Introduction

Ensco (NYSE: ESV) is an offshore drilling company headquartered in the United Kingdom, though its countries of operation vary widely as its rigs move around. The company operates as the world's second largest offshore drilling and well company with a fleet of drilling rigs used in offshore oil exploration.

Ensco Drilling Rig - Wall Street Journal

However, despite its market leader position in the offshore drilling industry, Ensco has had a difficult time recently along with all other offshore drillers. The company has watched its stock price crash from almost $60 per share before the 2014 oil crash to lows of less than $8 per share in February of this year. Since then, the company's stock price has recovered but the company's stock still remains at just over $10 per share.

Current Market Conditions

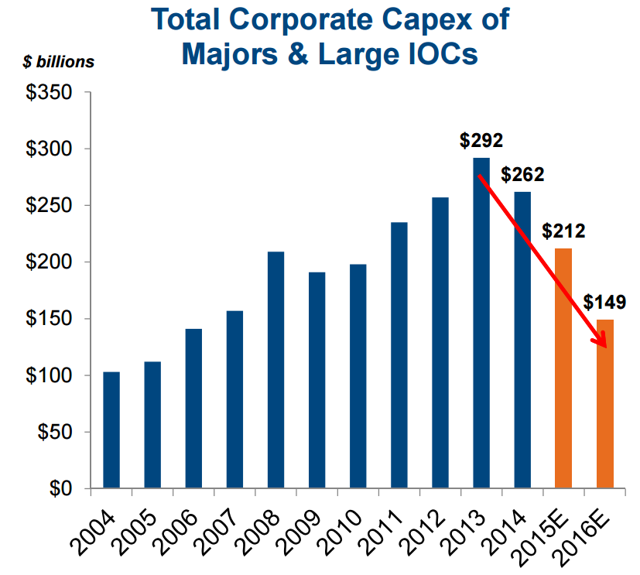

Ensco's recent difficulties have stemmed from the fact that capex is cut much faster than oil prices. That is, for a company like ExxonMobil (NYSE: XOM) that produces millions of barrels of oil per day, unless prices go to $0 per barrel, the company will continue bringing in revenue. However, Ensco instead relies on drilling contracts, and in an environment of low oil prices as companies cut capex, Ensco will struggle to bring in any respectable revenue.

Total Capex of Majors & Large IOCs - Ensco Investor Presentation

The following overview of current market conditions shows how fast the capex of oil majors and large integrated oil companies has been decreasing. Since a peak in 2013 when oil prices maxed out, capex has dropped from $292 billion to $149 billion in 2016, a drop of almost 50%. More importantly, the recent doubling of oil prices from less than $30 per barrel in January to roughly $50 presently will likely not have a significant impact on capex. This significant drop in capex has made contracting rigs