US stocks swung between gains and losses on hump day as Germany and France discussed assistance for Greece, offsetting Federal Reserve Chairman Ben S. Bernanke’s plan to raise the discount rate for loans to banks “before long.” Trading volumes are slowing due to snow storms in the US Northeast. Five of the last seven full trading sessions have seen triple-digit point moves in the Dow.

Today’s Market Moving Stories

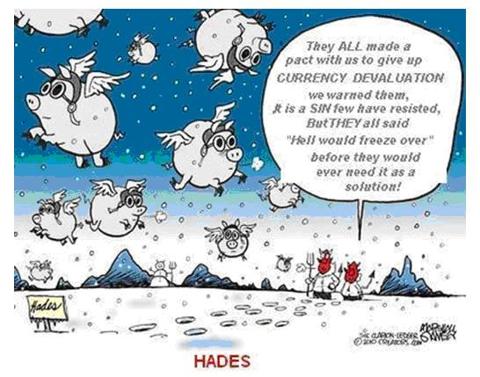

Germany and France have agreed to a deal to “safeguard financial stability” for Greece and the wider eurozone following crisis talks at a European Union summit. Political agreement on general principles was thrashed out during tense negotiations between Germany, France, Greece and the European Central Bank on Thursday morning. “There is an agreement on the Greek situation. We will communicate now the agreement to the other leaders,” Mr. Van Rompuy said. Jose Manuel Barroso, the European Commission President, said that Greece would receive support in return for and aligned to progress on sweeping austerity cuts. “Greece needs to do whatever is necessary, including additional measures, to ensure that the deficit reduction targets for this year are met,” said an official. “Secondly, in that case the euro zone members should be ready to safeguard financial stability in the euro zone area as a whole.”

The focus for markets overnight was the release of Fed Chairman Bernanke’s testimony that, but for the weather, was to have been presented to the House Financial Services Committee (Greece has taken a back seat overnight, ahead of the EU Head of State and Government Summit meeting in Brussels today). Crucially, Chairman Bernanke repeated that: “The FOMC anticipates that economic conditions, including low rates of resource utilization, subdued inflation trends and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.” Indeed, according to Bernanke, the outlook for monetary policy remains