- Inflation - The Good & The Bad

- What's Driving Rates?

- Tailwind For Bonds

- Market & Sector Analysis

- 401k Plan Manager

The Good & Bad Types Of Inflation

Since the November election of Donald Trump, the investing landscape has gone through a dramatic change of expectations with respect to economic growth, market valuations and particularly inflation. It is the view of inflation that I want to touch on today as it relates to the belief the "Death Of Great Bond Bull Market" has finally arrived.

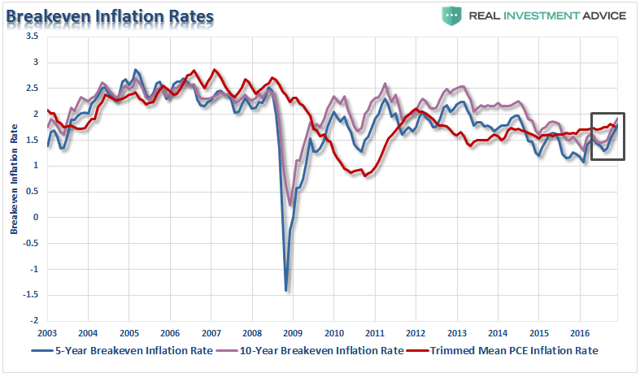

The chart below shows the massive surge in inflationary expectations as of late in both the 5-year and 10-year rates as well as the mean PCE inflation rate. (#SarcasmAlert)

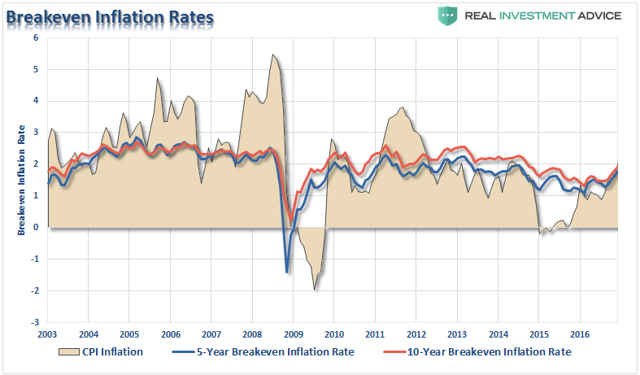

As you can see, while expectations of a rise in inflationary pressures have risen since the election, the consumer price index (CPI) was already rising fairly strongly since the beginning of 2015.

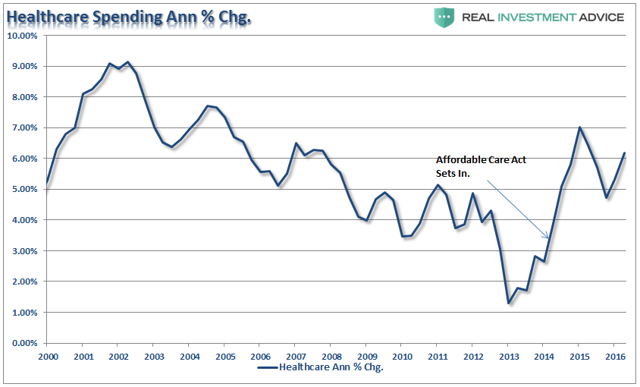

So, if the rise in inflation expectations remains muted, what's the reason for the recent surge CPI? That rise can be directly linked to the full onset of the Affordable Health Care Act which sent medical inflation costs surging. This is something I warned about many times in the past.

"The impact of the Affordable Care Act is now taking root. Unfortunately, for many, that impact is not a positive one as surging premiums absorb more of the discretionary budget of households."

The Fed believes the rise in inflationary pressures is directly related to an increase in economic strength. However, as I will explain: Inflation can be both good and bad.

Inflationary pressures can be representative of expanding economic strength if it is reflected in the stronger pricing of both imports and exports. Such increases in prices would suggest stronger consumptive demand, which is 2/3rds of economic growth, and increases in wages allowing for absorption