This is the third article I am writing on Asia Pacific Wire & Cable Corp. Ltd (NASDAQ:APWC).

New Dividend Policy

If you read my previous articles and follow the company closely, you should have observed that LONSIN succeeded to get in place a new dividend policy from management and the Board of Directors.

The company has never had a dividend payout policy and consequently not paid any dividends in nearly 20 years since its IPO (March 25th 1997). The new dividend policy stated a minimum payment of 25% - and no maximum - of its net post-tax audited consolidated profits attributable to shareholders.

If this dividend policy had been in place 10 years ago, long-time shareholders would have received approximately a minimum of 25% payout, representing $1.05 per share and up to a maximum full pay-out of $4.21 per share. See further below in the article for FY16 dividend payment forecast.

Stock Price Trading At Discount

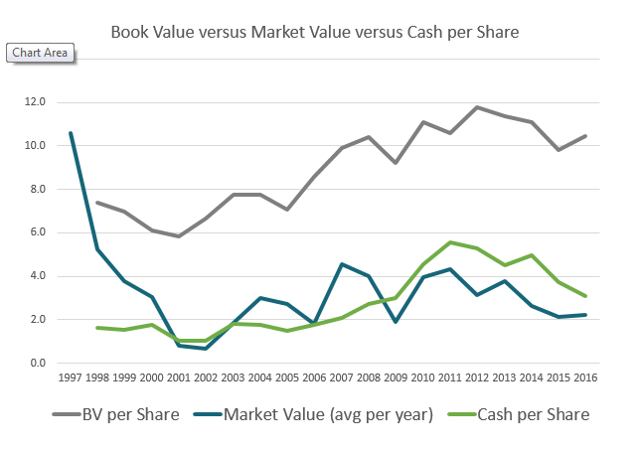

The dividend policy is welcome, but the share price discount to book value suggests much more must be done by management to honour its 2016 stated commitment to improve shareholder value. The current stock price of APWC is still considerably below its book value; in spite of the current rally of the shares, it is still significantly below the cash per share.

As per the graph above, we can see that the most recent book value (3Q16) of APWC is $10.4 per share while the average trading price for 2016 is $2.21 per share.

As per the graph above, we can see that the most recent book value (3Q16) of APWC is $10.4 per share while the average trading price for 2016 is $2.21 per share.

Another ratio to look at is NCAVPS (net current asset value per share) which stands at $10.86 (3Q16), again significantly higher than current market price.

Since the first article (published on 05/19/16) to today (01/09/2017), the share price appreciated by 92% from $1.61 to $3.10, showing that shareholder activism is worthwhile.