The all powerful head of the Fed's Committee on Bank Supervision, Dan Tarullo, spoke today at Yale's School of Management, presenting the long awaited Federal Reserve's capital adequacy guidance titled " The Next Steps in the Evolution of Stress Testing". During the one hour long presentation, Dan Tarullo outlined how the Federal Reserve wished to establish a "better alignment of CCAR (comprehensive capital analysis review) with the new regulatory capital rules" for 2018 and beyond.

You can listen to his speech on youtube or read his presentation on line. Either way, you can directly see how the Federal Reserve intends to impose a "Surcharge Capital Buffer" on the larger banks designed to better insulate the integrity of G-SIB banks (those banks deemed to be global systemically important banks) during times of extreme stress.

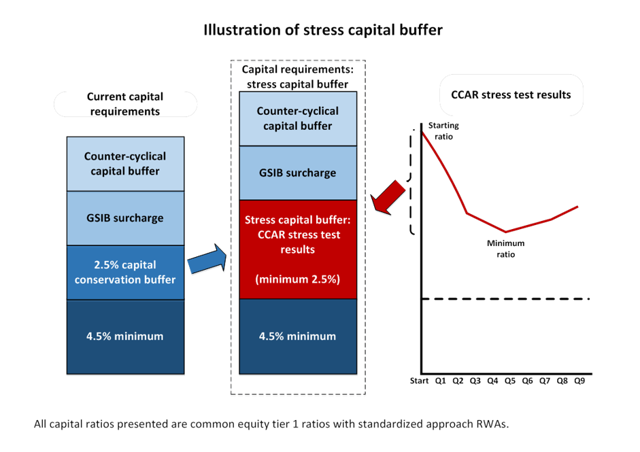

The first portion of his speech focused on the need for the regulators to provide better clarity to the banks and to ensure that the stress test continues to be dynamic and relevant. He then presented just one slide. The slide shows how a large bank (the GSIB banks) capital requirement will be determined going forward. The speech explained why large banks such as C, JPM, and BAC will be better protected with yet another new layer of capital, "a new buffer," as determined by their level of perceived individual risk and complexity. In his presentation, the speech suggested that the typical large GSIB bank would likely need about 12.5% Tier 1 equity (a level most large banks have already reached or are near). Such a capital level has been well anticipated and is largely nothing all that surprising. Perhaps his more important point was that CCAR and the Fed exams would be better coordinated and combined in their capital analysis efforts. The chart is shown below:

Then Mr. Tarullo got much more interesting. He began to discuss how and when a bank would be disallowed from returning excess capital to share holders. The following two paragraphs below may make for very painful reading, but they contain powerful information. By establishing a capital level at which a bank would be disallowed from returning excess capital to shareholders, the Federal Reserve is in fact agreeing to be more precise and more clear in establishing the level at which a bank is free to return its excessive capital. In other words, the Fed has agreed to present a model to the banks that better explains how much capital is needed and how much capital is deemed excessive. Mr. Tarullo's comments tacitly provided more freedom to the banks to do with their excess capital as they see fit, provided they play by the rules.

Then Mr. Tarullo got much more interesting. He began to discuss how and when a bank would be disallowed from returning excess capital to share holders. The following two paragraphs below may make for very painful reading, but they contain powerful information. By establishing a capital level at which a bank would be disallowed from returning excess capital to shareholders, the Federal Reserve is in fact agreeing to be more precise and more clear in establishing the level at which a bank is free to return its excessive capital. In other words, the Fed has agreed to present a model to the banks that better explains how much capital is needed and how much capital is deemed excessive. Mr. Tarullo's comments tacitly provided more freedom to the banks to do with their excess capital as they see fit, provided they play by the rules.

Tarullo: "a firm would be subject to restrictions on its capital distributions whenever its capital levels fall below the combined regulatory minima and buffers. Although it is likely that the stress test losses will continue to exceed 2.5 percent of risk-weighted assets for most GSIBs, the SCB would have a specified floor at this current CCB level to avoid any reduction in the stringency of the regulatory capital rules. A firm's buffer requirement would be recalculated after each year's stress test, and its capital plan would not be approved in CCAR if the plan indicated that the firm would fall into the buffer under the stress test's baseline projections.

Let me use a hypothetical example to illustrate how the SCB would work. Assuming that a firm's common equity tier 1 capital ratio declines in CCAR's severely adverse scenario from 13 percent to 8 percent, that firm's SCB would be the greater of 2.5 percent or the 5 percent decline--thus, 5 percent. Assuming further that this firm is a GSIB with a surcharge of 3 percent and that the countercyclical buffer is not in effect, the firm would be constrained in making capital distributions that would bring its common equity tier 1 capital ratio under 12.5 percent. The 12.5 percent figure is the sum of the 4.5 percent minimum common equity tier 1 risk-weighted capital requirement, the 3 percent surcharge, and the 5 percent stress loss as calculated in annual stress test. "

Reading between the lines, Mr. Tarullo just stated that the typical large GSIB bank would be expected to have about 13% tier 1 equity by 2018 and would be free to distribute all future excess capital from that point onward so long as market conditions did not reduce Tier 1 Equity below a level of 12.5%. Fortunately, our banks ought to have no trouble reaching the Fed's 2018 required capital level and will then gain more freedom to distribute their excess capital as they deem appropriate.

This new level of freedom is further supported by the fact that Mr. Tarullo later took the time to outline when and how share buybacks and dividends would likely be reduced or eliminated. During this part of his presentation, he suggested that a specific dividend payout ratio would not be deemed an industry norm as some banks would no doubt wish to pay significantly higher dividends than other banks. He did acknowledge that currently a typical payout ratio was around 30% for many banks, but he also pointed out that there were some banks that paid out 100% of earnings as dividends and yes some could be allowed to continue to do so under certain circumstances.

The point of Mr. Tarullo's presentation today was to provide the banking industry with the latest up date from the Federal Reserve, as guidance. For investors, however, the main take away is that banks are gaining better, more specific rational guidance. As it is becoming ever more clearly outlined, our large banks are being freed to pursue more aggressive share buybacks and larger cash dividends, provided they first comply with Federal Reserve quantitative and qualitative expectations. The bottom line: regulatory clarity will lead to higher payout ratios, a higher level of investor confidence, and eventually higher relative valuations.