.

ACN gets its revenue from five big operating segments:

Communications, media and technology (20% of net revenue), financial services (22%), health and public service (16%), products (24%) and resources (18%).

Geographically, 48% of total revenue comes from the Americas, 39% from Europe, Africa and Middle East (EAME), and the remaining 13% comes from Asia. The consulting business represents 56% of net revenue, while outsourcing business has the other 44%.

In the next section, I will analyze the company and its fundamentals using information available on its SEC filings.

Profit margins.

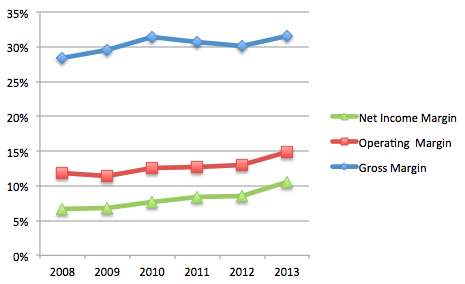

The following graphic shows a history of ACN's profit margins for the past five years and last quarter of 2013.

As the picture shows, ACN is constantly improving its margins, especially net income, which has jumped from 6.7% to 10.5% in the past 5 years.

Income Statement.

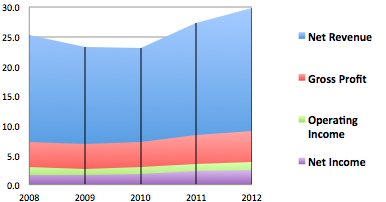

For the last 5 years, revenue has grown at a modest rate of 4.1% annually. As a result of profit margins improvement, net income has grown at a faster rate of 11.2%, getting from $1.7 billions to $2.6 billions in the 2008-2012 period.

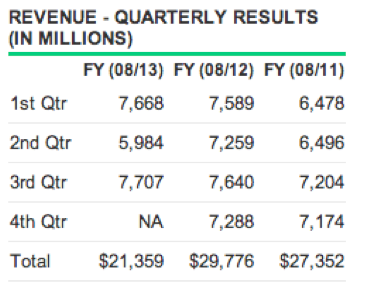

For 2013's quarterly results, revenue has behaved almost flat, as you can see in the next picture from MSN money shows.

In its most recent 10-Q management explains that net revenues coming from the Americas increased 8% in local currency, driven by growth in the United States, partially offset by a decline in Brazil's.

EMEA net revenues decreased 1% in local currency. They also explain that Finland experienced a significant