Over the past several months, the battle for control of Dell (DELL) between founder Michael Dell and activist billionaire Carl Icahn has carried on. While it's easy to get caught up in the details of the battle, predictions of who will win and the like, at the end of the day, there is a struggling operating company underneath it all. The firm posted second-quarter results recently, with revenue flat year-over-year at $14.5 billion, in-line with consensus estimates. Earnings-per-share was $0.25 on a non-GAAP basis, down 50% from a year ago, but still slightly better than consensus expectations. The big metric that matters in this situation-free cash flow-totaled $1.5 billion, equal to 10% of revenue.

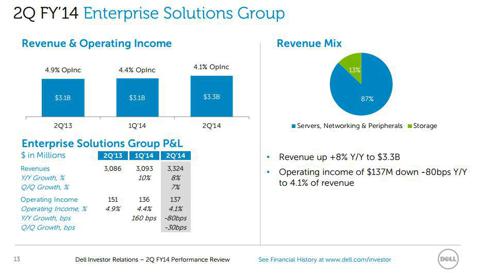

Image Source: DELL 2Q FY2014 Slides

Leading the charge at Dell was strong performance at the firm's Enterprise Solutions Group, where revenue rose 8% year-over-year to $3.3 billion, though operating income declined 9% year-over-year to $137 million. Management chimed in with some positive commentary on the segment, noting its strength in servers. Corporate Controller Tom Sweet explained:

"Within ESG, our server, networking and enterprise peripheral business delivered revenue of $2.7 billion, which equates to 14% growth.

This was driven by strong growth in our hyper-scale data center servers. In this space Dell Servers power four of the top five search engines and 75% of the top social media sites worldwide."

Of course, while it is great to have strong market share, operating margins of just 4.1% suggest share is coming at the expense of profitability. This may not matter as much to a privately-held company, but for a public company to see one of its "growth" segments experience steep margin declines certainly does not bode well for pleasing shareholders.

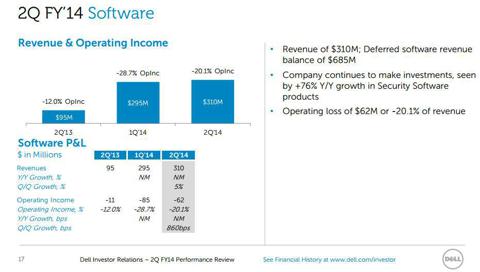

Image Source: DELL 2QFY2014 Slides

On top of solid performance from its Enterprise Solutions Group, we thought Dell's