The Magic Formula (MF) is a quantitative investing method devised by famed value investor, Joel Greenblatt. Greenblatt described the Magic Formula in the 2004 book "The Little Book that Beats the Market". He updated the book in 2010 with updated portfolio performance in "The Little Book that Still Beats the Market".

The Magic Formula screen essentially ranks stocks on two metrics, low relative cost ("cheap") and high returns on capital ("quality" or "good"). Greenblatt has said that he wanted to marry the investment philosophies of Ben Graham ("cheap") and Warren Buffet ("quality"). One could also say that the screen finds high quality firms that are on sale. Greenblatt posts the results of his screen for free at magicformulainvesting.com.

Magic Formula investing is a mechanical method of investing in stocks (also known as quantitative investing), which essentially removes all subjective bias on the part of the investor. A typical mechanical investing philosophy consists of purchasing a portfolio of stocks (20 or 30 is common), as specified by the given screen criteria, and held for a period of time. At the end of the period, the portfolio is updated with the new screen results, i.e. sell those no longer appearing on the screen, and replace with new issues. A year holding period is common. The Magic Formula is just one such mechanical investing method.

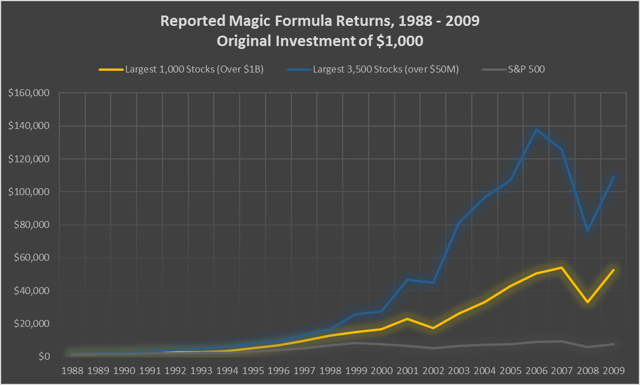

The reported performance of the Magic Formula from the period 1988 to 2010 is illustrated below (as backtested by Greenblatt).

Source: Data from Greenblatt's book & Author Calculations

Impressive returns are reported in the hypothetical portfolios charted (practically 20 or 30 stocks are included in an investor's portfolio at any time, not 3,500 or 1,000). An investment of $1,000 in 1988 would result in a portfolio worth approximately $110,000 in 2009 (over a 100 fold increase in 21 years). Over the period, this equates to compounded