Since the Fed started raising the federal funds rate in December, the U.S. preferred stock market has been offering today's buyers the best prices (and therefore yields) that we have seen since last spring.

There are currently 114 high quality preferred stocks selling for an average price of $24.77 (January 31), offering an average yield-to-call of 5.70 percent. And 57 of these high quality issues are selling below their $25 par value. By high quality I mean preferreds offering the characteristics that most risk-averse preferred stock investors favor such as investment grade ratings, cumulative dividends and call-protection.

But prices have been edging back up since the beginning of the year as the impact of the Fed's December rate increase has started to wear off. I'll compare market reaction of the December 2016 rate increase to that of December 2015 in a moment, but U.S. preferred stock prices increased an average of $0.59 per share during January.

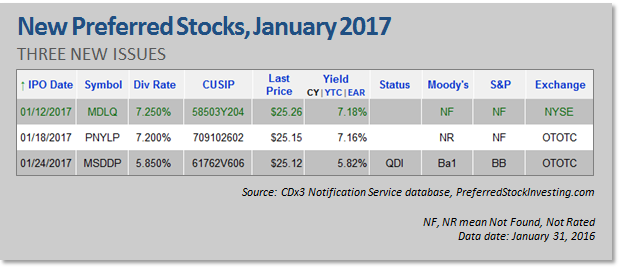

January's new issues

With upward pressure on rates, we typically see fewer new preferred stock issues and January was no exception. Only three new preferred stocks were introduced for the consideration of preferred stock investors during January. But with 57 high quality issues currently available for less than their $25 par value to pick from, the number of new preferred stock IPOs becomes much less relevant to today's buyers.

There are now a total of 879 of these securities trading on U.S. stock exchanges.

Note that I am using IPO date here, rather than the date on which retail trading started. The IPO date is the date that the security's underwriters purchased the new shares from the issuing company. Anxious to sell the new shares, underwriters will generally sell to broker/dealers using a temporary trading symbol on the wholesale over-the-counter exchange (who, in turn, sell them to us at retail within