Eyegate Pharmaceuticals, Inc. (NASDAQ:EYEG) is a pre-revenue stage company engaged in the development of drugs and drug delivery devices for diseases of the eyes. Over $14M was raised through a February 2015 IPO and follow-on equity financing which is being used to advance their product pipeline through clinical validation. Currently under development is EGP-437, the company's lead therapeutic candidate which is in a late-stage, pivotal trial for uveitis and in earlier-stage studies for macular edema and cataract surgery. EGP-437, a reformulation of generic dexamethasone phosphate, and Eyegate II Delivery System, which uses iontophoresis to non-invasively and efficiently deliver drugs to the ocular tissues, are proprietary and patent-protected.

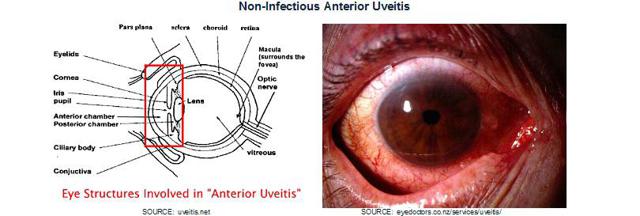

Non-Infectious Anterior Uveitis: Uveitis is a generic term used to describe inflammation of the uvea. It can occur either in isolation or be the result of an underlying medical condition in other parts of the body. The uvea is the middle layer of the eye, below the white of the eye, and consists of the iris (colored portion), choroid layer (connective tissue) and ciliary body (secretes liquid). Infectious uveitis is caused by a virus or bacteria in the eye while non-infectious uveitis is endogenous, or the result of a disease elsewhere in the body.

Symptoms include redness, inflammation and pain in the eye, photophobia (extreme sensitivity to light), blurred vision and change in shape or size of the pupil. If left untreated, anterior uveitis can result in development of other complications including glaucoma, formation of synechiae, cataracts, macular edema, retinal detachment and, eventually, even blindness.

Symptoms include redness, inflammation and pain in the eye, photophobia (extreme sensitivity to light), blurred vision and change in shape or size of the pupil. If left untreated, anterior uveitis can result in development of other complications including glaucoma, formation of synechiae, cataracts, macular edema, retinal detachment and, eventually, even blindness.

Prevalence of uveitis in the U.S. is roughly (estimates vary depending on source) 50 people per 100k population, or approximately 165k. U.S. incidence estimates also vary by study - the most cited study estimates range from a low of about 17 to a high of about 52 people per 100k population[1],[2],[3],[4] - an average of ~35 per 100k, or approximately