In the past few weeks, global leaders have made a number of statements and policy decisions, markedly affecting forex trades in a slight reversal of the bullish dollar thesis.

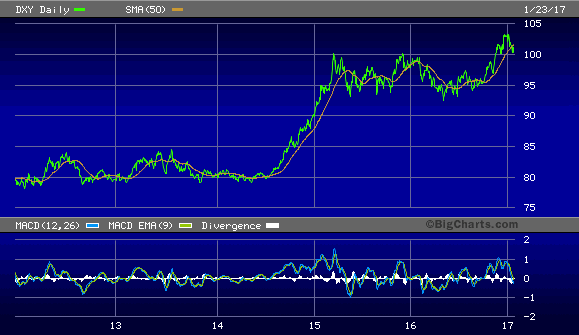

After the election of Donald Trump in November, the dollar gained as much as 6% against a basket of foreign currencies in expectation of fiscal stimulus from the U.S. as well as against the backdrop of overall tightening credit conditions.

However, statements from not only Trump but other G10 leaders across the globe at venues such as the Davos World Economic Forum have caused the dollar to move in reverse. On Jan. 17th:

- The trade-weighted dollar retreated 1.14% as Donald Trump suggested the dollar was "too strong".

- The pound sterling rallied 2.8% to over $1.23 as Theresa May outlined a more clear and concise framework for Brexit negotiations, suggesting the U.K. could use competitive tax rates and defense cooperation as bargaining chips for obtaining a new free trade agreement. However, she stressed that the U.K. would leave the European Economic Area and Customs Union with or without a secured deal.

- The offshore yuan strengthened to about ¥6.80 as Xi Jinping claimed China has no intention to devalue the renminbi or launch a currency war.

And today, Trump signed several executive orders in alignment with his aggressive protectionist stance on trade which, aside from ignoring basic economic and technological realities, has caused the dollar to continue its descent, with the DXY dollar index settling at about 100.23.

Société Générale provides some color on the developments here:

It has been a bad start to the day and year for the dollar. The correction in relative real yields continues and is dragging the dollar lower. Charts of EUR/USD and USD/JPY against relative real yields suggest that there's nothing to get bullish about in la-la dollar-land, at