Brief introduction of Noah Holdings

Noah Holdings (NYSE:NOAH) is a leading wealth management service provider focusing on distributing wealth management products to the high net worth population in China.

According to its issued 2Q2013 results, as of June 30, 2013, NOAH had 525 relationship managers in 56 branch offices to serve three types of clients:

1. high net worth individuals,

2. enterprises affiliated with high net worth individuals, and

3. wholesale clients, primarily local commercial banks or branches of national commercial banks that distribute wealth management products to their own clients.

The number of its registered clients accounted for 45,839 as of June 30, 2013.

The OTC wealth management products distributed by the company primarily include fixed income products, private equity funds, private securities investment funds, investment-linked insurance products and mutual fund products. The company also raises and manages proprietary and innovative wealth management products, including fund of funds products and real estate funds products.

Financial and Operational highlights

Results of 2008-2012

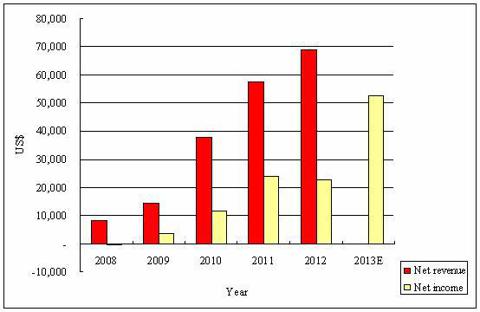

For the last five years, NOAH has consistently recorded strong results despite the financial crisis, the European debt crisis and the slowdown of economic growth in China. During the period, the company experienced an average yearly compounded growth of 52.3% in its net revenue, or, in other words, 8 times the 2008 net revenue. The net income attributable to the shareholders of the company had a huge turnaround from a loss of US$0.40 million in 2008 to a gain of US$22.83 million in 2012. The following chart gives you a clearer insight of the trend.

Results of 2Q of 2013 and 2013 guidance (US$50 million - US$55 million)

Due to the enhancement of the wealth management product development, NOAH continues to drive significant growth in transaction value and assets under management. The company's strong results in the second quarter of