Apollo Education Group, Inc. (NASDAQ:APOL) is one of the world's largest private education providers, serving students since 1973. APOL is most well known for its University of Phoenix brand, but also operates Western International University, Axia College and the College for Financial Planning. APOL operates within the United States as well as internationally with brands in Chile, Mexico and Germany, among others.

Wow, Those Charts Look Terrible

The entire for-profit education industry has struggled over the past three years. Starting way back in April of 2010, the for-profit education industry came under attack. With rising student loan levels hitting national headlines, proactive politicians added the evil for-profit education industry to their talking points. See follow contributor Mariusz Skonieczny's article here.

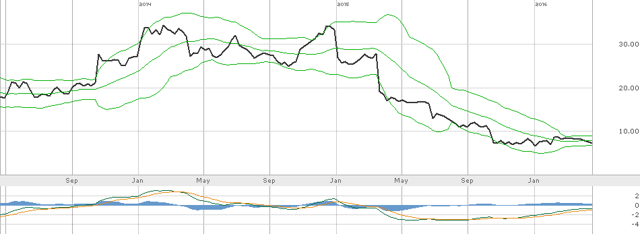

Apollo Education Group

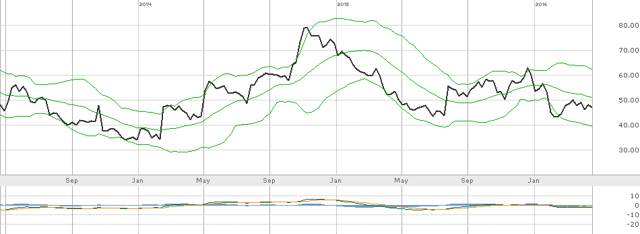

Capella Education Co. (NASDAQ:CPLA)

Strayer Education (NASDAQ:STRA)

Brief Fundamental Analysis of APOL

APOL has as strong balance sheet with working capital of approximately $286 million as of February 29, 2016 (10-Q). The company has losses of approximately $121 million for the six months ended February 29, 2016, which included impairment charges and acquisition related expense of approximately $144 million. Excluding the impairment and acquisition costs, the company had income from operations of approximately $23 million for the six months ended February 29, 2016, compared to $46 million of adjusted income from operations in the prior six-month period. The one-year change of the stock price of the company is approximately -58%.

Apollo Global Management, LLC's $9.50 Offer

During February 2016, Apollo Global Management, LLC, no relation to APOL, made an all-cash offer of $9.50 per share to purchase 100% of the outstanding shares of APOL. Rather quickly, APOL's two largest shareholders (Schroders UK and First Pacific), totaling approximately 25% of the outstanding Class A shares, came out against the deal saying the offer was too low. Subsequently, APOL's board and management detailed the sale process which included 17 bidders showing interest in