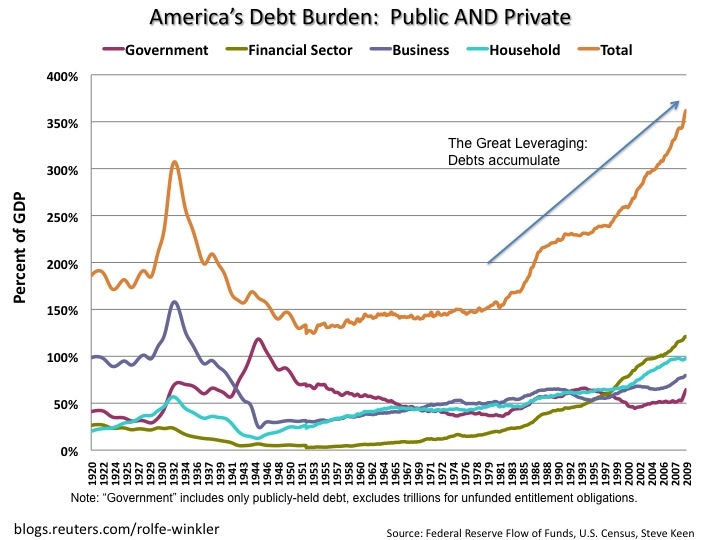

Investors are celebrating an incipient “recovery,” but the interventions that were responsible for it are sowing the seeds of a more violent contraction down the road. The problem, quite simply, is debt. We’ve accumulated record amounts, yet many economists tell us we need more.

Leading the charge is Paul Krugman. He exhorts us to borrow our way back to prosperity, but he doesn’t acknowledge that his brand of Keynesian economics ignores the consequences of debt. If you look at a chart of America’s total debt burden, he’s leading us over a cliff.

(Click chart to enlarge in new window)

The problem begins with the flawed way Krugman and other economists measure well-being. Primarily, they look at measures of activity, like GDP. These tell us how much people spend, but say nothing about where we get the money.

Every so often, we overextend ourselves, buying too much useless stuff with too much borrowed money. So we cut back, dumping the third family car and swapping the McMansion for a townhome.

But this is problematic for Krugman and other economists. Less spending means falling GDP. It means “recession.”

They ride to the rescue with two blunt instruments — monetary and fiscal policy — that encourage more borrowing and thus more spending. More spending equals “growth” so economists congratulate themselves for engineering “recovery.”

But if recessions never happen, bad businesses and unpayable debts are never washed away. They grow like cancer inside the system.

Since the mid-1980s, we’ve intervened whenever the economy hiccuped, so sectors that should have shrunk sharply — like housing and finance — never did. Feasting on easy credit, these sectors have exploded as a percentage of the economy.

Now, since individuals and corporations refuse to borrow more, the only way to grow spending is for the government to borrow.