This week we finally got what we would consider a perfectly normal report, in line with seasonal trends. Crude oil as well as product inventories increased, but not by unreasonable amounts and imports stayed close to normal levels. The only caveat we see to this normalcy are the very large product inventory builds during two of the previous three weeks, and near-record high levels of stocks of both crude oil and refined products.

Crude oil (NYSE: NYSEARCA:USO) prices jumped by about $0.50/bbl after the report was released and then gave back some of the gains.

Source: Finviz.com

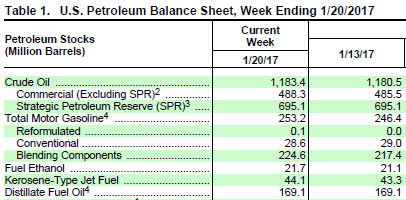

Stocks:

* Crude oil inventories increased by 2.8 million barrels.

* Gasoline inventories increased by 6.8 million barrels.

* Distillate inventories increased by 100,000 barrels.

About the same level of stock build than the previous week. This would be in-line with seasonal patterns, except for the exceptionally large build in product inventory that accumulated during the last week of December and the first week of January.

As we stand, crude oil stocks as well as product inventories are at very high levels. With the shoulder season just a couple of months away and domestic production potentially ramping up, at least based on the number of rigs that have been added recently, this could be very bearish for crude oil fundamentals.

Source: EIA

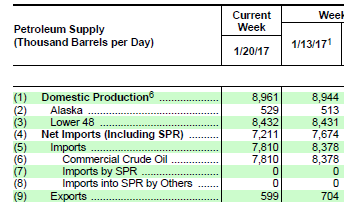

Production and Refinery Utilization:

* Domestic production increased by 17,000bpd, though mostly from Alaska, which is more volatile in the short term.

* Production in the Contiguous United States (excluding Alaska) stayed unchanged (1,000bpd increase).

* Net imports decreased by 463,000bpd to a level slightly below what we consider to be the normal level given current domestic production and consumption levels.

Source: EIA

* Refinery utilization fell to the 80's which is actually in line with seasonal trends for January. Utilization could actually