The past year has been brutal for most brick-and-mortar retailers. The U.S. Department of Commerce estimates that for the third quarter of 2016, e-commerce as a percent of total retail sales accounted for 8.4 percent of total sales. This represented a growth of about 4 percent from the previous quarter. There is no hiding from the fact that online sales have been a headwind for these traditional retailers. The net sales and profitability of these retailers have taken a hit as a result.

Costco (NASDAQ:COST), which falls under the brick-and-mortar retailers category, on the other hand, has managed to remain an exception to the norm. From fiscal year 2010 to 2014, Costco delivered an annualized net sales growth of 11.5 percent, handily beating other retailers in terms of growth. However, net sales have shown slower growth during fiscal years 2015 and 2016. So, the question is, has Costco reached a plateau? Or is this just a period of consolidation before a return to impressive growth? To answer this, a basic understanding of the strengths and weaknesses of the company is required. But first, let's take a historical view of the company's performance.

1. Costco's Impressive Growth History

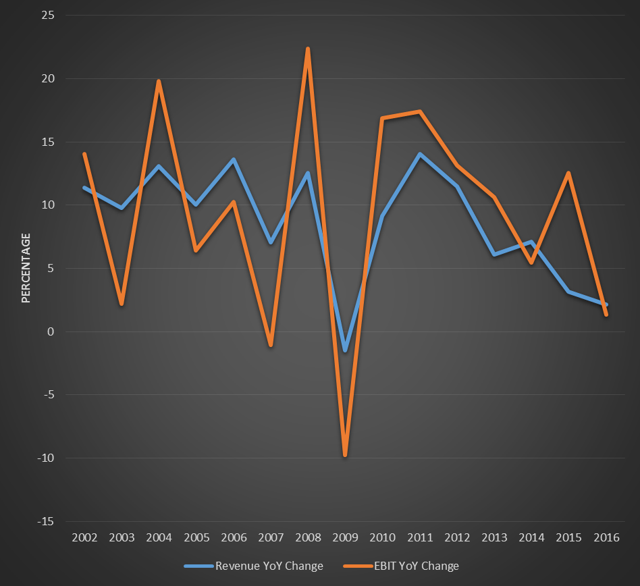

Figure 1 shows the total revenue change YoY (includes net sales and membership revenue) and earnings before income tax (EBIT) change YoY.

Figure 1: YoY Revenue and Operating Income Change. (Data taken from annual Costco 10-K filings)

Costco has a good history of providing solid revenue growth. Negative sales growth was seen only during fiscal=year 2009. However, growth promptly returned to the high-single digits during fiscal year 2010 once the economic conditions improved. Additionally, operating income has shown similar growth trends to revenue growth. There have been only two instances of negative operating income growth; during 2007 and 2009. However, Costco overcame these struggles to deliver solid sales growth