Xerox (NYSE: NASDAQ:XRX) is spinning off its business process services segment; and in order to receive shares of the spin-off company (Conduent), investors need to be a shareholder of record at the close of business on December 15, 2016. Shareholders of record will receive one share of Conduent common stock for every five shares of Xerox. The distribution is planned to be a tax-free distribution.

Xerox stock price has seen a decline over the past year, with revenue growth struggling. The company is viewed as operating in a declining industry where management has not been able to improve the financial metrics of the business. This doesn't mean there isn't value in the company with strategic actions management is taking currently. We will analyze the value post spin-off to get a better understanding of future value.

Overview

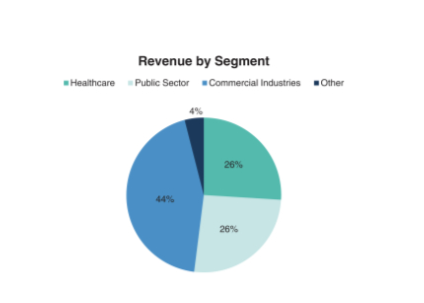

Conduent (spin-off company) provides business process services with a focus on transaction-intensive processing, analytics and automation. The services are basically consulting and outsourced support services. The company has three reportable revenue segments.

Source: Form 10

Commercial industries segment is its largest segment from a revenue perspective with 44%. Many clients in this segment come from the automotive, retail, manufacturing, financial services and aerospace industries. Total revenue in 2015 was $6.66 billion with 90% being reoccurring. A key factor is the majority of the businesses revenue is reoccurring. Below is a more detailed breakdown of all the services provided by the company.

Source: Form 10

Competition in these markets for business process services is fierce but large, which is estimated to be at $260 billion overall. It is a big market and Coduent is strategically aligned to grow its market share. Management believes with laser focus it will see 6% growth over the next few years.

Valuation

Since Conduent has a plethora of services provided, there's