In an article last month, I had told investors why ConocoPhillips (NYSE:COP) looks like an attractive bet even after the dividend cut. It has been almost a month since that article, and I'm not surprised to see that Conoco shares have appreciated close to 20% on the stock market.

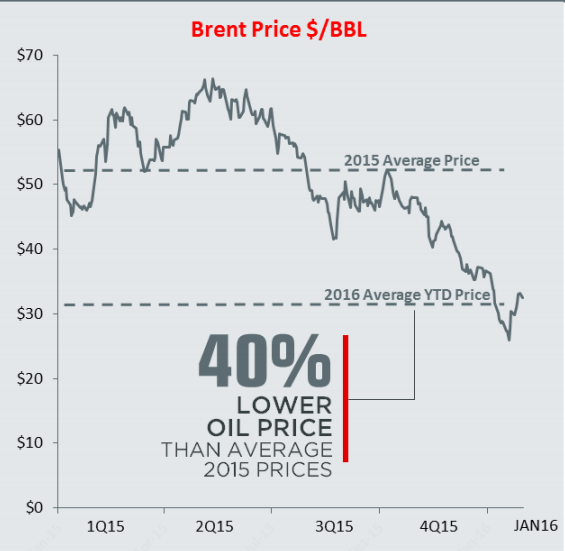

However, the volatility in the oil market still persists, and investors should not be forgetting the fact that oil prices have averaged lower so far this year as compared to 2015. This might pose a danger to the remainder of Conoco's dividend, as the company still has to pay out $1.24 billion in dividend this year considering the number of shares outstanding and its annual dividend payout of $1 per share.

In this article, we will see why the possibility of a further dividend cut at ConocoPhillips cannot be ruled out.

Why the remaining dividend might be in danger

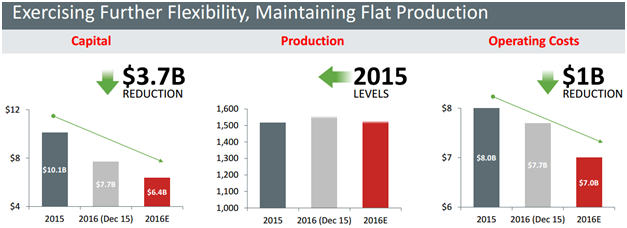

When ConocoPhillips released its fourth-quarter last month, it slashed the quarterly dividend to 25 cents per share from 74 cents per share. This action will allow it to save cash worth $2.4 billion. The company took this decision in order to keep its balance sheet in good shape so that it can mitigate the weakness in the end market to some extent.

Also, as shown in the following chart, crude oil prices have averaged 40% lower than last year, so a dividend cut was imminent.

Source: ConocoPhillips

Apart from the dividend cut, ConocoPhillips has also revised its previously disclosed 2016 operating plan. The company has slashed its capex for the current year to $6.4 billion from last year's $7.7 billion as it will be cutting down on drilling activity in the Lower 48 areas. Moreover, ConocoPhillips has also scaled down its operating cost forecast to $7.7 billion from the earlier $7 billion. As a result of these moves, the company believes that