Introduction

Most American REITs are trading (way) above book value, so sometimes it's interesting to cross the border to find other real estate-focused companies trading at more attractive valuations versus their respective book values.

One of these companies is Klepierre (OTCPK:KLPEF), a French real estate company focusing on malls. Two years ago, the company made an important acquisition, as it acquired Dutch competitor Corio, resulting in one of the largest European REITs. The company is also included in the CAC 40 index, and in the iShares MSCI France ETF (EWQ).

Trading on the US exchange is limited, so I would strongly recommend you to trade in Klepierre shares through the facilities of Euronext Paris, where the company is trading with LI as its ticker symbol. With an average daily volume of 600,000 shares (approximately $24M), the liquidity is much better in France.

Source: finanzen.net

A robust book value and strong cash flows

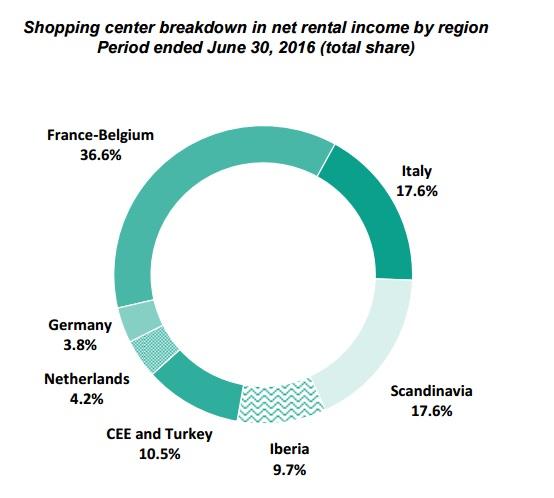

Klepierre is focusing on European commercial real estate, with three core markets (France-Belgium, Italy and Scandinavia) representing in excess of 70% of the net rental income of the entire company. With a specific focus on large shopping centers in Continental Europe, the company is prone to changes in the consumption pattern of the population of its core countries.

Source: half-year report

In the first half of 2016, virtually all of the countries Klepierre is exposed to showed positive growth, with a 0.9% increase in retail sales in France and a more impressive 3.1% increase in Italy (which is surprising given the weaker state of the Italian economy).

The gross rental income decreased by approximately 1% in the first half of last year (mainly due to asset disposals), but the net rental income increased by 2% to 535M EUR due to the lower 'building expenses', which fell by more than 40% to just 18M