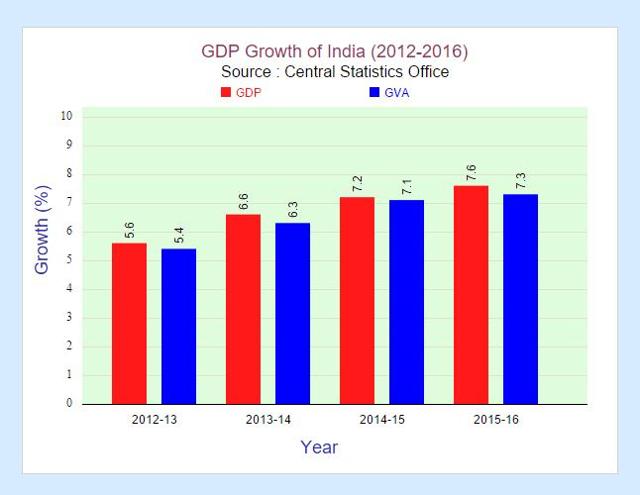

1. One Of The Best GDP Growth Rates

The GDP of India has seen a growth of 7.6 percent in the past financial year, and the country's growth rate has overtaken China's.

Inflation has come down from 6.37% in 2014 to 5.88% in 2015. Personal disposable income has increased from INR127.9 trillion (USD1.9 trillion) to INR138.2 trillion (USD2.09 trillion).

Foreign exchange reserves have been steadily rising (now at USD353 billion), making it easier for the Reserve Bank of India to handle currency volatility.

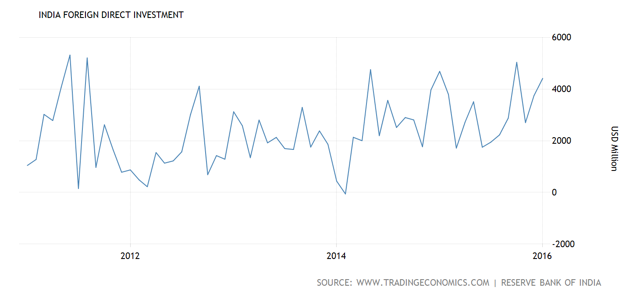

2. Improving Foreign Investment Environment

India is a better option for foreign investment compared with the other developing countries. As per the United Nations Conference on Trade and Development World Investment Report 2015, India now grabs the 9th position in the Top 10 countries attracting highest FDI.

2015 witnessed 24.5 percent increase in FDI inflow (USD44.9 billion) compared to 2014 (USD36 billion). India has more liberal and transparent policies among the emerging and developing countries. FDI norms were relaxed for 25 sectors in September 2014 (retail, insurance, service). In 2015, FDI norms for 15 sectors including construction, civil aviation, banking, broadcasting were further liberalized. Banks are now allowed up to 74 percent FDI. The government of India took several initiatives such as "Make in India" and "Digital India" to promote foreign investment.

3. Bullish Investment Sentiment

According to a poll conducted by Bank of America Merrill Lynch, for 43 percent respondents, India was one of the most favorite equity market for the global investor for the year 2015 followed by China at 26 percent.

Due to the recent reforms, initiatives and overall attractiveness of Indian corporates, the Indian stock market remained attractive to foreign investors. FIIs have invested a net of USD89.5 billion in 2014-15.

India has also allowed Qualified Foreign Investors to directly invest in the