Wells Fargo (WFC) is repaying their $25Bn TARP loan.

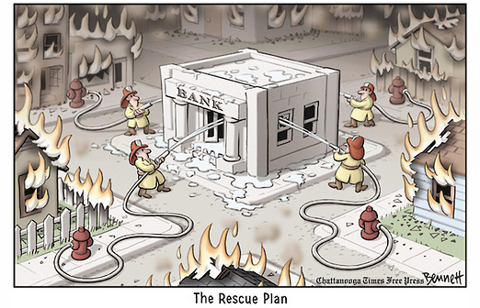

That makes WFC the last of the big boys to be done with the emergency loan program, just one year after it started. At this point $161Bn of the $245Bn lent out will be repaid, with WFC raising $10.4Bn in a stock sale to get out from under the government’s thumb - just in time to pay out the Christmas bonuses. I won’t go off on a rant about how stupid it is for the banks to borrow and dilute in order to pay big bonuses and further punish shareholders by reducing earnings - it won’t matter anyway, any bank but Citi (C) that announces they are done with TARP gets a nice boost as it indicates they can go back to raping and pillaging as usual in 2010.

It’s good that we can label this bailout a success because that way Congress won’t waste time approving the next one in March when Commercial Real Estate fails (oops, that’s supposed to be a secret). The banks were anxious to get out from under Government oversight as soon as their pay practices were called into question. Perhaps WFC was the last to pay us back as they "only" have 62 employees who got bonuses over $1M last year with just 7 employees putting more than $3M in bonus money under the tree. That’s nothing compared to C, which had 738 employees who would consider anything less than $1M a pay cut, and you would think Goldman (GS) would be the leader with 983 Million-Dollar bonus babies last year, but they've got nothing on JPMorgan (JPM), where 1,626 Employees got 7-figure bonus checks.

Of course, GS beats JPM on a bonus per employee basis by a wide margin but that’s because JPM actually does