The Department of Energy (DOE) released a report Wednesday which undertook a strategic review of the use of critical metals in the emerging clean energy space. "Critical Materials Strategy" is a 170 page report which provides a useful overview of the possible metal bottlenecks - and hence investment opportunities - in clean technologies.

The investment thesis which can best benefit from shortages is called "Strategic Positioning". Developed by Patrick Wong, former CIO of Dacha Capital, this thesis "basically looks at parts/processes in the building of any product and looks for ones that are a small % of the overall value yet are critical and cannot be substituted easily." One prominent example is the 50-100g of dysprosium used in hybrid and electric vehicles' motors to allow reliable operation at the 180-200C temperatures reached during driving. 50g dysprosium oxide will set you back $15, a trifling 2,000th of the retail price of a $30k hybrid.

Demand is thus highly inelastic, which bodes well for price in the event of a shortage. Another example is the 4-20kg of gallium and 16.5-110kg of indium required per megawatt of Copper-Indium-Gallium-diSelenide (CIGS) thin film solar. At current prices, these elements make up less than 2% of the installed cost of this flavour of solar thin film. Other examples are the use of terbium in high efficiency linear fluorescent lamps (LFL) and compact fluorescent lamps (CFL) or the use of indium in indium tin oxide (ITO) coatings on LCD screens.

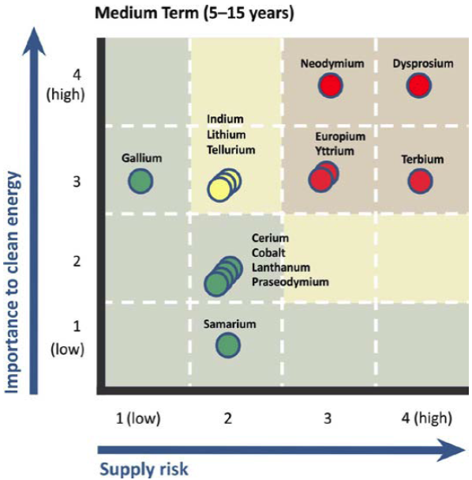

The DOE has helpfully constructed a clean energy criticality matrix to reflect the supply demand balance in the medium term:

Trying to place large bets on these elements is difficult, because so little is produced annually - only around 200 tonnes of gallium, 250 tonnes of terbium, 480 tonnes

Are Critical Energy Metals a One-Way Bet?

Eamon Keane is an Energy Systems Engineering masters student at University College Dublin with an interest in electric cars, rare earth metals and energy.

He is looking for a job in the energy sector anytime after August 2010.