Introduction

Seven & i (OTCPK:SVNDY; OTCPK:SVNDF), a company which generally has not received much media attention in the past, has been hitting the headlines more and more lately. And while at first, a management crisis may seem more a reason to become concerned about one's investment in a company, in this case, thanks in part to activist investor Daniel Loeb of Third Point LLC (related: TPRE; OTC:TPNTF), the situation has resolved itself into a more favorable climate for shareholders. The future of Seven & i has never been brighter, and if the rest of Japan Inc. follows suit, poor corporate governance (nepotism, criminalism, cronyism, etc.) will no longer be a stain on Japan's corporate image.

Management Mix-Up

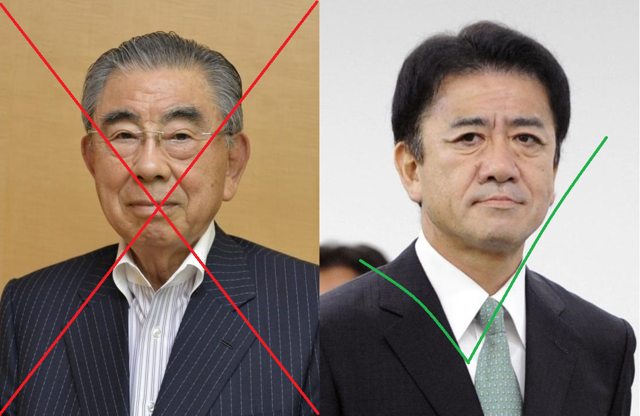

(Toshifumi Suzuki is out; Ryuichi Isaka is in.)

This past Friday (Apr. 15th), at the most recent nomination committee hearing, the saga surrounding the heir to Toshifumi Suzuki's throne seems to finally have ended. But what exactly happened?

On Apr. 6th, insider sources reported that executive management was attempting to oust Ryuichi Isaka, the President of Seven & i's convenience store branch, and groom Suzuki's son for the CEO position. Isaka's name should sound familiar to those familiar with the company's history; it was Isaka who oversaw the absolutely explosive growth of Seven & i's convenience store operations since he took the President/COO position in the 1980s. Naturally, Isaka was the presumed best choice to take over as CEO of the holding company for his experience, performance, and loyalty within the company. To not only hand over the CEO position to Suzuki's son in an act of blatant nepotism but to attempt to pre-emptively oust Isaka was a brazen and ill-calculated move that could have greatly harmed the company's standing, especially in such a delicate time as the company shifts operational models and engages in creative destruction/cost savings measures.