Hopefully this article will help you grow your assets.

Realty Income Corp. (NYSE:O) is a commercial real estate REIT in the US. Realty Income was added to the S&P 500 Index on April 6, 2015. It is also a member of the S&P High-Yield Dividend Aristocrats Index. On January 17, 2017 Realty Income Corp. announced another dividend increase of 6% from $0.2025/month to $0.2105/month (4.2% annually). This was the 90th dividend raise since O's listing on the NYSE in 1994. O has had a 17.9% Compound Average Annual Return since its NYSE listing in 1994. This by itself is a strong argument for investing in O.

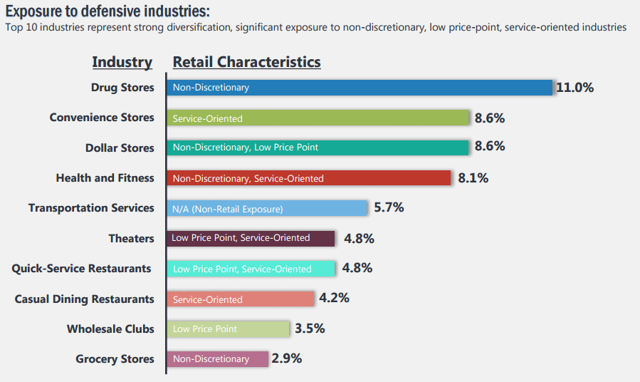

However, the landscape for retail, which is 78.7% of O's business leases, is changing. It is hard to get excited about a company that leases out "brick and mortar", when the latest trend is to online sales. Sales for Thanksgiving Day and Black Friday at "Brick and Mortar Stores" fell in 2016 by -5.0%. Retail Next data shows traffic in Brick and Mortar Stores has dropped for 48 straight months; and monthly sales have dropped for 36 straight months. Buying a company that leases out Brick and Mortar buildings seems questionable under the current circumstances. However, Realty Income is exposed to defensive industries (see chart below).

None of the first five categories above are going to move online anytime soon. When people get sick, they want medicine right away. When they "conveniently need some food", they don't want to wait for a 1-2 day internet delivery. Dollar stores will not deliver based on internet sales, the prices are too low; and the margins are too thin. Health and Fitness is not going to move online. It provides things you do at a site with a lot of other people. I could go on; but the point is that few of the above services can be easily