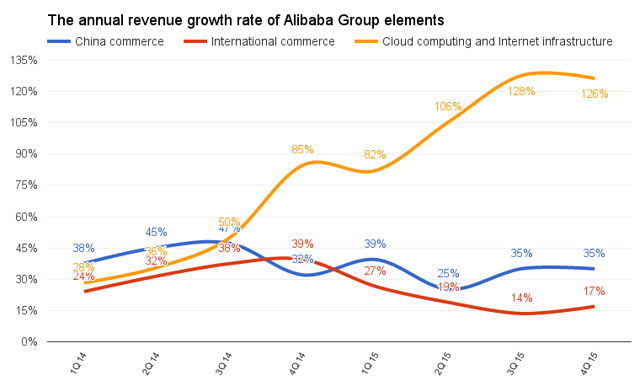

Over the past two years, cloud computing and Internet infrastructure have been demonstrating the best growth rates in the revenue structure of Alibaba Group (NYSE:BABA). Given the huge potential of the cloud market in China and protectionist policies of the Chinese Government in matters of information security, I believe that Alibaba Group cloud-based business is only beginning to accelerate its growth.

Source of data: Alibaba Group

According to Bain & Company, the cloud market in China will reach $20 billion by 2020. For comparison, two years ago the size of this market in China was only $1.5 billion.

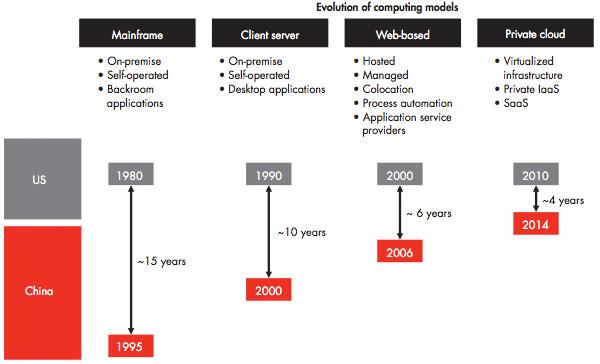

Also, according to Bain & Company, though the cloud market in China is behind a similar market in the United States, this gap is constantly decreasing. In this sense, now the cloud market in China corresponds to the cloud market in the United States four years ago. Thus, today's success of companies like Amazon Web Services (AMZN) and Azure (Microsoft) in the United States indicates favorable prospects for the cloud-based business in China. However, it has some special characteristics.

Source: Bain & Company

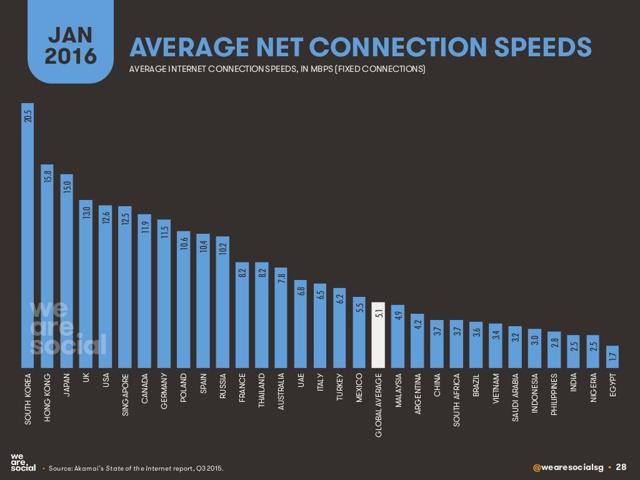

The ability of the infrastructure to support the growth of the cloud market is critical. In this context, there is much to be done in China. According to the data as of January 2016, the average Internet speed in China is 3.7 Mbps. For comparison, the average Internet speed in the United States is 12.6 Mbps, and the leader in the global ranking is South Korea with 20.5 Mbps.

China is not one of the world leaders in Internet penetration among the population. Only 49% of China's population has access to the World Wide Web. In the United States, a similar proportion is 87%.

But this is only a temporary difficulty in the way of cloud development market in