Welcome to the tech sector's sixteenth edition of "Buy on Weakness?", a series of articles that sifts through the underperformers of the week to find potential investment opportunities in the large-cap tech world.

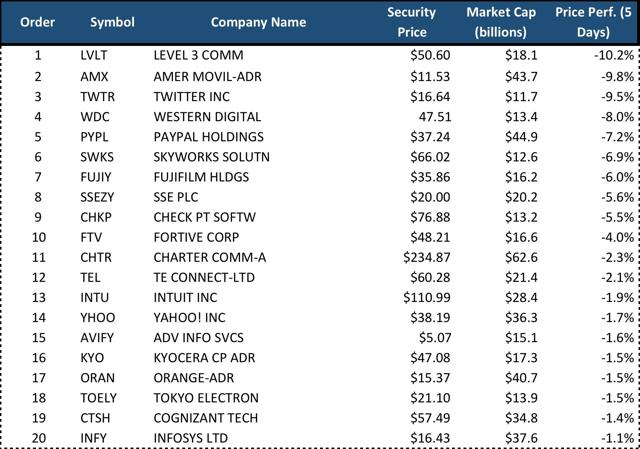

The table below highlights the top 20 tech companies - worth $10 billion or more in total equity value - that have performed the poorest in the previous five trading days.

Source: DM Martins Research, using market data compiled from Zacks

With another big week of earning announcements in the books, the tech sector continues to climb north with a 2.1% return on the week.

This week, our focus will be on Twitter (TWTR) as it continues to slip with a 9.5% loss on the week. We will re-examine our previous thesis to see if Twitter is now worth buying into.

Diving deeper into the data

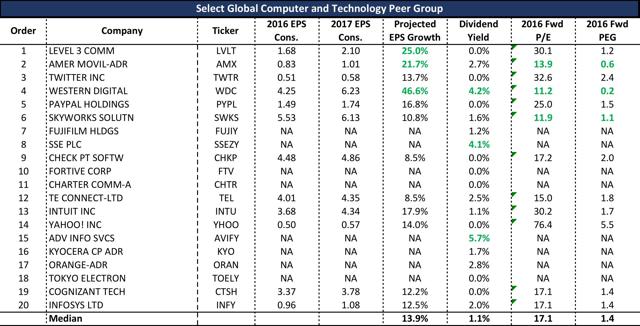

The top 20 tech losers of the week have a median 2017 forward P/E of 15.5x, compared to the S&P 500's median trailing P/E of 14.6x and the overall tech sector's 26.3x. This week's top 20 group is expected to grow EPS in 2017 by 13.9%, and the companies generate median dividend yield of 1.1% (11 of the 20 companies are dividend-payers).

The table below highlights, in green font, the three best-positioned tech companies in each of the following categories: projected EPS growth, dividend yield, forward P/E and forward PEG (P/E divided by percentage-point EPS growth).

Re-examining Twitter:

With the Street reacting negatively to the Q2 2016 earnings release, we will take another look at our prior analysis on Twitter.

· Is Twitter continuing to improve its cost management and is there room to cut costs even further?

· Do we see the ARPU making a turnaround Twitter's new initiative in the Live-streaming space?

· Could Twitter be a potential buyout candidate