A few days after the US election, we reviewed the spike in uncertainty metrics and their link to the real economy and markets. Our conclusion was that, overall, the positive impulse from some of the advertised policies of the new administration were sufficient to overcome that hit from the spike in uncertainty, at least in the short term.

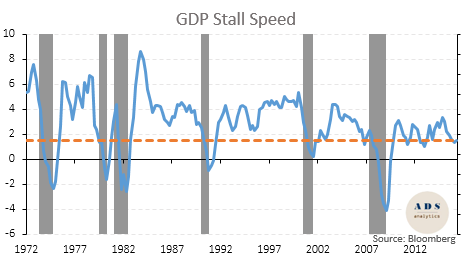

In this article, we dig a little deeper and review what the data and markets are telling us as far as the likelihood of a recession. While risk indicators have been relatively bullish, the macro situation overall is not as rosy as some of the markets would indicate. In particular, we remain concerned about the so-called "stall speed" (see below) of the US economy - GDP growth below which the likelihood of a recession increases substantially.

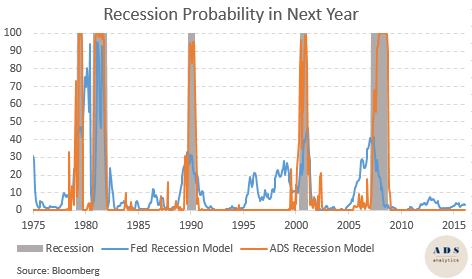

Moving top-down - our first port of call is the recession probability indicator. We show two versions of this indicator both of which rely on macro data: The one published by the Fed as well as our own. The Fed model is more sensitive though it has a longer lead-in time. Both models are flashing green at the moment with very low probabilities of a recession in the coming year.

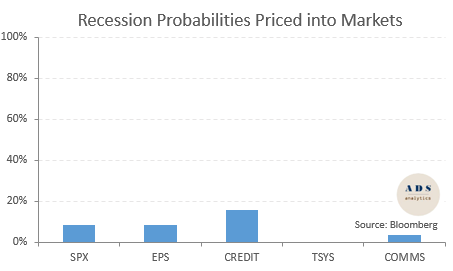

Our second set of indicators are market-implied probabilities of recession which are measured either as peak-to-trough changes in prices or the average of prices in recessionary and non-recessionary periods. Apart from a blip in the credit markets (which are well off historic market tights), the other indicators are very benign.

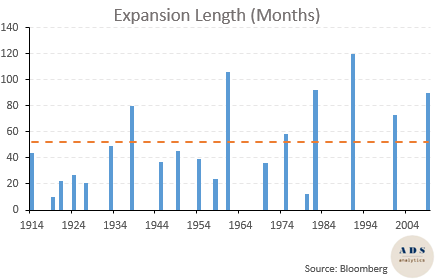

Finally, we put the length of the current expansion in context. While the current expansion is well above the historic average, it is not at an extraordinary level. In fact, three of the previous cycles since the 1960s have been longer.

So, what does all of this