The low commodity prices in natural gas have generated negative sentiment around Calpine (NYSE:CPN). The company has ~27,000 megawatts of generation capacity, with 97% being natural gas-fired. Normally, you'd think this would be a good thing for the company and its customers, but the market doesn't see it that way. Anything natural gas-related is being sold, regardless of the underlying fundamentals. The continued drop in oil and gas prices dictates that electricity will remain low. Calpine is still able to generate excess free cash in a low electricity price environment; however, it gets better margins on high prices.

With that said, we don't expect oil and natural gas prices to remain at these depressed levels forever. So, is the dip in Calpine an opportunity to back up the truck in this best-in-class utility operator?

The largest provider of electricity from natural gas and geothermal

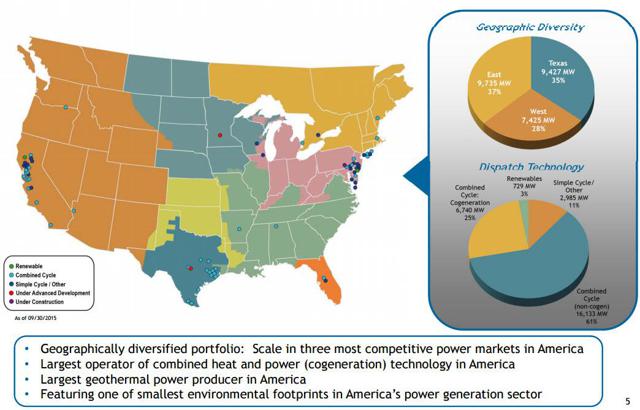

Calpine was founded in 1984, and is one of the largest power generators in the U.S. The company has ~27,000 megawatts of generation capacity from 83 power plants in 19 states and Canada. It has a formidable presence in the increasingly competitive wholesale power markets in the northeastern U.S., California, and Texas. In addition, it owns natural gas and geothermal power plants across North America.

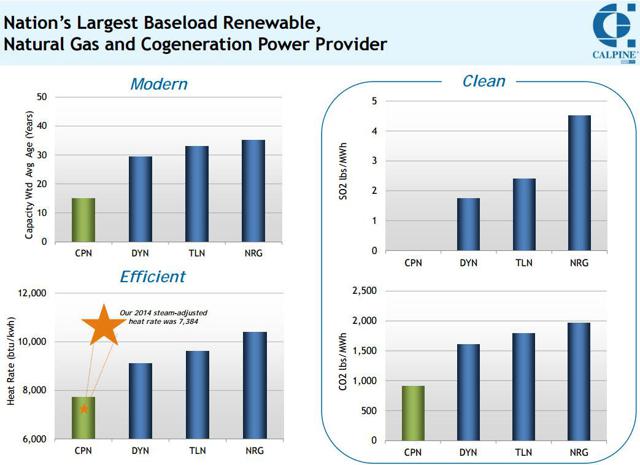

Essentially, the company's power generation portfolio consists of natural gas combustion turbines and renewable geothermal conventional steam turbines. (1) Calpine is one of the largest owners of cogeneration plants and industrial gas turbines. (2) It also has one of the largest geothermal power portfolios in the U.S. with its Geyser assets in northern California. The company generates ~15% of the renewable energy in California.

Calpine has strong competitive advantages from its scale, low-cost status, and geographic presence. The natural gas shale revolution has certainly driven down the price of natural gas with the glut