Gilead Sciences (NASDAQ:GILD) reported revenue and earnings that beat analysts' estimates yesterday as sales trends are strong. The company added an additional $5 billion to its share buyback authorization for a total of nearly $7 billion. At current prices that would represent about 23% of the shares outstanding. It has committed to buying back at least $2 billion worth of shares during 2011, which at current prices amounts to over 6% of shares outstanding.

There was a setback in its pipeline as a manufacturing issue caused the FDA to ask for more information, pushing back approval of Gilead's B-Tripla drug by three to four months, according to the company. More analysts actually raised estimates for Gilead rather than lowering them despite this setback.

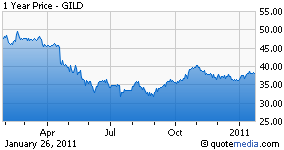

Gilead would probably be trading closer to $39 this morning were it not for this minor setback that will likely mean little in the bigger picture. I was able to pick up a decent amount of shares in the after hours session down over a dollar from yesterday's close because of the scary headline of an FDA delay. I believe sellers at that level are missing the forest for the trees.

Disclosure: I am long GILD.