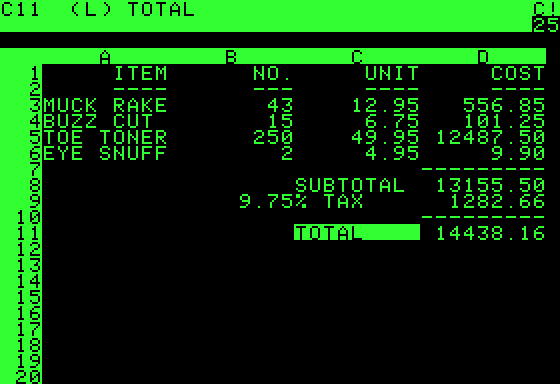

This is part 1 in a three part series of articles where I’m going to chronicle the price movement of Apple (NASDAQ:AAPL) and relate it to significant events initiated by Apple, third parties and the economy. So, what’s the purpose of these articles? What can we learn about rehashing history, isn’t it more important to look at what’s happening in the here and now? Quite frankly no! Technical analysis is all about examining the past in order to predict the future. By looking at what really influenced Apple over the years, we can learn what type of influences are responsible for the really big moves. And by understanding that, perhaps we’ll recognize the next big thing. Apple is a mature company, it’s been doing business since 1976, when Steve Wozniak created the Apple I in his garage. It was a kit computer that required assembly. He tried to sell it to HP (HPQ), but they weren’t interested. Woz realized that he wasn’t any kind of sales guy, so he turned to his friend Steve Jobs to help him out. Steve saw the potential right away, got stoked, and so they started Apple Computer. They were able to sell a small number of the kits, but it wasn’t going anywhere. The Woz produced a prototype of the Apple II, and Steve found some interested financiers, and they were off to the races. From 1976 until 1984 Apple had a rich history with a lot of significant advances, but it was essentially a private boutique company with some very interesting and ground breaking products. Essentially, Apple created the era of personal computing. But what made the Apple computer a huge hit, was a killer application. Most will agree that was VisiCalc

The History of Apple Price Movements, Part 1

A seasoned coach and advisor, Ernie has been guiding traders and executives for over 25 years. His expertise spans fintech, hedge fund management, and overseeing large portfolios. As a former chief technologist for a top company, Ernie developed agile processes and financial systems for Wall Street institutions. His work as a quantitative scientist involved crafting options and futures strategies for asymmetric returns. This rich background led him to create the 0-DTE service, focusing on educating traders in 0DTE options for professional advancement.