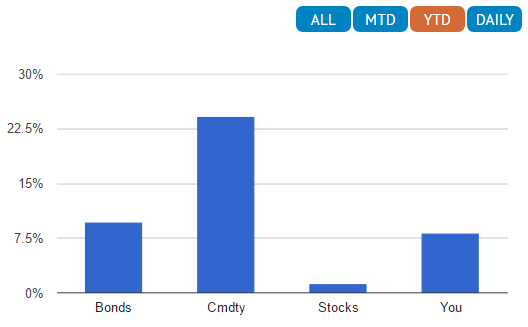

Risk Parity has had a phenomenal year-to-date. One popular provider of the strategy for retail clients is up nearly 9% while the S&P is up a little over 3%. This is primarily due to big rallies in both the bond and commodity markets, as the Fed has continued to ease off on interest rates while the global outlook has stabilized.

YTD Performance of Major Asset Classes vs. Risk Parity (labeled "You")

Source: Yahoo Finance, Federal Reserve, WSJ, Hedgewise

Despite this strong outperformance, the bond rally has raised a familiar worry: what happens when interest rates rise? Given the strategy has a heavier bond allocation than most traditional portfolios, does it continue to be a viable option?

Fortunately, we have decades of historical data that show that rising interest rates are not a cause for great concern. In times of high inflationary pressure, like the 1970s, the strategy is protected by assets like commodities and inflation-protected bonds. While higher short-term rates do reduce the benefits of using leverage, our backtested model still performed at least as well as the S&P 500 throughout the 70s.

The absolute "worst case" scenario is one in which rates are being driven up by continuously strong real growth, such as the post-WWII economy from 1950 to 1970. In this situation, both bonds and real assets like gold will tend to perform poorly while the stock market rockets ahead. Though Risk Parity will probably underperform the S&P 500 over such a stretch, you will still make solid returns; they simply won't be as high compared to a portfolio of 100% equities.

In exchange for this possibility, you avoid the risk that the next 2008 may be right around the corner. While rising interest rates may seem like a foregone conclusion, recent history in Germany and Japan demonstrates that rates may